In the latest 13F filing, Bridgewater Associates revealed that it dumped shares of Netflix (NASDAQ:NFLX), Broadcom (NASDAQ:AVGO), and Home Depot (NYSE:HD), among others, during the second quarter. The move by the firm to exit these stocks might be seen as a negative indicator for these companies’ near future. Nonetheless, it is best for smart investors to use more than one parameter to form their investing strategies. Savvy investors can leverage TipRanks’ Experts Center tools to make an informed investment decision.

With this backdrop, let’s check what the future holds for these stocks.

Is Netflix Stock a Buy or a Sell?

Netflix appears to be a long-term winner. Its initiatives, including the crackdown on password sharing, the launch of ad-supported plans, and the focus on strengthening its financial performance, will likely support its growth. But NFLX stock has gained about 72% over the past year, which makes its valuation rich.

On July 23, Robert W. Baird analyst Vikram Kesavabhotla upgraded Netflix stock to Buy from Hold. The positive outlook from the analyst underscores his growing belief in NFLX’s capacity to effectively implement new endeavors, such as advertising and paid sharing. The analyst admitted that Netflix stock’s valuation appears rich but is warranted due to the underlying momentum in the business.

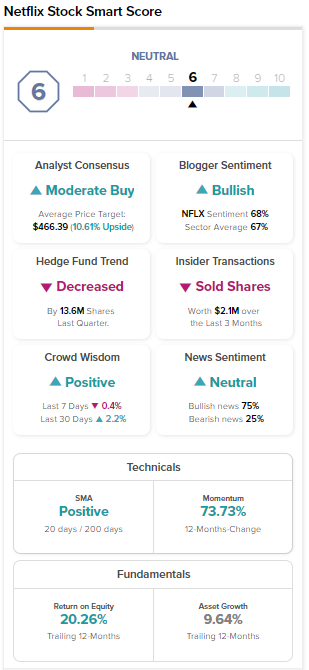

While Kesavabhotla is bullish, the consensus rating suggests that analysts are cautiously optimistic about Netflix stock. It has received 19 Buy, 13 Hold, and two Sell recommendations for a Moderate Buy consensus rating. Analysts’ 12-month average price target of $466.39 implies 10.61% upside potential from current levels.

Further, the stock sports a Neutral Smart Score of six.

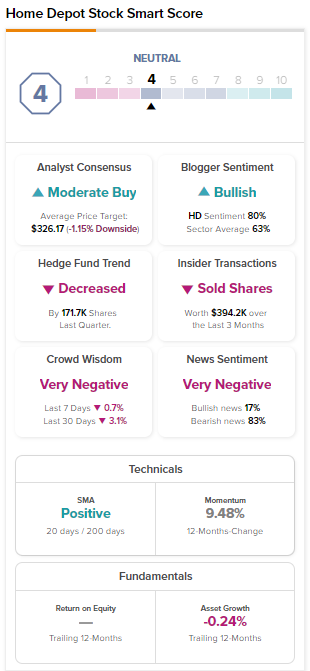

Note that TipRanks’ Smart Score tool is a proprietary quantitative stock scoring system. It provides a score from one to ten (10 being the best) on stocks, based on eight key factors such as Wall Street analysts’ ratings, corporate insider transactions, technical analysis, and fundamentals, among others.

Is Broadcom a Buy, Sell, or Hold?

Broadcom stock has gained significantly, nearly 55%, on a year-to-date basis. The uptrend in AVGO stock reflects its strong financial performance and expanding market share in the chip industry. The company is benefitting from high demand for next-generation technologies. Further, its leadership in networking with a measured ramp into large-scale AI (artificial intelligence) networks augurs well for growth.

On July 19, Wolfe Research analyst Chris Caso initiated coverage on AVGO stock with a Hold recommendation. The analyst expects the company to benefit from momentum in networking and computing. Contrary to this, softness in storage and broadband could remain a drag.

Although Caso remains sidelined, most Wall Street analysts maintain a bullish outlook on Broadcom. AVGO stock has 13 Buys and three Holds, translating into a Strong Buy consensus rating. However, given the recent rally, analysts’ 12-month average price target of $880.79 implies a marginal upside of 3.12% from current price levels.

Further, AVGO stock has a Neutral Smart Score of six on TipRanks.

Is Home Depot a Buy or a Sell?

Home Depot has witnessed solid demand over the past couple of years, driven by a rise in repair and remodeling activity. On the other hand, Home Depot cautioned earlier that demand will moderate in 2023, which will adversely impact its top and bottom lines.

The company will report its second-quarter earnings today, and analysts expect its revenue and earnings to decline. Telsey Advisory analyst Joseph Feldman downgraded HD stock on August 8. The analyst expects the weakness in the housing market to hurt HD’s prospects.

Overall, analysts are cautiously optimistic about HD stock. With 15 Buys and 11 Holds, Home Depot stock has a Moderate Buy consensus rating on TipRanks. Analysts’ average 12-month price target of $326.17 shows a slight potential of 1.15% from current levels.

Moreover, Home Depot stock has a Neutral Smart Score of four.

Bottom Line

Taking cues from the trading activities of top hedge funds ould benefit retail investors in forming investing strategies. Moreover, the buying or selling of stocks by hedge fund managers could be perceived as a positive/negative sign in the short term. Nevertheless, retail investors are best off examining several parameters, like Wall Street analysts’ ratings, insider transactions, and fundamentals, for long-term investment planning. To further enhance their decision-making process, they can make use of TipRanks’ valuable tools, such as Smart Score and Expert Center.