Demand is galloping for software applications that make life less dependent on computer hardware. Broadcom’s recent $61 billion VMware deal is a case in point.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let us take a look at two names in this space and how they might fare in the coming months.

CDW Corp (CDW)

CDW provides IT solutions to customers across government, education, and healthcare end markets. Its IT solutions include on-premise, hybrid, and cloud capabilities.

The Topline has steadily ticked upwards from $14.8 billion in 2017 to $20.8 billion in 2021. The figure is further expected to rise to $26.1 billion in 2023. The earnings per share of the company have also risen in tandem, from $3.83 in 2017 to $7.97 in 2021.

This performance has continued in CDW’s recent first-quarter numbers. Revenue jumped 23% year over year to $5.95 billion beating, estimates by $277.74 million. Earnings per share at $2.20 came in ahead of expectations by $0.18.

President and CEO of CDW, Christine A. Leahy, commented, “Customers continue to turn to CDW as a trusted advisor with the breadth, depth, expertise, and scale to deliver business-enhancing outcomes across the full technology stack and lifecycle.” This performance was also aided by CDW’s acquisition of Sirius Computer Solutions.

Bank of America Securities’ Ruplu Bhattacharya has reiterated a Buy rating on the stock while increasing the price target to $240 from $235.

Overall, the Street has a Strong Buy Consensus rating on CDW based on four unanimous Buys. The average CDW price target of $231.75 implies a potential upside of 35.45%.

Unisys Corp (UIS)

This technology solutions provider offers digital workplace solutions (DWS), cloud and infrastructure solutions, enterprise computing solutions, and business process solutions.

Revenue is expected to increase from $2.05 billion in 2021 to about $2.3 billion in 2023. Moreover, from a net loss per share of $6.75 in 2021, Unisys is expected to turn around and deliver a positive bottom line of $0.93 per share in 2023.

While Unisys saw a 12.4% year-over-year decline in its recent first quarter, the company experienced a 43% growth in its annual contract value. The total company pipeline jumped by 31% during this period.

Most importantly, Unisys is transforming its DWS business to focus on solutions that offer higher growth and a higher margin. Furthermore, Unisys saw a 7% increase in Cloud and Infrastructure Solutions on the back of its targeted strategy.

Recently, Unisys announced three major customer wins. Maureen Sweeny, the Senior Vice President, and Chief Commercial Officer at Unisys, commented, “With digital workplace, we are winning contracts with new and current clients looking to transform their employees’ experience through technology. With cloud and infrastructure, clients choose Unisys to not just help them move to a multi-cloud environment at scale but to help them fully leverage the benefits of the cloud ecosystem.”

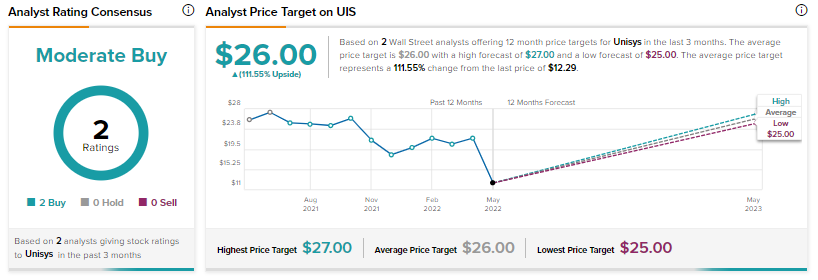

Canaccord Genuity’s Joseph Vafi has reiterated a Buy rating on the stock while decreasing the price target to $25 from $30.

Overall, the Street has a Moderate Buy consensus rating on Unisys based on two unanimous Buys. The average Unisys price target of $26 implies a massive 111.55% potential upside. That’s after a 40.6% slide in the share price so far in 2022.

Closing Note

With the end markets of both these names set to expand as technology becomes more and more mainstream, both these names stand to gain. The substantial potential upside expected by the Street should definitely put these names on investors’ radars.

Read full Disclaimer & Disclosure