The technology companies flying just outside of our radar may be the ones that have the most room to run this year. Undoubtedly, there’s more to investing than just buying the largest seven companies in the stock market. Bigger has been better, at least in the past year. But what has worked best in the recent past may not continue to work so well in the future. Right now, investors may wish to check out some Strong-Buy-rated stocks for a shot at making the most of the tech-driven rally while potentially steering clear of the biggest potholes in the road.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

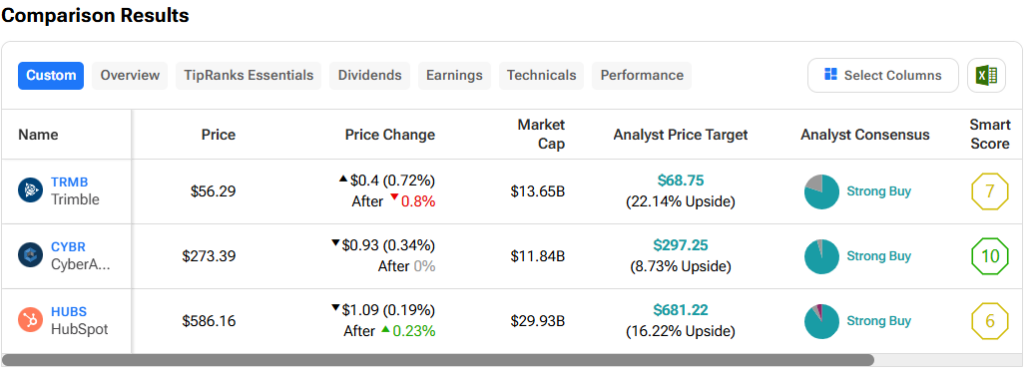

Therefore, let’s use TipRanks’ Comparison Tool to compare and contrast three impressive tech stocks — TRMB, CYBR, and HUBS — that have what it takes to outrun the market’s current heavyweights.

Trimble (NASDAQ:TRMB)

Shares of geospatial tech firm Trimble have been struggling to hang onto the big surge they enjoyed since bottoming in November 2023. The tech firm, which serves a wide range of industries, now finds itself in a correction, down close to 15% from 52-week highs. Despite the share slip, which came weeks after the company reported a strong first quarter (earnings per share of $0.64 vs. $0.62 expected), I’m inclined to stay bullish as Trimble looks to launch new products that may emerge as meaningful long-term growth drivers.

Looking ahead, new scanning systems such as the X9 3D laser scanner, which it showed off in Geo Week 2024 earlier this year, may be a timely catalyst that helps TRMB stock out of its rut. It’s more than just a faster and more accurate 3D screener, though; its auto-calibration capabilities could help users save time and take a bit of human error out of the equation.

Indeed, such new tech makes Trimble a niche technological innovator and one that Cathie Wood may have been wrong to trim. At writing, the stock trades at 20.2 times forward price-to-earnings (P/E), considerably below the Scientific and Technical Instruments industry average of 19.9 times.

What’s the Price Target for TRMB Stock?

TRMB stock is a Strong Buy, according to analysts, with four Buys and one Hold assigned in the past three months. The average TRMB stock price target of $68.75 implies 22.1% upside potential.

CyberArk Software (NASDAQ:CYBR)

From geospatial tech to cybersecurity, we have CyberArk Software. It’s a smaller ($11.8 billion market cap) Israeli firm that deserves to be mentioned whenever the cohort is discussed on television after a major breach reignites interest in cybersecurity names. With various cybersecurity players in the market, each boasting unique specialties, CyberArk’s offerings deserve attention.

CyberArk’s bread and butter is in identity security, a promising sub-scene in the cybersecurity market. As the Israel-based firm continues improving its already impressive Identity Security Platform, it’s tough not to be bullish on the lightweight cybersecurity firm eyeing a vast market.

Despite its size, CyberArk stands out as a market leader in the Identity and Access Management (IAM) market, which could enjoy a compound annual growth rate (CAGR) of 15% between now and 2032, according to Fortune Business Insights. With impressive subscription annual recurring revenue (ARR) growth of 60% posted last year, CyberArk looks like a cash cow in the making.

At writing, CYBR stock is close to a fresh all-time high. Shares are on the high end of the past-year historical range at 14.5 times price-to-sales (P/S). However, the rich multiple may be worth paying for such a fast grower in a lucrative corner of cybersecurity.

What’s the Price Target for CYBR Stock?

CYBR stock is a Strong Buy, according to analysts, with 21 Buys and one Hold assigned in the past three months. The average CYBR stock price target of $297.25 implies 8.7% upside potential.

Hubspot (NASDAQ:HUBS)

Hubspot stock has been blistering hot over the past two years, soaring almost 80%. Though the rally has since petered off in 2024, the small- and medium-sized (SMB) business software firm may still have legs going into the second half of the year as IT spending looks to experience a bit of an uptick. As a compelling takeover target with a great deal of AI innovation under the hood, I’m inclined to stay bullish on the stock, just like analysts.

Undoubtedly, recent headlines have been dominated by chatter regarding a potential $33 billion Alphabet (NASDAQ:GOOGL) takeover. Robust, AI-leveraging customer relationship management (CRM) software certainly seems to be the missing piece of the Alphabet puzzle. A deal would help it more effectively clash against some of its software-as-a-service (SaaS) rivals, most notably enterprise giant Microsoft (NASDAQ:MSFT), which has been busy infusing AI across the suite.

More recently, reports noted that other “bidders” have stepped up, expressing interest in gobbling up the firm for an unknown amount.

Deal or not, Hubspot stands out as a compelling software recovery play and a serious CRM market disruptor as it triples down on AI tools to help customers “work smarter.” At 80.6 times forward price-to-earnings (P/E), HUBS shares don’t come cheap. However, if Google and others are eyeing a potentially higher admission price, perhaps investors may be at risk of underestimating the magnitude of the growth narrative.

What’s the Price Target for HUBS Stock?

HUBS stock is a Strong Buy, according to analysts, with 18 Buys and one Hold assigned in the past three months. The average HUBS stock price target of $681.22 implies 16.2% upside potential.

The Takeaway

The following Strong-Buy-rated software plays are worth checking out as they look to seize any market opportunities headed their way. Whether we’re talking about Trimble and its new 3D scanner, CyberArk’s ever-improving identity security offering, or Hubspot’s AI-first software that’s caught the attention of “bidders,” it’s clear some huge opportunities lie outside the market’s top five. Of the trio, analysts see the most upside potential (22%) from TRMB stock.