Although the ongoing crisis in Ukraine imposes massive concerns, the spotlight centers on deteriorating relations between the U.S. and China. With the latter seemingly poised to attack Taiwan – a breakaway island that Beijing deems as part of its territory – and the former now committed to defending it, the Biden administration finds itself in a tricky situation. About the only winner in this mess are defense stocks, in particular, the tickers RTX, LMT, and HII.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

First, it’s important to set the background for what could be a clash between the two biggest economies of the world. As TipRanks reporter Chandrima Sanyal stated, “Taiwan is an independently governed island country off China, which is still within the realm of the Republic of China. The history of Taiwan’s resistance to Chinese communist rule dates back to post-World War II times.”

Initially, the U.S. bonded with Taiwan over its mutual distrust of Beijing. Now, however, “Taiwan’s global dominance over semiconductor manufacturing has piqued the interest of the U.S., which has been trying to extend support to the country in its political struggle with China.”

It’s not just a matter of ideological squabbling. Per Voice of America, “Taiwan makes 65% of the world’s semiconductors and almost 90% of the advanced chips.” Despite political sensitivities across the spectrum, the harsh reality is that an attack on Taiwan represents a strike against American innovation and economic development.

What’s more, it’s not just the U.S. that views challenges to Taiwan’s independence as an existential threat. Last year, Japan’s deputy defense minister, Yasuhide Nakayama, stated that his country must defend Taiwan. Therefore, the stakes for defense stocks couldn’t be higher.

To be clear, the investment narrative is not that war erupts so that defense firms can supply advanced weaponry. Rather, these companies play a preventative role, subtly demonstrating the terrible consequences associated with a brazen attack. To that end, these are the defense stocks to consider.

Raytheon Technologies (NYSE:RTX)

One of the biggest defense stocks in the world, Raytheon Technologies played a critical role in defending Ukraine during the initial phase of Russia’s invasion. Moving forward, the company’s specialty in defense systems against aerial targets may be called up to action. In recent weeks, Moscow stepped up its aggression, using Iranian-made Shahed-136 suicide drones to attack civilian infrastructure.

This dynamic brings relevancy to a potential conflict in Taiwan because China will almost certainly deploy similar weapons systems. To protect against aerial assaults, Taiwan requires the best defense architecture available. Few companies command as much expertise in this space as Raytheon, thus driving the fundamental argument for RTX stock.

Presently, Raytheon features a forward P/E ratio of 16.5x, lower than the aerospace and defense industry’s median forward P/E ratio of 18.6x. In addition, the company commands a net margin of 6.8%, ranked better than 65% of its peers.

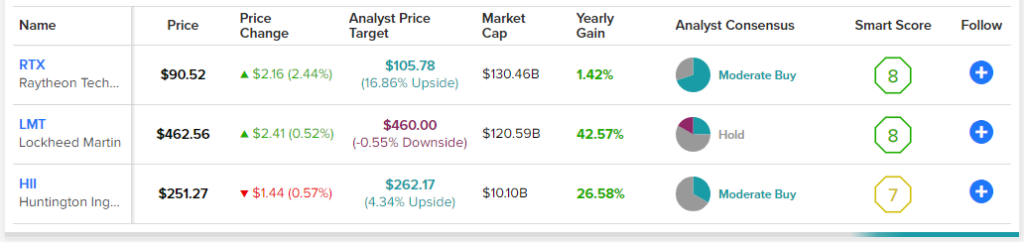

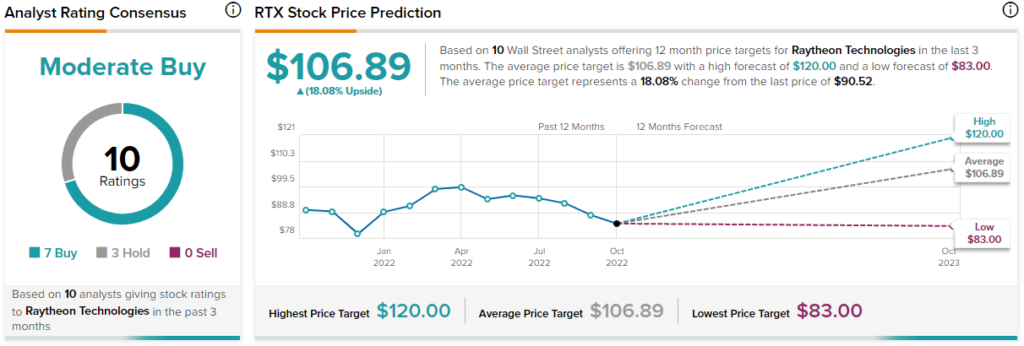

Is RTX Stock a Buy, According to Analysts?

Turning to Wall Street, RTX stock has a Moderate Buy consensus rating based on seven Buys, three Holds, and zero Sell ratings. The average RTX price target is $108.11, implying 18.1% upside potential.

Lockheed Martin (NYSE:LMT)

Similar to Raytheon above, Lockheed Martin played a pivotal role in the initial defense of Ukraine. Under a joint venture together, the two stalwarts among defense stocks produced the Javelin anti-tank missile. Celebrated throughout Ukraine for devastating Russian hardware, the shoot-and-scoot system may be of relevance should China invade Taiwan.

In addition, Lockheed manufactures the HIMARS long-range mobile artillery system. Undoubtedly, HIMARS changed the narrative in Ukraine, allowing resistance fighters to transition from defense to offense. Combined with Lockheed’s other defense products – particularly the F-35 Lightning II fighter jet – the defense contractor provides another preventative measure against potential Chinese belligerence.

To be fair, Lockheed’s valuation is starting to creep to the overvalued side, featuring a forward PE of 16.8x. As mentioned earlier, the median metric is 18.6x for defense stocks, so it’s not too far off. However, Lockheed carries above-sector-average metrics for growth and profitability. As well, its return on equity stands at a stout 54.4%, reflecting a high-quality business.

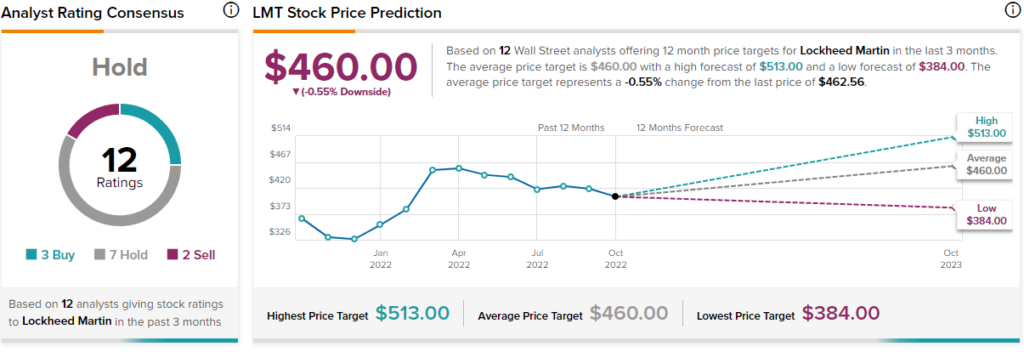

Is LMT Stock a Buy, According to Analysts?

Turning to Wall Street, LMT stock has a Hold consensus rating based on three Buys, seven Holds, and two Sell ratings. The average LMT price target is $460.00, implying 0.55% downside potential.

Huntington Ingalls Industries (NYSE:HII)

While Raytheon and Lockheed command arguably most of the attention among defense stocks for their Ukraine relevancies, moving forward, investors need to pay close attention to Huntington Ingalls Industries. As the largest military shipbuilding company in the U.S., Huntington Ingalls plays a pivotal role for the Navy and Coast Guard.

Obviously, with Taiwan being an island territory, naval power represents a conspicuous deterrent against any Chinese aggression. Leveraging both carrier strike groups and submarine fleets, the U.S. can rain devastation from anywhere and at any time. Additionally, what bolsters all the defense stocks above is that the U.S. and western forces command extensive combat experience. The same cannot be said about Chinese forces.

Currently, Huntington Ingalls represents an undervalued investment based on its forward P/E ratio of 14x. Also, the company features an impressive three-year book value per share growth rate of 25.7%, ranking better than most defense stocks.

Is HII Stock a Buy, According to Analysts?

Turning to Wall Street, HII stock has a Moderate Buy consensus rating based on two Buys, four Holds, and zero Sell ratings. The average HII price target is $262.17, implying 4.3% upside potential.

Conclusion: Defense Stocks to Surge in Relevance

Although controversial, defense stocks will almost certainly surge in relevance from here. As the Russian invasion confirmed, the absence of the ability to wage war does not promote peace. Indeed, it encourages unscrupulous political administrations to exploit vulnerabilities for personal gain. Therefore, investors need to keep a watchful eye on this sector as the Taiwan issue simmers.