To buy or not to buy? Sometimes it’s better to leave the thinking to the pros, and with two nations at war, supply chains across the globe compromised, sky-high inflation, a potential recession, and more, this seems like the right time to do so. We begin the jolly season by acquainting investors with the best minds on Wall Street, who dig deep into a company’s business to find things that are not obvious to us, making it easier for investors to choose where to invest. TipRanks’ Top Wall Street Analysts tool helps us identify the best-scoring analysts and their recommended stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Today, our spotlight is on Mizuho Securities analyst Vincent Lovaglio, and we’ll explain why his convictions should matter to investors.

Lovaglio’s expertise lies in companies in the oil & gas industry dealing in exploration % production (E&P). He is a seasoned analyst, having worked at Wolfe Research, Cowen and Company, and Dahlman Rose & Co. earlier, each time as an equity research analyst focusing on different sectors.

Impressively, Lovaglio is a CFA charter holder with a Bachelor of Arts in Financial Economics from Columbia University.

The TipRanks Star Ranking System ranks Lovaglio #2 out of the 8,166 analysts in the TipRanks database. Additionally, out of all the 24,458 overall experts followed by TipRanks, this five-star analyst holds the 10th position. The ranking has been determined by taking into account Lovaglio’s success rate, returns generated, and the large number of recommendations made by him.

Now, arriving at the measures, Lovaglio boasts an 87% success rate on the 209 ratings given by him in the past year. Moreover, these successful ratings have generated an average return of 44.4% over the year.

Similarly, compared to the S&P 500 (SPX) and the basic materials sector’s performance, his ratings delivered an average return of 46.8% and 39.9%, respectively, during the same period.

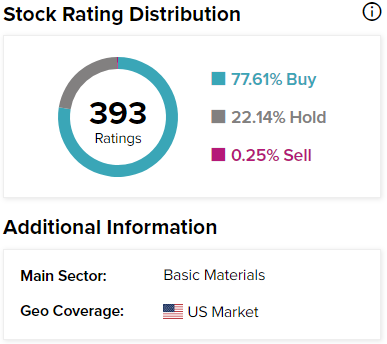

Lovaglio is a Wall Street bull, largely, with 77.6% Buy ratings in his nine-year career so far as an analyst. The analyst’s most profitable call was on oil and natural gas explorer Comstock Resources (NYSE:CRK). Lovaglio’s Buy rating on CRK stock between April 20, 2021, and April 20, 2022, generated a giant return of 253%.

Here are two of his latest recommendations:

Pioneer Natural (NYSE:PXD)

Hydrocarbon exploration firm Pioneer Natural, which has a Moderate Buy consensus rating on Wall Street, has been on Lovaglio’s buy list for 2.5 years. Remarkably, 12 out of 13 of his ratings on PXD stock have generated profits, with each rating bringing an average return of almost 35%.

Southwestern Energy (NYSE:SWN)

Oil company Southwestern Energy has been recently given a Buy rating by Lovaglio. However, Wall Street is cautiously optimistic, with a Moderate Buy consensus rating based on six Buys, two Holds, and one Sell. The analyst was cautious of the stock for about a year until May 2021 but has maintained a bullish stance ever since. Importantly, his ratings have generated average returns of 18.51% each.

The Takeaway

Wall Street has many other experts too, who are ranked in a similar way on TipRanks, and whose recommendations and trading patterns may be insightful for investors. In this regard, recommendations of hedge fund managers, financial bloggers, and top corporate insiders, along with analysts, are available collectively on TipRanks’ Expert Center.

That said, now we know the returns an investor would have received by trading in accordance with Lovaglio’s ratings. Keep following this column to see which analyst is next in the queue and why.

Want to know which Wall Street analysts to follow and which stocks they’re recommending? Give TipRanks Premium a try.