Entertainment stocks—like TTWO, LYV, and DIS—have been showing signs of life over the past year despite what remains of a challenging macro environment. As the economy shows signs of resilience and consumers have a chance to save a bit more disposable income for enjoyment and experiences, I’d look for the entertainment scene to continue adding to recent momentum.

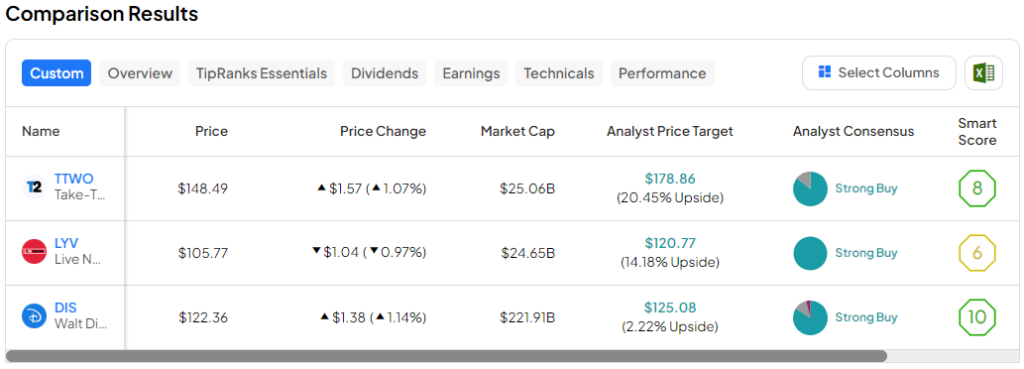

Indeed, only time will tell if they’ll be next in line to make new all-time highs. Regardless, each of the following names has Wall Street’s confidence, with most analysts recommending them as Buys. Therefore, let’s use TipRanks’ Comparison Tool to compare and contrast each entertainment play to see which one Wall Street is most bullish on.

Take-Two Interactive (NASDAQ:TTWO)

First, let’s look at the at-home entertainment play Take-Two Interactive, which has been looking to gain ground over the past year after surrendering most of its pandemic-era gains in 2021 and 2022. Undoubtedly, the reopening of the economy meant video game firms were forced to compete with theme parks, concerts, and other “real-world” forms of entertainment again.

However, with inflation and layoffs continuing to have the potential to weigh on consumer balance sheets, I think at-home entertainment stocks could begin to gain the upper hand again.

When it comes to Take-Two, it has its long-awaited Grand Theft Auto VI (GTA VI) release up ahead, which could make the most of the opportunity at hand as it looks to entertain gamers with the next generation of its immersive open-world blockbuster title.

With mind-blowing water physics and gorgeous scenes revealed in the game’s first trailer, everyone is hyped and ready to hand over their money to Take-Two. I share the enthusiasm and am staying bullish on the name, regardless of when GTA VI actually ends up being released.

In any case, Take-Two stock recently hit a snag, as news broke that GTA VI could be delayed. According to Kotaku, such delays could push the title from 2025 to late 2025 or 2026. With return-to-office orders issued by Take-Two, the hope is that potential delays can be minimized.

Even if GTA VI doesn’t launch for another two years, I don’t think the recent single-day plunge of 4.2% was warranted. It speaks to the short-term-focused nature of some gain-chasing investors. Now that a big chunk of them are out of stock, long-term thinkers may have the opportunity to snag an excellent entertainment play at a slight discount.

Does it really matter if TTWO’s blockbuster doesn’t land until a few months later than expected if you have a five-year horizon? Probably not.

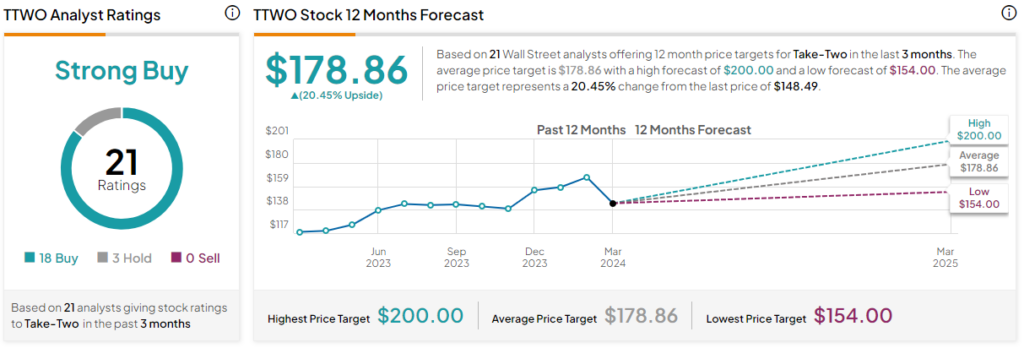

What Is the Price Target of TTWO Stock?

TTWO stock is a Strong Buy, according to analysts, with 18 Buys and three Holds assigned in the past three months. The average TTWO stock price target of $178.86 implies 20.45% upside potential.

Live Nation Entertainment (NYSE:LYV)

Live Nation Entertainment is perhaps the best way to bet on live music and real-world experiences. Sure, the Metaverse and all the sort seek to replicate the feeling of going to a concert. However, don’t count on the next generation of spatial computers to eat into the demand for Taylor Swift tour tickets anytime soon, or, actually, ever.

Live Nation is the undisputed king of live entertainment, and for that reason, it deserves a premium price tag (80.7 times trailing price-to-earnings) and analysts’ bullishness. I share their bullishness as the stock’s rebound kicks into high gear.

Earlier this year, Roth MKM’s Eric Handler upgraded LYV stock to Buy from Hold while hiking his price target by around 23%. Mr. Handler’s a big fan of the demand trajectory, noting that the firm seems poised for “above-trend” growth from here.

Though sought-after concert tickets are incredibly expensive, the crowd seems more than willing to pay the lofty price of admission to such unforgettable experiences. Indeed, there’s really nothing like a good show from your favorite artist.

In short, Live Nation is a low-tech entertainment giant with a moat that not even next-generation technologies can penetrate. With plenty of big events beyond Taylor Swift’s Eras tour (think the Creed reunion tour) up ahead, look for Live Nation to keep its growth going strong.

What Is the Price Target for LYV Stock?

LYV stock is a Strong Buy, according to analysts, with 14 unanimous Buys assigned in the past three months. The average LYV stock price target of $120.38 implies 13.8% upside potential.

Disney (NYSE:DIS)

Disney stock is finally on the ascent, with shares now up around 25% over the past year. While new highs are still out of sight, I do think the potential election of Nelson Peltz to the board of directors could give the media and entertainment giant the spark it was looking for. Undoubtedly, CEO Bob Iger has arguably had enough time to work his magic. Until now, the only magic that investors are looking forward to is a change-up in the c-suite.

Beyond the management shift, there are some intriguing and potentially overlooked catalysts that could help DIS stock sustain its comeback. From investing in expanding theme park incremental capacity to tapping into Epic Games’ Fortnite to level up, I believe there are enough drivers to get excited about Disney again.

Oh, and let’s not forget about the potential to more effectively monetize its ESPN assets as live sports and streaming enter their prime. Like so many analysts, most of whom view the firm as a Buy, I am bullish.

Undeniably, theme parks have been a strong point for Disney lately. By betting big on expanding capacity, the firm stands to gain big time as it welcomes more visitors at once, many of whom are more than willing to pay a pretty penny for entry. Though the Epic Games investment is a bit of a wild card, I can’t help but imagine what Disney may have in store in the distant future as it looks to double down on the Metaverse.

When it comes to metaverse-like plays that have resonated with young people, Fortnite is hard to overlook. As Disney continues putting money in the right areas (gone are the days of rampant spending on Disney+), I find that a recovery is likely just a matter of time. And with Peltz aboard the board, look for Disney’s recovery efforts to accelerate a bit. He’s a smart activist and one who could add ample value to the legendary media and entertainment giant.

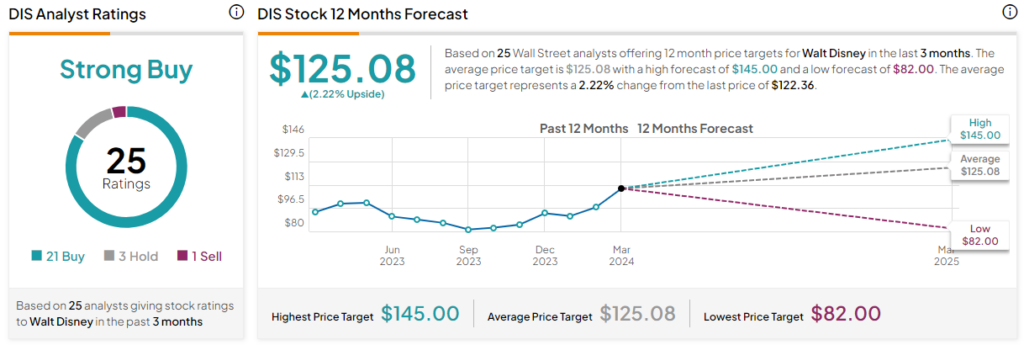

What Is the Price Target for DIS Stock?

DIS stock is a Strong Buy, according to analysts, with 21 Buys three Holds and one Sell assigned in the past three months. The average DIS stock price target of $123.21 implies 2.2% upside potential.

The Takeaway

As consumer sentiment improves, perhaps value investors may wish to entertain the thought of buying the aforementioned Strong-Buy-rated stocks while they continue their recoveries. Of the trio, analysts see TTWO as having the most to gain over the next year.