Unity Software (NYSE:U) stock initially tumbled 14% in after-hours trading on November 9 after the company reported its third-quarter earnings. I believe investors need to exercise caution, as Unity, a provider of real-time 3D developments and tools, has come under pressure not just because of lackluster Q3 earnings but also due to fundamental challenges the company is facing. I am neutral on U stock, as I believe it will take time for the firm to gain traction in the market despite enjoying a long growth runway.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Unity’s Deep-Rooted Challenges

Unity reported revenue of $544.2 million for the third quarter, a year-over-year improvement of 69%. On the back of this stellar revenue growth, the company topped Wall Street estimates for earnings, but the stock initially sold off after earnings as investor focus shifted to the challenges looming on the horizon.

Unity’s biggest challenge today is repairing its relationship with developers who are calling the company to backtrack on recently announced pricing changes. On September 12, Unity announced major changes to its pricing model. Under the new model, developers will be charged a “runtime fee” on all games built with its video engine, given that they meet a minimum revenue threshold and a minimum install threshold.

Many game developers rushed to oppose this decision, and some pledged to boycott Unity when these pricing changes go into effect on January 1, 2024.

Under these unforeseen circumstances, Unity quickly made several changes to its planned new pricing model. In a blog post dated September 22, Unity Create President Marc Whitten explained that only games with revenue of over $1 million and more than one million installs will accrue the runtime fee. Even more importantly, Unity clarified that this new model will only apply to games that are shipped in 2024 and beyond.

The damage, however, has been done. The company had built trust among developers for years through favorable pricing policies and high-quality tools, but the new pricing saga has brought the company’s trustworthiness into question. Amid the backlash from developers and investors, Unity CEO John Riccitiello retired in early October, handing over the duties to James Whitehurst, who now acts as the interim CEO of the company.

The need for a sudden price change came on the back of two factors: Unity has been underpricing its products, and the company found itself backed into a corner financially amid challenging macroeconomic conditions. Unity is a company with a market capitalization of just over $9 billion but carries a debt burden of $2.7 billion. After its Q3 earnings report, Unity announced the sale of $1 billion in senior convertible notes as well.

Although Unity has moved in the right direction in recent quarters, which is evident from the narrowing losses, the company is still forced to spend substantial amounts on research and development projects to maintain its competitive edge. These R&D investments, although necessary, will prove to be a major drag on its profitability in the foreseeable future.

To recover from the current slump, Unity will have to communicate better with developers and strike a balance between investing for growth and focusing on profitability. It will take time for the company to make progress on both these fronts, and Unity stock is likely to remain challenged in the foreseeable future.

Unity Still Has Room to Grow

Not everything is going wrong for the company. Since the departure of the former CEO, interim CEO James Whitehurst has filled in to oversee the business at this crucial juncture. Mr. Whitehurst served as the CEO of Red Hat before the company was acquired by IBM (NYSE:IBM), and after the deal, he served as the President of IBM before assuming duties as a special advisor to the board.

The extensive experience brought to the table by Mr. Whitehurst – both as a successful tech executive and an advisor to Silver Lake, the second-largest shareholder of Unity – will come in handy as Unity enters a transformational phase.

Despite the recent PR struggles Unity has faced, the company remains well-positioned to grow. Its growth will be aided by the increasing use of artificial intelligence and augmented reality and the growing prevalence of the Metaverse. Unity offers state-of-the-art 2D, 3D, and VR tools to assist developers in designing high-quality games and other experiences, and the company’s customer base is likely to remain sticky in the long run because of the high quality of tools offered by Unity.

In its third-quarter shareholder letter, Unity highlighted how the company is increasingly focusing on becoming a leaner, more agile business, which is an encouraging development. Leading to 2022, Unity’s approach was to achieve growth at any cost, but this strategy backfired when interest rates started rising. The new strategy should enable the company to grow sustainably.

Although Unity still has room to grow, growth rates will likely decelerate in the future. A couple of years ago, then-CEO John Riccitiello claimed that Unity would grow more than 30% annually in the long run, but analysts are expecting revenue growth to decelerate to 20% in Fiscal 2024 and remain below the 20% mark thereafter. The market will take more time to adjust to the lower growth rates expected in the coming years.

Is Unity Stock a Buy, According to Analysts?

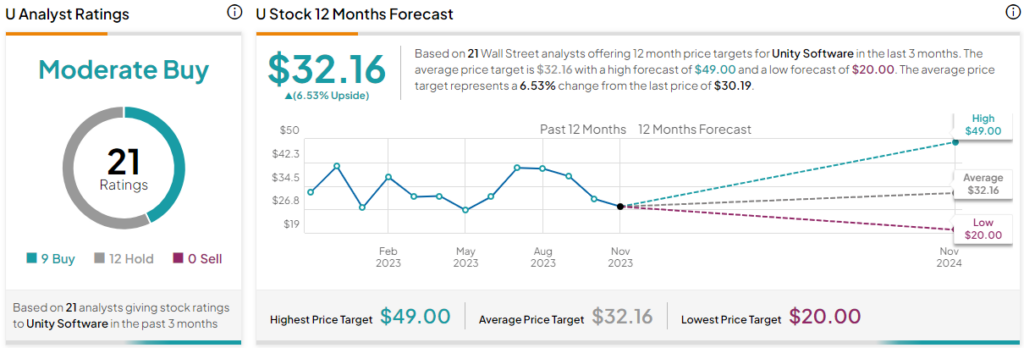

Based on the ratings of 18 Wall Street analysts, the average Unity Software stock price target is $32.16, which implies upside of 6.5% from the current market price.

Despite the upside potential, according to analysts, investors need to be cautious. The company is likely to see its earnings estimates revised negatively in the coming weeks as analysts digest Q3 earnings and the company’s updated growth strategy, which is likely to be discussed once a permanent CEO is appointed.

The Takeaway: Too Risky to Bet on

Unity Software still has room to grow, but a deceleration of growth is unavoidable. On top of that, the company will have to work hard to repair the reputational damage resulting from its failed rollout of the new pricing model and the former CEO’s remarks about some developers. In the foreseeable future, Unity’s challenges are likely to play a major role in determining stock price movements, which paints a bleak outlook.