Despite the economic slowdown and gloomy outlook, dividend-paying stocks are holding up – here, we’ve picked two of Britain’s best.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Global miner Rio Tinto (GB:RIO) and house builder Barratt Developments (GB:BDEV) are two of the few stocks in the FTSE 100 that currently offer a dividend yield of more than 10%.

Here, we have used TipRanks’ Stock Screener tool to shortlist the companies with a higher dividend yield. This tool can guide investors in choosing stocks based on different criteria such as dividend yield, analyst ratings, market cap, Smart Score, and more.

Let’s see the two stocks in detail.

Rio Tinto

Rio Tinto is a multinational mining company dealing in mineral resources such as iron ore, aluminium, copper, diamonds, and coal.

As iron ore contributes the most to the company’s earnings, the company has a huge dependency on its prices. The recent slump in iron-ore prices has hit Rio’s profits. The share prices also witnessed a lot of volatility in the last six months and were trading down by 17.8%.

The company has shifted its focus on new-age metals such as nickel and lithium, which have huge demand in the battery markets and could diversify its revenue streams.

The company is among the best dividend payers in the market. Even though profits have declined, the dividend story remained intact because of its solid balance sheet position. The company had net cash of $291 million at the end of June 2022. This gives enough flexibility to the company to counter market volatility and also invest in new assets.

As per the company’s policy, it pays 50% of underlying earnings as dividends. It paid $4.3 billion as interim dividends, which was the company’s second highest so far.

With world-class assets that generate strong cash flow and a solid balance sheet after distributing higher returns to the shareholder, Rio is doing everything right.

The stock’s decline presents a good opportunity for long-term investors.

Are Rio Tinto shares a good buy?

According to TipRanks, Rio Tinto stock has a Hold rating based on 13 analysts’ recommendations.

The RIO target price is 4,907.9p with a high forecast of 6,300p and a low forecast of 3,181.7p.

Barratt Developments

Barratt Developments is a residential property builder in the UK. The company’s operations include land acquisition, design and construction, and sales and marketing.

The UK housing market is currently showing some signs of a slowdown as mortgage costs continue to rise. This has impacted the share prices of builders with Barratt losing 31% of its value in the last six months.

The company, however, did make up for that with the highest dividend yield among the competitors. The company’s future dividend payments are also secured based on its strong financial position and favourable forward sales book combined with its vast land assets.

The company is on track for its buyback programme for £200 million, announced in September 2022.

The company recently issued a trading update and reported a decline of 8.5% in forward sales. Still, the company continues to see a strong level of buyer interest and has 64% of its forward sales in privately owned home completions.

Barratt expects its adjusted profit before tax to be in line with expectations. The company has a strong advantage of higher selling price in its favour. After years of regular increases, the average selling price for the company is £3,77,200.

Barratt share price forecast

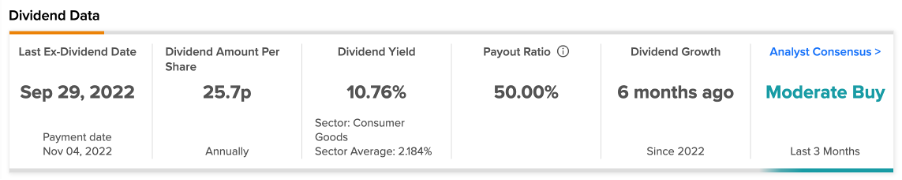

According to TipRanks’ analyst rating consensus, Barratt’s stocks has a Moderate Buy rating, based on three Buy and four Hold recommendations.

The BDEV target price is 549.5p, which is 58% higher than the current price level.

Conclusion

Looking at their asset base and robust financial situation, these high dividend-paying stocks are a must to build your dividend portfolio.

Their commitment to generating higher returns for shareholders is commendable.