What is common between the U.S. and China? Both countries are obsessed with Taiwan due to its control of the semiconductor market. The Semiconductor Industry Association describes semiconductors as the brain of modern electronics. Now, about 63% of these “brains” are manufactured in Taiwan. The Taiwan Semiconductor Manufacturing Co. (TSM) itself churns out 54% of the global semiconductors. This clears the picture of why the U.S. and China are so focused on Taiwan.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Earlier this month, U.S. House Speaker Nancy Pelosi’s trip to Taiwan thrust the tense China-Taiwan-U.S. dynamics into the limelight. China was very bothered by this trip and immediately got down to a full display of power as a protest. Many reasons are behind this, but the most important of all is the power play between the world’s two largest economies for control over Taiwan’s semiconductor manufacturing.

Geopolitical Dynamics Between the Countries

Let’s talk about the dynamics between Taiwan and China, as well as between Taiwan and the U.S.

Taiwan is an independently governed island country off China, which is still within the realm of the Republic of China. The history of Taiwan’s resistance to Chinese communist rule dates back to post-World War II times.

The U.S. initially bonded with Taiwan over mutual opposition to China’s communist-dominated political system. However, now, Taiwan’s global dominance over semiconductor manufacturing has piqued the interest of the U.S., which has been trying to extend support to the country in its political struggle with China.

Needless to say, China is not happy about this setup. Although China enjoys around a 7% share in the global chip manufacturing market, it primarily relies on Taiwan’s chip supply to manufacture its drones, military hardware, and other defense equipment.

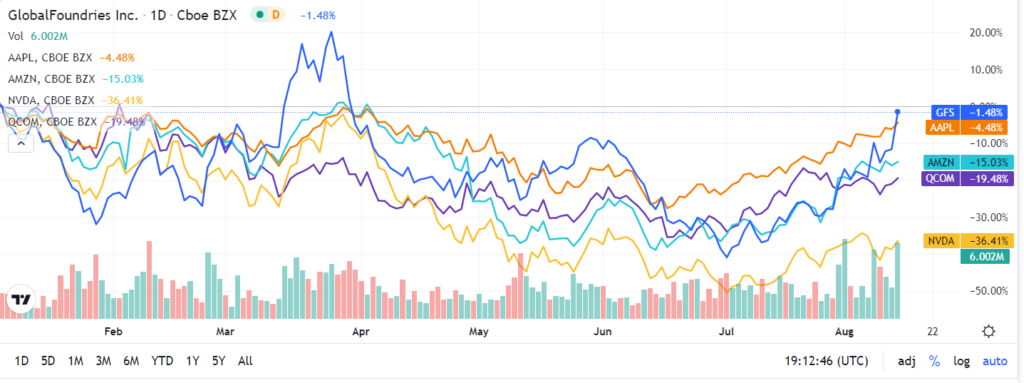

The U.S., on the other hand, also has around a 7% market share, enjoyed by Global Foundries (GFS) in the international semiconductor manufacturing market. Even though it has some self-reliance in most of its military technologies, the U.S. still relies on Taiwan’s chips to design several key defense systems. Moreover, 90% of the chips marketed by American tech stalwarts like Apple (AAPL), Amazon (AMZN), Nvidia (NVDA), and Qualcomm (QCOM) come from TSMC.

Why Has Nancy Pelosi’s Visit Irked China?

Coming back to the controversial visit, China had warned against this move multiple times. The defiance was the first red flag. Moreover, during the trip, Pelosi met Mark Lui, chairman of TSMC, which further bothered China. This is because the U.S. has been trying to get TSMC to build a manufacturing unit on U.S. soil and reduce its chip supply to China.

Knowing the repercussions of such a move by Taiwan, China retaliated against Pelosi’s trip with an elaborate display of fire drills, making Taiwan aware that China could take it over at any moment.

What a Chinese Invasion of Taiwan Means for the U.S. Semiconductor Industry

If China invades and cuts off Taiwan’s export of chips, China’s market share could climb to 70%. Given the trade issues between the U.S. and China, the latter will have a monopolistic advantage over semiconductors, making it either difficult to attain or very expensive for American companies to source chips from China-controlled Taiwan.

On the flip side, Taiwan also sources raw materials and chemicals to produce its semiconductors. So, cutting off Taiwan will also hurt Taiwan’s production, leading to a fresh disruption in the global supply chain.

Given this uncertainty of chip supply from Taiwan, countries have begun to hoard chips, giving a new direction to the already jammed supply chain. This may lead to a massive supply shortage of semiconductors in the U.S. and elsewhere, accompanied by price rises, denting the margins of semiconductor companies.

There’s One Good Thing about the Current Supply Crunch

Interestingly, one good thing to come of this scenario is the new Chips and Science Act of the U.S., which allocates almost $53 billion towards efforts to internalize chip production, citing it unsafe to depend on Taiwan.

From navigating a potential supply crunch of a large magnitude to expanding its own innovation and production capacity, the U.S. semiconductor industry has a lot of work to do. The government’s investment will support semiconductor companies to achieve self-reliance at discounted costs. The near term may look shaky, and supply may be tight, but American chipmakers have a long runway for considerable growth in the long haul, with or without Taiwan.