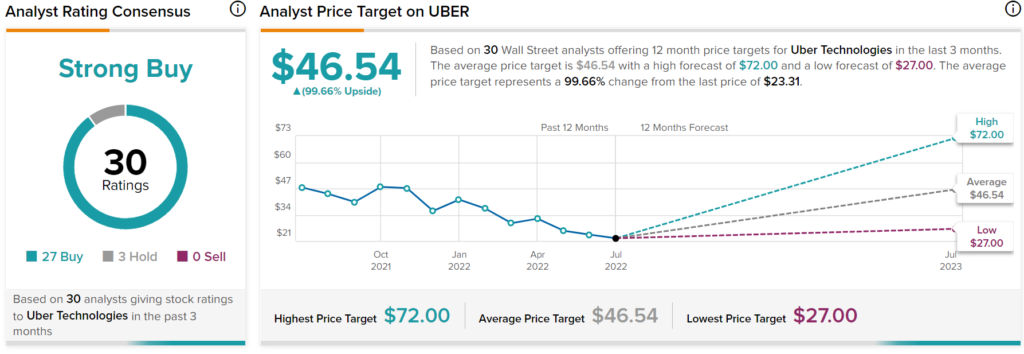

Shares of popular ride-hailing firm Uber (UBER) have been a Wall Street favorite (the average price target implies shares could double) for well over a year now. Despite tumbling further into the abyss, the company has so much potential as the underlying economics of its ride-hailing business look to improve after slogging through two years of seemingly endless headwinds.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Uber seems focused on moving into free cash flow positivity. The alleviation of the current slate of headwinds could help Uber make the jump. Further, Uber is looking to take a step back to become more of a go-to transportation company. In a prior piece, I noted that Uber was well on its way to building out a “super app” capable of covering everything from rides to food and grocery delivery to package and freight delivery.

In the distant future, Uber may be able to leverage its impressive algorithms and network effects to break into higher-margin transportation businesses, including flying taxis and fully-autonomous ride-hailing. Over the nearer term, Uber is likely to pursue M&A opportunities to add to its already impressive network while exploring vertical shifts into parallel markets, including charter buses.

Even with a recession on the horizon, the road ahead seems bumpy but on a steady upward trajectory. As such, I’m inclined to agree with the 27 bullish Wall Street analysts who continue to stand by Uber stock despite its 46% downfall in the past 12 months. I am incredibly bullish on the stock at these depths.

Uber Getting into the Charter Bus Market

Uber’s recently-announced pivot into charter buses was rather perplexing. However, such moves could transform Uber from a simple ride-hailing app into a transportation-as-a-service super app. The company is rolling out its bus functionality to Dallas and Houston first, with more cities to be included over time.

The bus charter feature is thanks to a partnership with U.S. Coachways and aims to help large groups of people book travel across long distances. Indeed, the feature could evolve to become a step up from Greyhound and other such services.

Though the rollout is in its infancy, the rewards potential seems high, given nearly non-existent risks. If charter buses don’t work out, Uber can always pull the plug!

Uber Partners with Hertz to Jolt EV Shift

Uber also entered a partnership with Hertz (HTZ), allowing more than 15,000 Uber drivers to rent Tesla (TSLA) vehicles. The deal accelerates Uber’s move to electrify its fleet by 2030.

Undoubtedly, the deal seems to work out well for both parties. With a “Comfort Electric” plan to be rolled out in select cities, consumers may be able to pay a bit more to enjoy an emission-free ride. Such a premium will likely help bolster Uber’s margins and profitability prospects.

Indeed, the electrification shift isn’t just an effort to help save the environment or improve Uber’s ESG rating. It may very well leave a long-lasting jolt to margins. Further, a large EV fleet could help Uber separate itself from long-time rival Lyft (LYFT) over the medium term.

Wall Street’s Take on Uber

Turning to Wall Street, Uber has a Strong Buy consensus rating based on 27 Buys and three Holds assigned in the past three months. The average Uber price target of $46.54 implies 99.7% upside potential.

Takeaway – Uber Stock is Too Cheap to Pass Up

Uber is doing many things right. It’s making strategic acquisitions where it makes sense and is teaming up with firms to form mutually-beneficial relationships. The company is well on its way to free cash flow positivity due to such initiatives and the alleviation of inflationary headwinds. At 2.1 times sales, shares of Uber seem too cheap to pass up for those bullish on the firm’s ability to widen its moat across various transportation verticals.

Looking ahead, the recession could make the road to free cash flow positivity bumpy. That said, management remains upbeat, as it believes it can tackle a new set of headwinds with grace. Corporate insiders are eating their own cooking, with $5.3 million in shares bought over the last three months.

Make no mistake, ride-hailing and food delivery are discretionary services. Such services tend to see demand destruction during periods of economic contraction. Still, Uber may just be able to hold as there’s still a good chance the economy can avoid falling into a recession. In such a scenario, count me unsurprised if Uber stock ends up doubling from current levels.

In any case, Uber is incredibly well-managed and may be on the cusp of a shift into high gear as it takes steps to add to its dominance while improving upon its economics.