The S&P 500 Index (SPX) showed some recovery in 2023. However, the uncertain economic environment could keep the stock market volatile. Thus, following top investors like Ray Dalio, the founder of Bridgewater Associates, could prove profitable for retail investors. Recently, Bridgewater Associates filed the 13F report, which shows that the ace investor placed big bucks on JPMorgan Chase & Co. (NYSE:JPM), Citigroup (NYSE:C), NextEra Energy (NYSE:NEE), Franco-Nevada (NYSE:FNV)(TSE:FNV), and BlackRock (NYSE:BLK).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

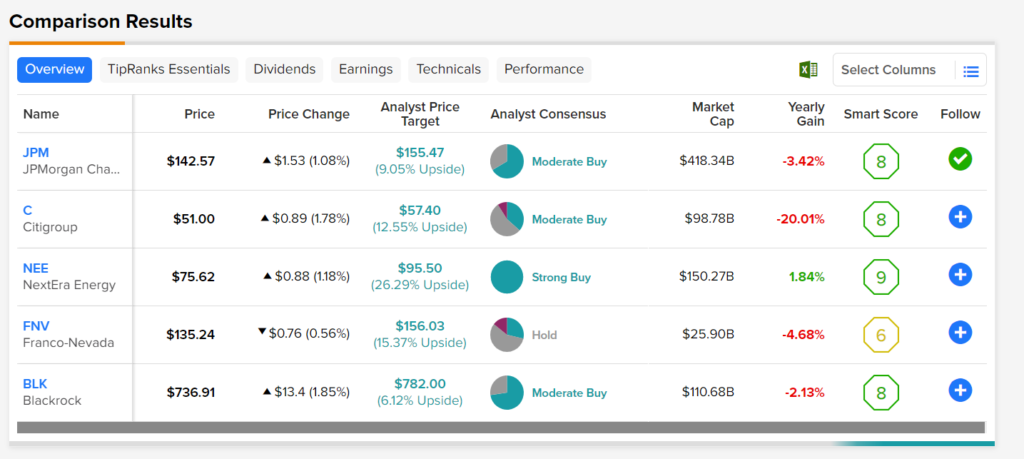

Using TipRanks’ Stock Comparison tool, we found that Citigroup, NextEra, and BlackRock stocks have an Outperform Smart Score on TipRanks. This implies that they are more likely to beat the broader market averages. Meanwhile, only NextEra stock has significant upside potential.

What’s the Prediction for NEE Stock?

NextEra Energy is a leading electric utility holding company. It operates a low-risk business backed by rate-regulated assets. The company is poised to benefit from investments in renewables and storage. Further, expansion into new markets and contributions from new projects will likely support its growth.

Besides for capital appreciation, investors will likely benefit from NEE’s solid dividend payments. Thanks to its resilient business, NEE expects to grow its earnings by a CAGR of 6-8% through 2026. Meanwhile, it plans to increase its annual dividend by 10% through at least 2024.

Wall Street is bullish about NEE stock. It has received 12 unanimous Buy recommendations, translating into a strong Buy consensus rating. Meanwhile, analysts’ average price target of $95.50 implies 26.29% upside potential. Moreover, NEE stock offers a decent dividend yield of 2.27%.

Dalio Exited these Stocks

According to the 13F filing, Ray Dalio closed his positions in Advanced Micro Devices (NASDAQ:AMD), Nvidia (NASDAQ:NVDA), and Micron (NASDAQ:MU). These semiconductor stocks came under pressure in Q4 due to weak end-market demand and inventory issues.

Besides for these semiconductor stocks, Dalio sold Caterpillar (NYSE:CAT) and Intercontinental Exchange (NYSE:ICE).

Bottom Line

While Dalio took new positions in multiple stocks in Q4, NEE has a higher potential to beat the benchmark index due to its Strong Buy consensus rating and an Outperform Smart Score. Meanwhile, retail investors could make good use of TipRanks’ Experts Center tool to identify winning stocks and outperform the broader market.

Find out which stock the biggest hedge fund managers are buying right now.