Insiders are grabbing shares of The Beachbody Company (BODY) by the bagful. In the last three weeks alone, the subscription health and wellness company’s top brass have picked up shares worth about $4.76 million in seven transactions. Most importantly, all of these Buys were informative in nature.

BODY provides an on-demand streaming platform, a live digital streaming subscription, and the Beachbody Bike.

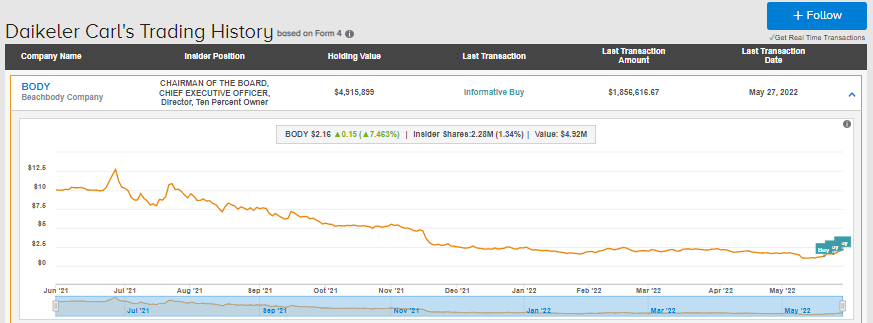

Daikeler Carl, the Chairman of the Board, CEO, and Director, bought shares worth $3.12 million in the past week. Carl has acquired all of his holdings in BODY for the first time since June 2021 and now has total holdings of about $4.92 million in the company.

Furthermore, the Co-Founder and Vice-Chairman of BODY, Congdon Jonathan, picked up shares worth $243,000. The third major name to acquire BODY shares is COO Kathy Vrabeck, who picked up shares worth $499,643 in the company.

With these transactions, the TipRanks tool highlights that insider confidence remains very positive in the stock. All of the above purchases were made in the range of $1.06 to $1.91 per share and come at a time when the stock has dropped nearly 78% in the past year.

However, BODY shares have jumped nearly 125% in the past three weeks after the company posted its first-quarter numbers.

Recent Developments

Earlier this month, BODY delivered mixed first-quarter numbers. Revenue declined 12% year-over-year but came in ahead of expectations by $18.2 million. The net loss per share at $0.24 came in wider than estimates by $0.11.

BODY is focusing on new launches in 2022 and is following a synergistic strategy with the combination of digital fitness, nutrition, and community. The company delivered 16,600 bikes during the quarter and now has 2.26 million digital subscriptions. Impressively, it delivered 38.2 million streams in Q1.

Looking ahead, for the second quarter, BODY sees its top-line landing between $175 million and $185 million. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss is expected to be between $7 million and $12 million.

Concurrent with the rise in share price and insider Buys, our scan indicates BODY stock is receiving more and more attention on stock forums with the expectation of share price gains. It has received more mentions than other names such as AMC Entertainment (AMC) and Enact Holdings (ACT) in the past few days.

At the same time, a key insight that our TipRanks insider tool delivered is that BODY’s COO, Kathy Vrabeck, also happens to be a Director in another trader’s favorite, GameStop (GME), and has a 50% success rate in her GME holdings. The average 10-day trading volume in BODY of nearly 1.9 million is already 50% higher than the past three months’ average volume of 1.22 million shares.

Closing Note

While recent times have been challenging for at-home fitness names, BODY’s recent price gains and positive insider moves send reassuring signals to investors. The company has delivered robust subscription and streaming numbers, and the expected launch of new products should help the trend continue.

Read full Disclaimer & Disclosure