Accsys Technologies (GB:AXS) and Woodbois Limited (GB:WBI) are two companies trying to make a difference to the environment, operating in sustainable wood manufacturing, and analyst Alex Brooks has a buy rating on both of them.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Brooks is the managing director at Canaccord Genuity and has earlier worked with J.P. Morgan, UBS Investment Bank, and Credit Suisse.

He has extensive experience in IPOs and other capital market research in the energy, materials, agriculture, and natural resources industries.

As per the TipRanks star rating system, Brooks is a five-star rated analyst with a success rate of 57%. He has an average return of 9.3% per rating.

Brooks is ranked 580 out of 8,021 analysts on TipRanks and covers stocks from both UK andU.S. markets.

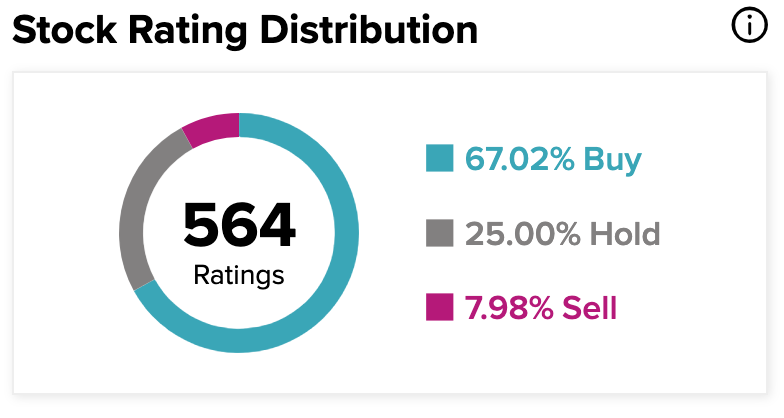

Brooks is mostly bullish on these sectors as 67.02% of his ratings are buy, 25% are hold and around 8% are sell.

Let’s see the two stocks in detail.

Accsys Technologies

Accsys Technologies is a manufacturer of sustainable wood products that are stable and durable, environment-friendly, and better than carbon-intensive alternatives.

With the help of its technology, acetylation, the company offers wood that resist water and stay solid without much wear and tear.

The company has two product segments: Accoya and Tricoya, which are positioned in the construction and building market.

Last month, the company reported its annual results for 2022. The company’s revenue grew by 21% to €120.9 million, and the profit before tax increased by 18% to €1.3 million. The number reflects strong demand for sustainable products, which has led to higher productivity growth.

Looking at the demand for its products, which is currently outpacing the supply, the company has a goal to increase its production numbers by five times by 2025 with more investment in plants. The company is also considering partnering overseas in the U.S. and Asian markets to increase its sales.

Brooks said, “The company is on the brink of significant expansion following investment in the Arnhem manufacturing facility in the Netherlands and the current commissioning of the first dedicated Tricoya manufacturing facility in Hull, UK.”

Brooks views Accsys as “a core sustainability stock,” given the company’s significant growth potential from an established and profitable business.

Is AXS stock a buy?

According to TipRanks’ analyst rating consensus, Accsys Technologies stock is a Moderate Buy, based on one Buy rating from Brooks. He initiated coverage on this stock in July 2022.

The Accsys Technologies stock price prediction is 190.0p, which has 100.4% upside potential at the current level.

Woodbois Limited

Woodbois Limited manufactures and sells sustainable African hardwood products. It is also involved in forestry and timber trading.

The company’s stock gained good momentum after its first quarter results, during which revenue increased by 22%. The company became net positive in 2021. The company has reorganised its capital structure, which has helped it to reduce its debt and generate profits.

In the recently released first-half results for 2022, the revenue grew by 38% to $11.3 million and the gross profit increased by 59% to $2.7 million. The main driver behind the growth was record production levels. The company is optimistic about the full-year results being on track and delivering profits.

Is Woodbois Ltd a good investment?

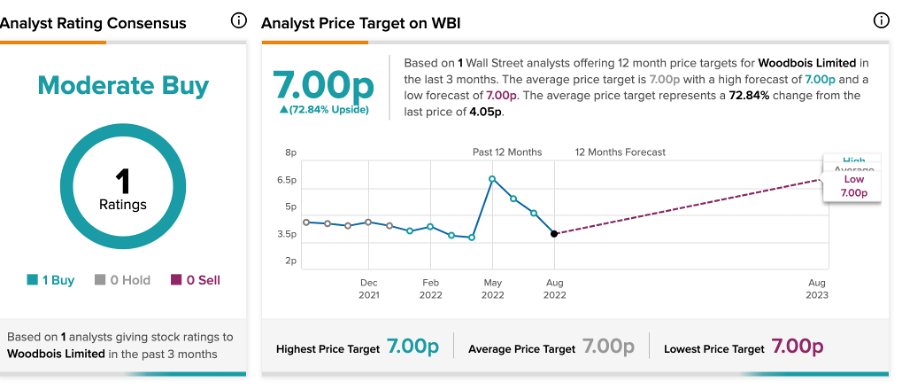

According to TipRanks’ analyst rating consensus, Woodbois stock is a Moderate Buy based on one buy rating from Brooks.

The WBI price target is 7.0p, which is 72.84% higher than the current price.

Last month, Brooks increased the target price of the stock from 6.0p to 7.0p, while maintaining the buy rating.

Conclusion

These companies, being smaller in size, are not on the radar of a lot of analysts, which makes them more interesting. The sustainable product sector is gaining a lot of traction, meaning potential huge top-line growth for these companies.