In turbulent economic times, analyst’s recommendations can offer great tips on the next stock to invest in, backed by sector expertise – Monique Pollard is a director at Citigroup and is a part of the travel and leisure team, covering hotels, gaming, online food delivery, and catering stocks.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The unique tools on TipRanks enable investors to focus on highly rated analysts – and the top stocks they have picked.

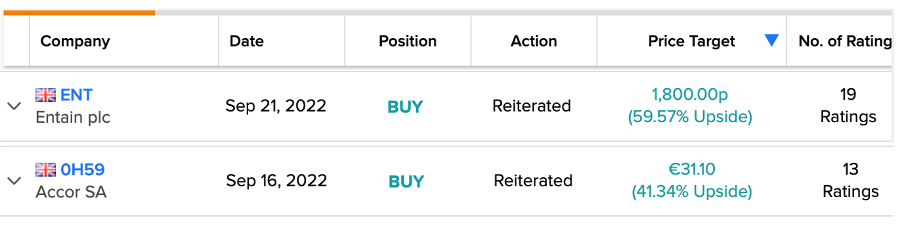

Today, we are highlighting Monique’s picks, online gaming and betting company Entain Plc (GB:ENT) and hospitality group Accor SA (GB:0H59) from her list.

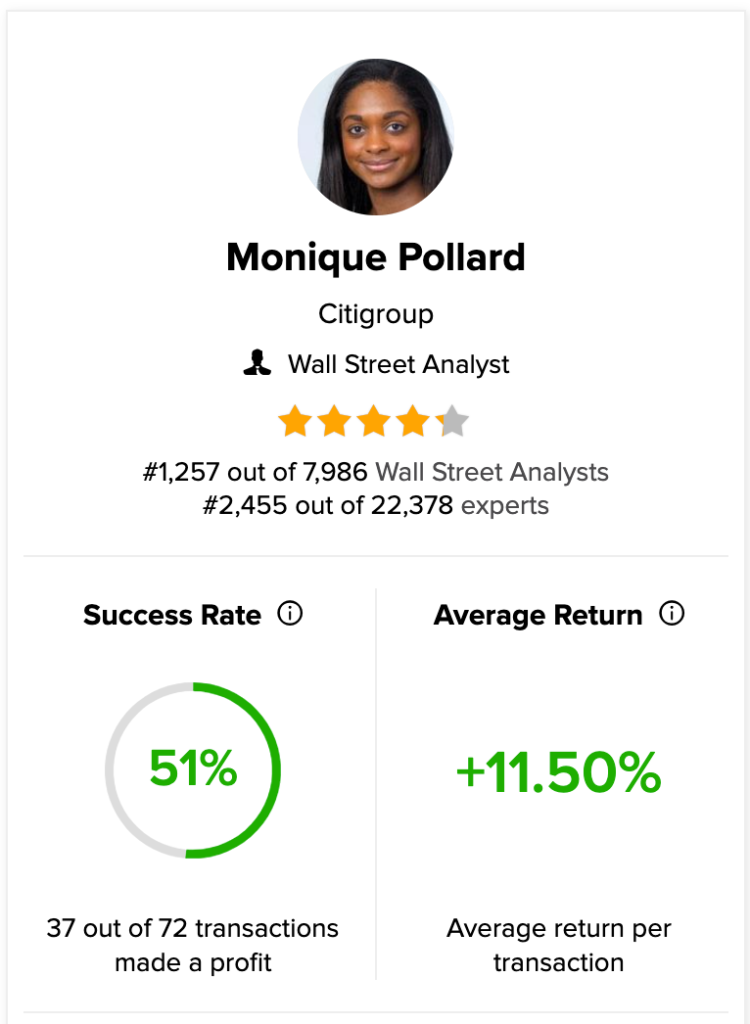

Pollard rates stocks from the UK, the U.S., and German markets. Before joining Citigroup in 2017, she had worked with Goldman Sachs for six years as an executive director in equity research.

She is ranked 1,257 out of 7,986 analysts on TipRanks and 2,455 out of 22,378 total experts. The TipRanks Expert Centre provides a detailed list of analysts covering various sectors and the stocks rated by them.

As per the TipRanks star rating system, Pollard is a four-star rated analyst with a success rate of 51%. She has an average return of 11.5% per transaction.

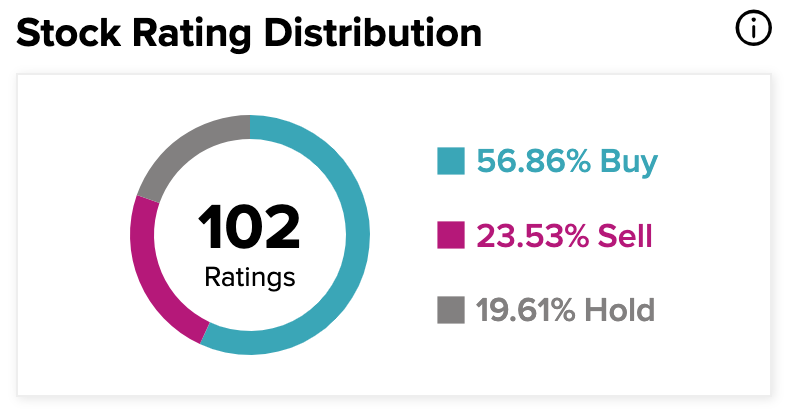

Pollard is mostly bullish on the travel and leisure sector. Out of her total ratings, about 56.8% of the stocks have Buy ratings.

Let’s see the two stocks in detail.

Entain Plc

Entain is among the leading sports betting and gaming companies inthe world. The company has a massive portfolio of well-known brands including bwin, Ladbrokes, partypoker, PartyCasino, and more.

The company enjoys a diversified business model, solid momentum in the online business, and sound profit margins.

The first half of 2022 witnessed the highest-ever level of actives, which increased by 57%. The company’s net gaming revenue also jumped by 18%, driven by a broader customer base. The company expects the remaining year to see the same level of growth and expects to generate more returns for its shareholders.

Entain share price forecast

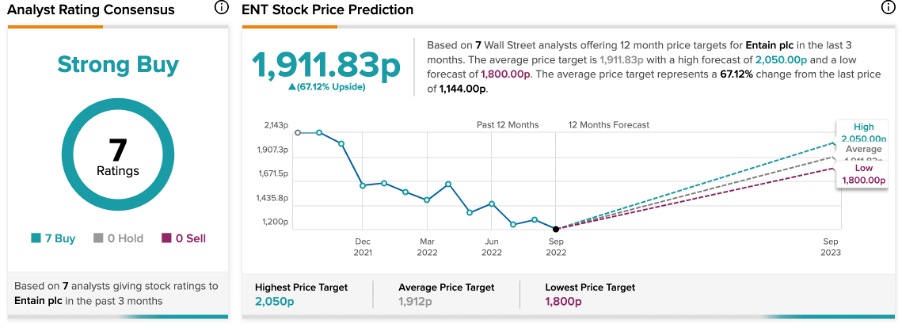

According to TipRanks’ analyst consensus, Entain’s stock has a Strong Buy rating, based on seven Buy recommendations.

The ENT price target is 1,911.8p, with a high and a low forecast of 2,050p and 1,800p, respectively. The price target implies an upside potential of 67.6%.

Pollard has a target price of 1,800p on the stock, which is 58% higher than the current price level. She has a 60% success rate on the stock, with an average return of 40%.

Accor SA

Accor SA is a global hospitality group based in France that owns and operates hotels and resorts. It also operates restaurants, bars, co-working spaces, entertainment venues, and more.

The company has a diverse portfolio of brands spread across the economy, midscale, premium, and luxury segments.

With the travel sector is back in action, the company witnessed a strong rebound in activity levels. In its half-yearly results, the company reported its second-quarter RevPAR (revenue per available room) increased above 2019 levels.

Revenue jumped by 109% to €1,725 million, driven by a global recovery in the tourism and hospitality industries. In the first half, Accor opened 85 new hotels and has a pipeline of 1,215 hotels.

Based on such positive drivers and tighter control on costs, the company last month raised its EBITDA guidance to be between €610 and €640 million, which was earlier announced at €550 million.

Accor SA share price forecast

Pollard has a target price of €31.10, which has an upside potential of 41%.

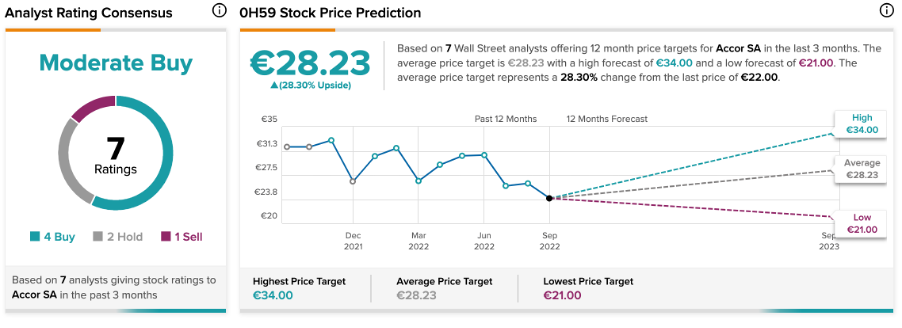

According to TipRanks, Accor stock has a Moderate Buy rating. The Accor price target is €28.23, which is 28.3% higher than the current price.

Conclusion

Both companies have a strong foothold in their respective sectors and are enjoying stable growth in revenues.

Based on Pollard’s experience in the industry, these stocks could become a great addition to any portfolio.