Uber Technologies (NYSE:UBER), the global leader in the ridesharing industry, reported third-quarter earnings that missed Wall Street estimates. The company also missed revenue estimates for the quarter, but its shares held up well in the market, with the company nearing an inflection point in its story.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Ever since its market debut in 2019, many investors have been skeptical about Uber’s potential to turn a profit, but the third quarter marked the second consecutive quarter of GAAP profitability for the company. I am bullish on Uber, as I believe the company is still getting started.

The Earnings Miss Masks Solid Progress

Uber, despite missing earnings estimates, had a very strong third quarter in which the company showed strength across almost all key financial performance metrics. Gross bookings on the platform grew by 21% year-over-year to $35.2 billion, while total trips grew more than 25% to 2.44 billion. Monthly active platform customers, on the other hand, increased by a stellar 15% to 142 million.

Uber’s adjusted EBITDA margin reached a high of 3.1%, with the company reporting an adjusted EBITDA of $1.09 billion for the third quarter. This marks the first time Uber’s adjusted EBITDA eclipsed the all-important $1 billion mark. The real highlight was the net income of $221 million the company reported for the quarter, alleviating investor concerns that the net profit reported in the previous quarter was a one-off occurrence.

The Delivery segment, which was expected to come under pressure in the post-COVID era, is continuing to grow at a steady pace, which is another encouraging sign. In the third quarter, delivery gross bookings grew by 16%, revenue grew by more than 5%, and adjusted EBITDA from this segment reached a high of $413 million. The continued strength in the Delivery segment can be attributed to the prudent decision by the company to form strategic partnerships with high-value restaurant chains.

Uber ended the quarter with almost $5.2 billion in cash. Unlike in the past, the company has turned cash-flow positive and, in Q3, brought in close to $1 billion in operating cash flows. Although Uber carries $9 billion in long-term debt, the company does not face any liquidity risks today, given how it has turned the tables around to be cash-flow positive, proving many skeptics wrong.

The Unmistakable Signs of Competitive Advantages

For a business to grow sustainably over a long period of time, the presence of competitive advantages is a must. Uber, until recently, had to battle for market share in almost all of the key markets it operates in. However, Uber has been able to slowly but surely emerge as the leader in all of its strategically important global markets, thereby paving the way to enjoy durable competitive advantages in the long run.

To evaluate the presence of competitive advantages, an investor has to dive deep into the company’s financial performance data. In the third quarter, the number of active monthly users of Uber’s delivery/mobility services increased by 15%, the number of trips booked increased by 25%, delivery orders increased by 25%, order frequency grew by 9%, the average gross bookings per order increased by 8%, and the number of drivers (including couriers) reached an all-time high of 6.5 million.

The above data highlights two important things: Uber is enjoying strong demand for its services from consumers while the supply of services remains at an industry-leading level, thanks to the millions of drivers and couriers who provide their services on the platform. This is an early yet unmistakable indication of the presence of competitive advantages. Uber has emerged as the go-to platform among both consumers and drivers, which is creating a flywheel effect to attract new users easily.

Another early sign of the presence of competitive advantages is how Uber’s selling, general, and admin expenses have declined as a percentage of revenue in recent quarters. Back in the first quarter of 2021, SG&A expenses accounted for 54% of revenue, but in the third quarter of this year, SG&A expenses represented just 17% of revenue. This is a clear sign that Uber’s customer acquisition costs have reduced drastically, enabling the company to enjoy higher margins.

Innovation is Paying Off Handsomely

Despite being the dominant player in most markets it operates in, Uber continues to focus on innovation to drive revenue growth. This is a good sign, as innovative products and solutions will make it difficult for a competitor to dethrone Uber.

A couple of years ago, Uber started focusing on advertising revenue to diversify the business. Today, this segment has become a profitable one, thanks to the high-margin nature of this business. In the third quarter, the company expanded in-car tablet advertising to several new markets in the U.S. while rolling out post-checkout ads internationally on Uber Eats. The growing Advertising business should improve the overall margins of the company in the future.

Next, Uber One memberships surpassed 15 million members in the third quarter, with the company launching the membership in several new countries in Q3, including Columbia, Peru, and Portugal. The membership tier is now available in a total of 18 countries. The success of Uber One will help the company add a stable, recurring revenue stream.

Further, Uber Moto, the company’s innovative motorcycle ridesharing service, is now available in 20 countries. The service was launched to gain traction in markets where riders prioritize low-cost options, such as India and a few South East Asian markets. In Q3, Uber Moto trips doubled compared to the corresponding quarter in 2022.

Is UBER Stock a Buy, According to Analysts?

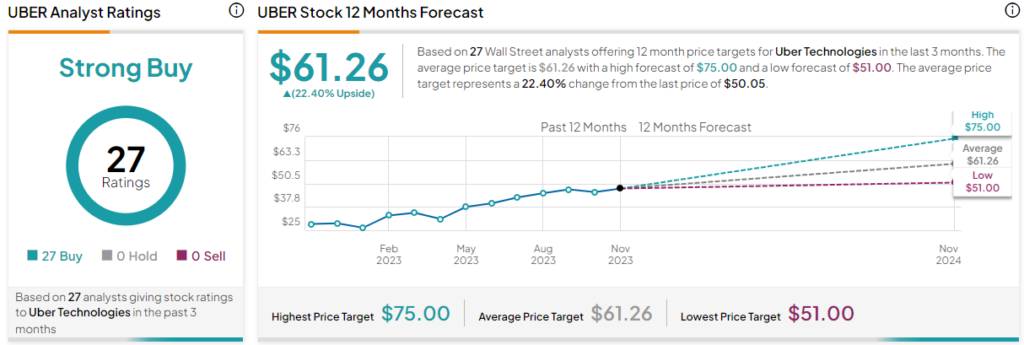

UBER stock comes in as a Strong Buy, according to analysts, with all 27 ratings being Buys. The average Uber stock price target is $61.26, which implies upside of 22.4% from the current market price.

The Takeaway: Uber Has a Long Runway to Grow

Over the last decade, Uber’s focus has been to gain market share in key markets while driving competition away. The company has successfully achieved this objective. In countries such as China, where competition is too strong, the company has decided to take a back seat by investing in local ridesharing businesses.

Today, Uber is at an inflection point where its focus is shifting from expanding scale aggressively to earning profits. With a long runway to grow in both domestic and international markets, Uber is poised to deliver handsome returns to long-term investors.