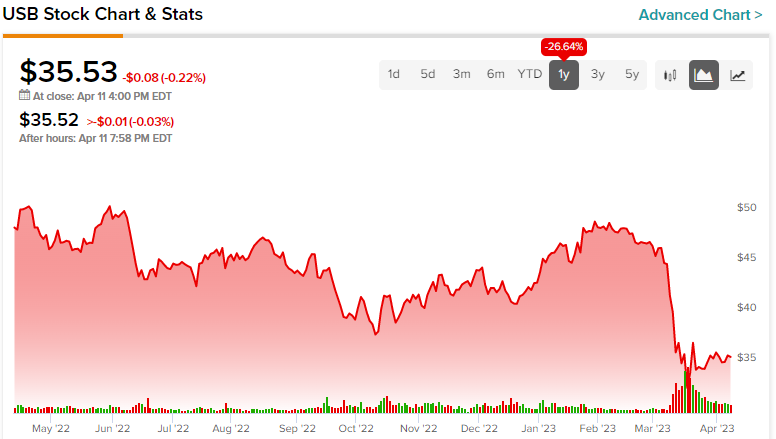

Some investors don’t find bank stocks like U.S. Bancorp (NYSE:USB) to be the most exciting investments in the world, but after the sector-wide sell-off caused by the collapse of Silicon Valley Bank, there’s nothing boring about the opportunity to invest in one of the U.S.’s top banks at an attractive price. Shares are now too cheap to ignore after falling 34% from their 52-week high.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Sweet Spot

According to Bankrate.com, U.S. Bancorp is the fifth-largest bank in the United States, with $585 billion in total assets. It has been operating since Abraham Lincoln was President, so this unlikely to be a bank that is going to vanish overnight like Silicon Valley Bank.

U.S. Bancorp is a level below the four global systemically important banks (GSIBs), namely JPMorgan Chase (NYSE:JPM), Bank of America (NYSE:BAC), Citigroup (NYSE:C), and Wells Fargo (NYSE:WFC), but it’s far larger than most regional banks, thus putting it into a relatively exclusive tier between the two levels with the two other largest regional banks, Truist (NYSE:TFC) and PNC Financial (NYSE:PNC).

These banks are in a sweet spot because they avoid some of the more onerous regulations affecting the GSIBs, but they are also more well-capitalized than the average regional bank and enjoy size and scale advantages that these banks don’t have. This scale has allowed U.S. Bancorp to do things like invest in technology to improve the customer experience in recent years.

Analysts See High Upside Potential for USB Stock

The stock is down from over $50 a share as recently as late January to around $35.53 at writing as fear has rippled through the banking sector in the aftermath of Silicon Valley Bank’s implosion. However, at this point, the selling off of U.S. Bancorp seems to be overdone.

Analysts seem to agree — U.S. Bancorp has a Moderate Buy consensus rating, and the average USB stock price target of $51.88 implies upside potential of 46%. Of the 18 analyst ratings on the stock, seven are Buys and 11 are Holds. There are currently no Sell ratings on U.S. Bancorp.

Wells Fargo analyst Christopher Harvey recently added U.S. Bancorp (along with PNC Financial) to Wells Fargo’s “Signature Picks” portfolio of best buys based on its strong balance sheet and attractive risk/reward profile. Wells Fargo says that U.S. Bancorp is well-rounded, with “some of the best offense (revenue growth, operating leverage) and defense (reserves for a 6-6.5% unemployment rate)” in the business.

One additional note is that U.S. Bancorp also looks to be in a strong position during the current crisis. Rather than needing liquidity, it was one of the banks that teamed up with JPMorgan Chase and other major banks to loan $30 billion to First Republic Bank (NYSE:FRC) in an effort to help prop up the embattled bank and stabilize the banking system. U.S. Bancorp chipped in with an uninsured deposit of $1 billion.

Too Cheap to Ignore

In addition to its oversold conditions and the positive view from analysts, U.S. Bancorp looks attractive from a valuation perspective. Shares trade at just 7.3 times earnings, which is a sizable discount to the average multiple for the S&P 500 (SPX), which is currently hovering well over 20 times earnings.

U.S. Bancorp is a dividend stock, and it also looks undervalued based on its 5.34% dividend yield. This is more than three times the average dividend yield of the S&P 500 and far greater than investors will find with many dividend ETFs or the 10-year Treasury note. Furthermore, USB’s dividend looks safe with a 50% payout ratio. The company has paid a dividend for 20 consecutive years, and it has increased its annual payout for 12 years in a row and counting.

Looking Ahead

U.S. Bancorp operates in a relatively sweet spot within the banking sector because it has size and scale advantages that other regional banks lack, but it falls below the threshold of the GSIBs. While shares have understandably sold off amidst the banking crisis, they now look oversold, and analyst price targets on the stock are a bullish indicator.

With its palatable valuation and high dividend yield, this looks like an advantageous time to pick up one of the U.S.’s top banks at an attractive price. I recently made this move in my portfolio, and I look forward to U.S. Bancorp being a long-term holding.