The world’s largest home improvement retailer, Home Depot (NYSE:HD), will report its second-quarter earnings on Tuesday, August 15. The macro headwinds impacting consumers’ big-ticket discretionary spending and uncertainty surrounding underlying demand raise investor worry over Q2 results.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s worth noting that Home Depot benefitted from the unprecedented demand over the past couple of years, led by an increase in repair and remodeling activity. However, the company expects demand to moderate in Fiscal 2023, which will likely hurt its top-and bottom-line growth.

Analysts’ Take

On July 26, Argus Research analyst Chris Graja reduced the price target on Home Depot stock to $350 from $400. The analyst is bullish about HD’s prospects. Nonetheless, the reduction in the price target reflects current apprehensions about near-term consumer spending. Graja said that consumers are lowering their spending amid macro headwinds, including higher mortgage rates.

Meanwhile, on August 8, Telsey Advisory analyst Joseph Feldman downgraded HD stock to Hold from Buy, citing weakness in the housing market. Feldman said that consumers are cutting back on big-ticket items and projects, hurting home improvement retailers like Home Depot and Lowe’s (NYSE:LOW).

Against this backdrop, let’s delve into analysts’ estimates for Q2.

Top and Bottom Lines to Continue to Decline

Analysts’ consensus estimate indicates that Home Depot’s top and bottom lines could continue to decline in Q2. The company’s sales fell 4.2% in the first quarter. As for the second quarter, analysts expect the company to post revenue of $42.2 billion, compared to $43.8 billion in the prior-year quarter.

The moderation in the home improvement market due to tight monetary policy will hurt overall consumer demand. In addition, the lumber deflation (falling lumber prices) is expected to adversely impact its comparable sales and profitability.

Given the lower sales, analysts expect Home Depot to post adjusted earnings of $4.45 per share in the second quarter, compared to the EPS of $5.05 in the prior-year quarter.

Is Home Depot Stock a Buy or Hold?

Analysts are cautiously optimistic about Home Depot stock ahead of Q2 earnings due to the near-term headwinds. It has received 15 Buy and 11 Hold recommendations for a Moderate Buy consensus rating on TipRanks. Moreover, analysts’ average price target of $326.17 implies a marginal downside potential of 1.15% from current levels.

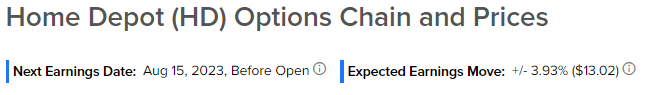

Options Traders Expect a 3.39% Earnings-Related Move

Options traders are pricing in a +/- 3.75% move after HD’s earnings report, which is greater than the previous quarter’s earnings-related move of -2.15% and the average -1.15% move in the last eight quarters. The anticipated earnings move is determined by computing the at-the-money straddle of the options closest to expiration after the earnings announcement.

Learn more about TipRanks’ option tool here.