Unity Software (NYSE:U) shares nosedived nearly 15% in the pre-market session today after the game-engine maker disclosed a $1 billion sale of 2% convertible senior notes due 2027.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

The company sold notes worth $940 million to entities affiliated with Silver Lake and notes worth $60 million to Sequoia Capital. At the end of September, Unity’s total outstanding convertible notes stood at $2.71 billion.

Today’s price decline comes on top of a nearly 13.6% drop in Unity shares over the past month. The company’s recent third-quarter performance disappointed investors after revenue of $544 million missed expectations by $10 million.

While its net loss per share narrowed to $0.32 from $0.84 in the year-ago period, the company is witnessing an impact from the gaming restrictions in China. Unity is now relooking at its product portfolio and is planning job cuts, a decrease in its office footprint, and an exit from certain products this quarter.

What is the Target Price for Unity?

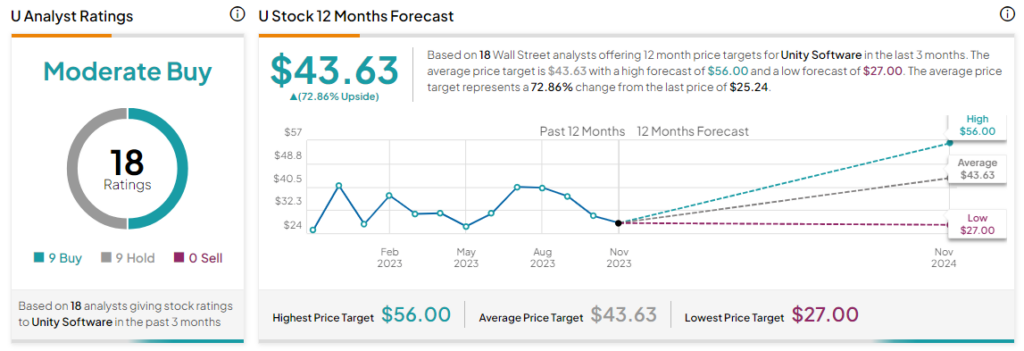

Overall, the Street has a Moderate Buy consensus rating on Unity Software. The average U price target of $43.63 implies an attractive 72.9% potential upside.

Read full Disclosure