After weeks of turmoil, the indices moved decisively yesterday after the U.S. Federal Reserve increased the benchmark interest rate by half a percent. Consequently, the S&P 500 rose 2.99% and the Nasdaq jumped 3.19%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Yet, the Nasdaq is down about 18% so far in 2022. These stomach-churning gyrations lead to sleepless nights for investors.

This is where the TipRanks Smart Portfolio tool comes to the rescue. The tool takes into account a number of factors, such as age, income level, and risk profile, to help investors make smarter choices.

Moreover, investors can use this tool to see how their portfolios are faring against the best-performing portfolios and gain valuable insights. Let’s have a look at the most held stocks in the Services and Industrial Goods sectors by the best-performing portfolios on TipRanks.

Walt Disney (DIS)

Walt Disney makes up 1.55% of the best-performing portfolios on Tipranks.

Disney is a global name catering to every age category with a plethora of entertainment choices ranging from theme parks, films, television content, streaming platforms, and major production houses including Lucasfilm, Marvel, Pixar, and Twentieth-century Fox.

While revenue has tapered to $67.4 billion in 2021 from $69.6 billion in 2019, the figure is expected to inch up to $94.26 billion in 2023. Furthermore, earnings per share of the company are expected to jump from $2.33 in 2021 to $5.63 in 2023.

Nonetheless, shares are down 25.9% so far in 2022 as the market accommodates streaming jitters after Netflix lost subscribers and Disney lost its ‘special district status’ in Florida.

All eyes will be on May 11, when Disney is expected to report second-quarter numbers. The Street is expecting earnings per share of $1.06 on revenue of $18.36 billion. In the comparable year-ago period, Disney posted earnings per share of $0.79 versus estimates of $0.27.

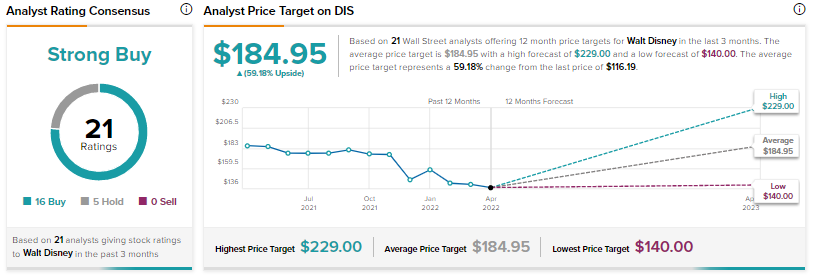

Wells Fargo analyst Steven Cahall has reiterated a Buy rating on the stock alongside a price target of $182. Overall, the Street has a Strong Buy consensus rating on the stock based on 16 Buys and five Holds. At the time of writing, the average Disney price target was $184.95, which implies a 59.2% potential upside from current levels.

Energy Transfer (ET)

The second name on our list, Energy Transfer, makes up 1.83% of the best-performing portfolios on TipRanks.

This energy-related services provider owns and operates a well-diversified energy asset portfolio in North America. Core operations include complementary natural gas midstream, intrastate, and interstate transportation and storage assets as well as NGL fractionation.

Yesterday, ET reported robust first-quarter numbers. Revenue gained 55.6% to $5.4 billion, beating estimates by $903 million. Earnings per share of $2.32 exceeded consensus by $1.44.

Notably, during the quarter, Energy Transfer commenced construction of the new 200 MMcf (one million cubic feet) per day Grey Wolf high-recovery cryogenic plant and the 1.65 Bcf (one billion cubic feet) per day Gulf Run Pipeline Project.

Moreover, no single segment contributes more than 25% of Energy Transfer’s consolidated adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). A major part of its segment margins is fee-based, meaning Energy Transfer is less sensitive to commodity price gyrations.

Further, annual revenue is expected to increase to $76.9 billion in 2023 from $67.4 billion in 2021.

Morgan Stanley analyst Robert Kad has reiterated a Buy rating on the stock while increasing the price target to $15 from $12.

Overall, the Street has a Strong Buy consensus rating on the stock based on nine unanimous Buys. At the time of writing, the average Energy Transfer price target was $14.44, which implies a potential upside of 19.5%. That’s on top of the 38.7% gain in share price so far in 2022.

Closing Note

Both Disney and Energy Transfer provide a well-diversified industry-leading asset portfolio in their respective industries. Additionally, in the present challenging macro environment for the markets, the two stocks rightly are part of the market-beating smart portfolios on TipRanks.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Musk to Make Twitter Public Post Turnaround

Tesla Has Big Plans for Shanghai

Universal Technical Acquires Concorde Career Colleges