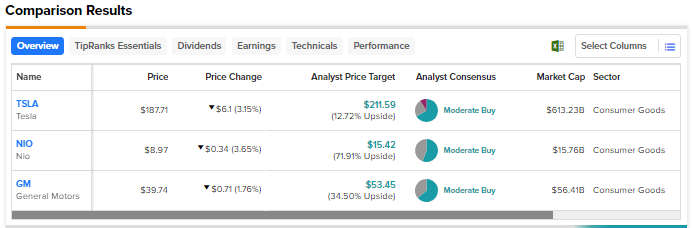

Macro pressures and intense competition are expected to weigh on electric vehicle (EV) makers over the near-term. Nonetheless, the long-term demand for EVs is expected to be robust, driven by innovation, an emphasis on clean energy, and government incentives. We used TipRanks’ Stock Comparison Tool to place Tesla (NASDAQ:TSLA), Nio (NYSE:NIO), and General Motors (NYSE:GM) against each other to select the stock that could offer the highest upside from current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Tesla (NASDAQ:TSLA)

Despite multiple headwinds, leading EV maker Tesla delivered upbeat fourth-quarter results and dismissed investors’ concerns about CEO Elon Musk not focusing on the company due to his much-publicized Twitter acquisition.

Tesla produced 1.37 billion vehicles (up 47%) and delivered 1.31 vehicles (up 40%) in 2022. The company’s revenue grew 51% to $81.5 billion last year, while adjusted EPS jumped to $4.07 from $2.26 in 2021. Tesla aims to produce 1.8 million vehicles in 2023. It recently lowered the prices for Model S and Model X in the U.S. to boost sales.

Meanwhile, Tesla continues to ramp its production capacity to ensure that it meets robust demand for EVs over the long term. Recently, Tesla received permission to establish its gigafactory in Mexico. The company aims to build more gigafactories to achieve its goal of producing 20 million EVs by 2030.

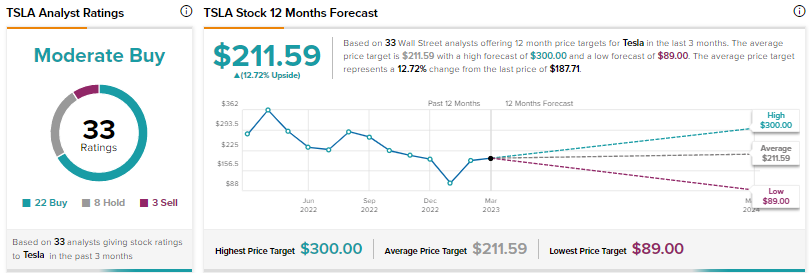

Is Tesla a Good Buy?

Following Tesla’s recently held Investor Day, Jefferies analyst Philippe Houchois reiterated a Buy rating on the stock and raised his price target to $230 from $180. Houchois feels that the lack of the launch of a new product at the event does not imply any “major growth delays.”

“Scaling up 3/Y further through dynamic pricing could limit the scope for earnings surprises in 2023/24 but benefit FCF [Free Cash Flow] and ROIC [Return on Invested Capital],” added Houchois.

Wall Street has a Moderate Buy consensus rating for Tesla stock based on 22 Buys, eight Holds, and three Sells. The average TSLA stock price target of $211.59 implies 12.7% upside potential. Shares have rallied over 52% since the start of 2023.

Nio (NYSE:NIO)

Chinese EV maker Nio’s fourth-quarter results and weak Q1 2023 deliveries guidance disappointed investors. The significant contraction in the company’s gross margin and a higher-than-anticipated loss in Q4 2022 were concerning.

Nonetheless, several analysts remain optimistic about the company’s innovation as well as the growing footprint of its battery swap stations and charging infrastructure. The company intends to speed up the expansion of its battery-swapping network and plans to install additional 1,000 power swap stations this year.

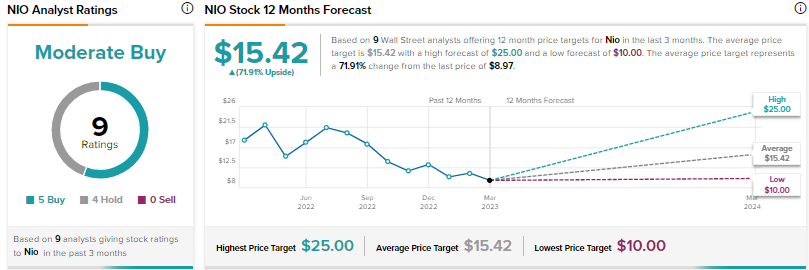

What is the Price Target for Nio?

Citigroup analyst Jeff Chung reiterated a Buy rating on Nio and a $23.30 price target on NIO after hosting a business update call with the company on March 2.

Chung noted that while management projects a gross profit margin of mid-to-high single-digit percentage in Q1 2023, they expect it to return to a double-digit percentage in Q2-Q3 2023 and are confident that the metric will reach 18% to 20% in Q4 2023. They expect this improvement to be driven by the ramp-up of high-margin models, “greater scale effect on sales increase,” and a potential decline in the cost of lithium carbonate.

Further, they expect 2023 sales to benefit from a strong product cycle, supported by eight NT2.0 models, increasing power swap stations, and a better customer experience fueled by autonomous driving. Chung noted that management believes Q4 2022 was the “worst time” for the company and “retail leads and order intake in Feb-23 proved to be the best in the past five months.”

With five Buys and four Holds, Nio earns a Moderate Buy consensus rating. At $15.42, the average Nio stock price target indicates 72% upside from current levels. Shares are down 8% year-to-date.

General Motors (NYSE:GM)

Legacy automaker General Motors closed 2022 with market-beating Q4 results and is positive about the business momentum this year. To improve its productivity during these challenging times, the company is targeting cost savings of $2 billion in its automotive business over the next two years.

Additionally, the company is aggressively expanding in the lucrative EV market. It projects capital expenditure for 2023 in the $11 billion to $13 billion range, with around 75% of its product-specific capital budget allocated to EVs and autonomous vehicles (AVs).

General Motors aims to double its revenue to the range of $275 billion to $315 billion by 2030. It plans to have a 1 million annual EV capacity in North America by 2025.

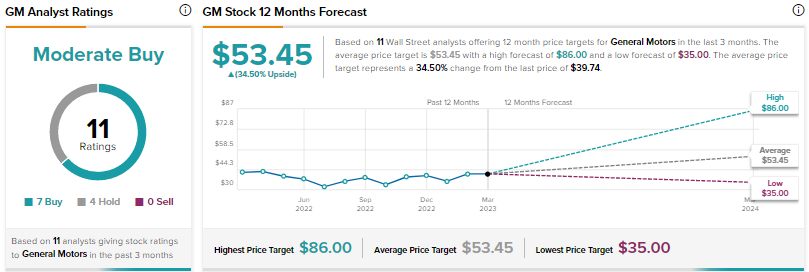

Is GM a Good Stock to Buy?

Recently, Tigress Financial analyst Ivan Feinseth reiterated a Strong Buy rating on General Motors stock and a price target of $86. Feinseth believes that “the ongoing cadence of new EV introduction ramps up, which, combined with GM’s ability to leverage the flexible architecture of its Ultium platform along with the introduction of software-defined capabilities and the connected vehicle, drive significant long-term shareholder value creation.”

The Moderate Buy consensus rating for General Motors is based on seven Buys and four Holds. The average price target of $53.45 suggests 34.5% upside potential. Shares have advanced 18% so far this year.

Conclusion

Wall Street analysts are bullish about the long-term prospects of Tesla, Nio, and General Motors in the EV space, even as they acknowledge the impact of near-term macro pressures on these automakers. Currently, they see the greatest upside in Nio stock. Nio is well-positioned to lead the EV market in China, backed by its technology, growing charging network, and expansion into international markets.