Ride-sharing company Uber (NYSE:UBER) is scheduled to announce its first-quarter earnings on May 2. The company is expected to benefit from the momentum in its mobility business that rebounded following the reopening of the economy. However, the pace of growth is expected to slow down sequentially.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Uber’s Q1 2023 losses are projected to narrow considerably compared to the prior-year quarter, fueled by higher revenue and margin expansion.

Q1 Expectations

Uber exceeded analysts’ Q4 2022 expectations, calling it the “strongest quarter ever,” driven by solid demand and strong margins. The company’s gross bookings increased 19% (26% on a constant currency basis) to $30.7 billion. Revenue grew 49% to $8.6 billion, with mobility revenue jumping 82% to $4.1 billion.

The company guided for Q1 gross bookings growth in the range of 20% to 24% on a constant currency basis and adjusted EBITDA between $660 million and $700 million.

Last week, Jefferies analyst John Colantuoni reiterated a Buy rating on Uber with a price target of $49, saying that he was constructive about the company heading into Q1 results. The analyst projects faster growth in mobility, “rational” international delivery markets, and greater advertising penetration to help drive higher margins.

Colantuoni expects mobility growth to gain from easy comparisons, while he expects restaurant delivery growth to slow further due to a pull-forward in demand. Colantuoni sees an upside to the consensus Q1 EBITDA estimate and has more confidence in the company’s ability to meet its $5 billion adjusted EBITDA target in 2024.

Meanwhile, the consensus analysts’ estimate for Uber’s Q1 2023 revenue of $8.7 billion indicates year-over-year growth of about 27%. However, it reflects a deceleration from the growth seen in Q4 2022. Analysts expect Q1 2023 loss per share to come down considerably to $0.09 compared to $3.04 in the prior-year quarter.

As per TipRanks’ Website Traffic Tool, visits on uber.com declined 7.9% year-over-year and were down 12.2% compared to the fourth quarter of 2022. Lower website traffic reflects negatively on the company’s Q1 top-line performance.

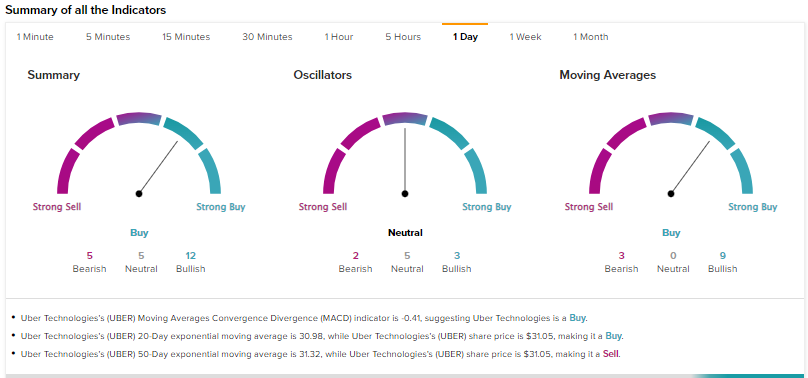

Technical Indicators Ahead of Earnings

Ahead of the Q1 earnings release, technical indicators reveal that Uber is a Buy. According to TipRanks’s easy-to-understand technical tool, UBER’s last trading price of $31.05 is slightly below its 50-Day EMA (exponential moving average) of 31.32. Meanwhile, its price is above its shorter duration EMA (20-day) of 30.98, signaling an uptrend.

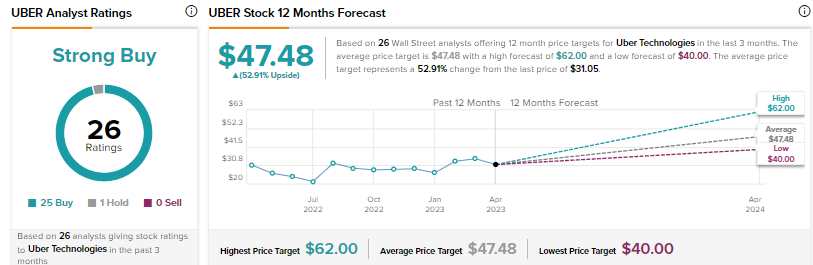

Is Uber a Buy, Sell, or Hold?

Wall Street’s Strong Buy consensus rating for Uber is based on 25 Buys and one Hold. The average price target of $47.48 suggests nearly 53% upside. Shares have rallied about 26% so far this year.

Conclusion

Analysts expect Uber’s mobility business to drive its Q1 performance, while the delivery unit’s growth might slow further. Revenue is expected to rise year-over-year but decelerate compared to the growth witnessed in Q4 2022.