To curb soaring inflation, the central banks are pushing interest rates globally: which is good news for banks. British-listed banking giants NatWest Group (GB:NWG) and HSBC Holdings (GB:HSBA) are right in the centre of this wave.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

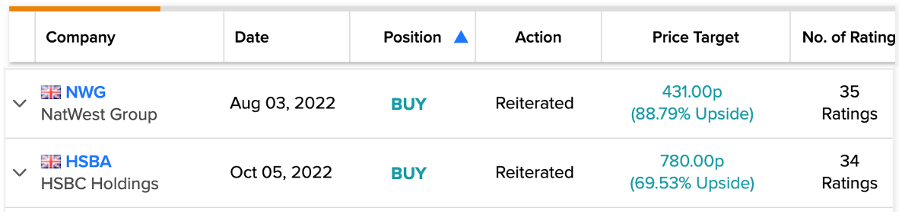

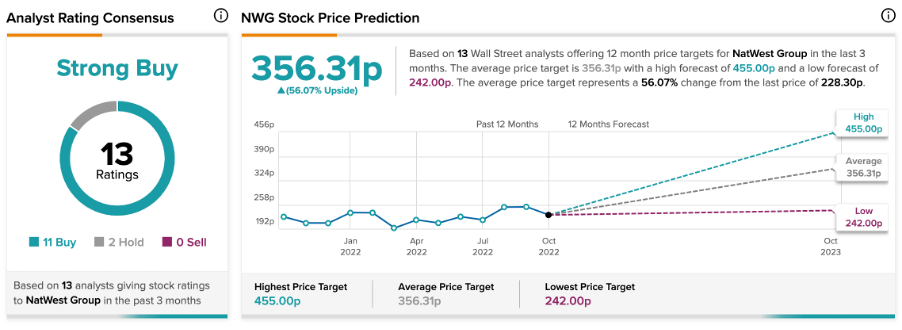

These stocks have a wide coverage from analysts, and Barclays analyst Aman Rakkar is highly bullish on these stocks.

Rakkar is a Director at Barclays’ banks equity research team and covers the UK and Irish banks. He also has experience in rating European banks’ stocks.

Rakkar was also part of the top UK analysts of 2020, ranked by TipRanks. These rankings were derived based on analysts’ returns on stock ratings made in 2020, measured over a period of three months.

As per the TipRanks star rating system, Rakkar is ranked 413 out of 7,978 analysts and 629 out of a total of 22,497 overall experts. He has a success rate of 65% with an average return of 18.2% per transaction.

The TipRanks Expert Centre rates the analysts on three parameters: success rates, average returns, and statistical significance. This tool can guide investors in choosing stocks recommended by highly successful analysts.

Let’s see the two stocks in detail.

NatWest Group

NatWest Group is a UK-based banking company that offers retail, commercial, and private banking services, along with asset management services, and more.

NatWest shares saw a gain of almost 5% in the last five trading days after it announced the closure of 43 branches. With this move, the bank is aiming for better cost management and also transforming with an increasing shift towards online banking. The branches will be closed in the first quarter of 2023.

The bank also struck gold with its capital allocation programme for its shareholders, which is expected to continue in 2023. This stock is an attractive option with a dividend yield of 13.09% and robust share buybacks. While investors wait for the stock to gain solid momentum, they are happy with passive income from this stock.

The bank is expected to post third-quarter earnings by the end of this month and the increase in mortgage rates could hurt the growth outlook. However, analysts expect the higher interest income will boost the overall profitability of the banks in the UK.

Rakkar has a 77% success rate on the stock, with 10 out of 13 ratings being profitable. His target price on the stock is 431p, which is 88.8% higher than the current price level.

Is NatWest stock a buy?

According to TipRanks’ analyst rating consensus, NatWest has a Strong Buy rating, based on 11 Buy and two Hold recommendations.

The NWG target price is 356.3p, which has an upside potential of 56%.

HSBC Holdings

HSBC Holdings is a multinational banking and financial services company. The bank has three business segments: wealth and personal banking, commercial banking, and global banking and markets.

Even though the bank has a presence in more than 60 countries, it continuously analyses its operations and exits unprofitable markets.

Analysts remain worried about earnings available for distribution amid the unfavourable business conditions. However, the bank is further looking for the sale of non-performing assets, which could generate some capital for shareholder’s returns.

The bank is highly exposed to Asian markets and is expected to generate its major growth from this region. Recently, HSBC has expanded its private banking operations in China to Chengdu and Hangzhou. With the growing number of Chinese millionaires and the rising digital population, the bank intends to grow its market share in the region.

Rakkar recently reiterated his Buy rating on the stock at a target price of 780p. This is almost 70% higher than the current price level.

Are HSBC shares a buy or a sell?

According to TipRanks’ analyst consensus, HSBC stock has a Moderate Buy rating. The stock has coverage from 14 analysts including five Buy ratings.

The HSBA target price is 658.1p, which is 43% higher than the current price level.

Conclusion

Both banks are due to report their next earnings at the end of October. The turbulence at the macroeconomic level is hurting growth prospects. However, the bank’s fundamentals are strong from a long-term perspective. Also, the stocks are great for income investors.