In this piece, I evaluated two point-of-sale (POS) software stocks, Toast (NYSE:TOST) and Lightspeed Commerce (NYSE:LSPD) (TSE:LSPD), using TipRanks’ comparison tool to determine which is better. Toast is a cloud-based restaurant management software company that provides an all-in-one point-of-sale system built on Android, while Lightspeed Commerce provides point-of-sale and e-commerce software.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Toast shares are up 21% year-to-date, bringing their one-year return to 13%. Meanwhile, Lightspeed Commerce’s New York-listed shares are still off 23% over the past 12 months after their year-to-date gain of 5%.

With such a clear divergence in stock-price performance, one would expect a sizable difference in valuation between these two companies, but that’s not the case. Neither is profitable, so we’ll use their price-to-sales (P/S) ratios to compare their valuations.

We’ll also gauge their valuations against that of their industry to determine how they’re faring in a broader sense. For comparison purposes, the U.S. software industry is trading at a P/S multiple of 9.4, lower than its three-year average of 10.4.

Toast (NYSE:TOST)

At a P/S of 3.4, Toast immediately looks cheap versus its industry. However, its lack of profitability, dependence on the restaurant sector, and recent stock rally suggest that a discount and a bearish view may be appropriate, especially considering the other issues discussed below.

Toast’s stock popped after its last earnings report, as it boosted its guidance while reporting positive free cash flow and adjusted EBITDA for the first time since going public. While that’s a major milestone, it’s still a far cry from full profitability, especially considering other potential issues.

Generally, analysts expect Toast to report its final loss in 2024 and become profitable in 2025, generating $146 million in profits that year. That would require an average annual earnings growth rate of 46%, which might seem possible, especially considering the 84% increase in non-GAAP (generally accepted accounting principles) profits in the most recent quarter.

However, it’s important to note that Toast has missed earnings estimates every time in the last four quarters, and three were wide misses. This suggests the company’s profitability may come later than currently expected, especially given that it’s relying on current customers increasing their spending by adding more Toast services.

With the restaurant sector struggling with higher costs and profit misses, Toast’s customers may be looking for ways to cut costs rather than adding more services. Importantly, the company’s processed payments per store are slowing dramatically, plummeting to 0.7% in the last quarter from 9.4% in the previous quarter, according to Morningstar (NASDAQ:MORN), a major warning sign that signals massive customer declines.

What is the Price Target for TOST Stock?

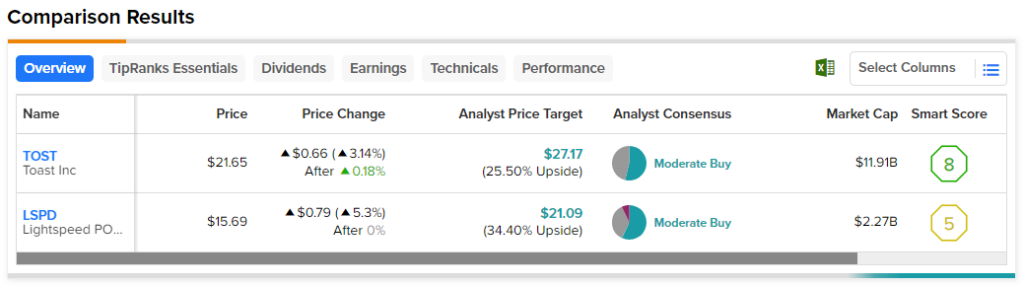

Toast has a Moderate Buy consensus rating based on seven Buys, six Holds, and zero Sell ratings assigned over the last three months. At $27.17, the average Toast stock price target implies upside potential of 25.5%.

Lightspeed Commerce (NYSE:LSPD)

At a P/S of 2.9, Lightspeed Commerce is trading at a discount to both Toast and the industry, but its lack of profitability warrants a discount. On the company’s August earnings call, management said they’re committed to breaking even or becoming profitable on an adjusted EBITDA basis by Fiscal 2024, which ends in March 2024. However, a wait-and-see approach may be best, considering that consumers are slowing their spending in general, suggesting that a neutral view may be appropriate.

While Lightspeed is headquartered in Canada, it reports its earnings in U.S. dollars. At first glance, a major concern is the dramatic widening of the company’s losses in the fiscal year that ended in March 2023.

However, a closer look reveals that $748.7 million of that loss was a non-cash goodwill impairment charge recorded in the third quarter. Another $12 million to $14 million was an estimated restructuring cash charge during the fourth quarter due to management layoffs as it streamlined operations.

Generally, a goodwill impairment charge results from a reduction in the value of an asset following an acquisition. Lightspeed, which has made over 10 acquisitions so far, said the tech downturn in 2022 and its lower share price affected certain assumptions in its annual goodwill test.

What is the Price Target for LSPD Stock?

Lightspeed Commerce has a Moderate Buy consensus rating based on eight Buys, five Holds, and one Sell rating assigned over the last three months. At $21.09, the average Lightspeed Commerce stock price target implies upside potential of 34.4%.

Conclusion: Bearish on TOST, Neutral on LSPD

Lightspeed is the clear winner here, although both face major battles from slowing consumer spending. Both may be on the verge of profitability, but Lightspeed’s recent impairment charge made its recent results look worse than they actually were.

A wait-and-see approach may be best for Lightspeed until its ability to become profitable soon becomes clearer, but there are too many warning signs for Toast right now, especially after the recent runup in its stock price.