The bulls are coming out in force, and predicting solid gains for the stock market in 2024. In recent forecasts, 5 out of 8 major investment banks are predicting that the S&P 500 will hit 5,000 or better. The most bullish of these, from Tom Lee, head of research at Fundstrat, says that the index will reach as high as 5,200 next year, for a 13.4% gain from current levels. In Lee’s view, the falling rate of inflation, and consequent easing of interest rates and tight money policies, will steer the economy away from recession.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

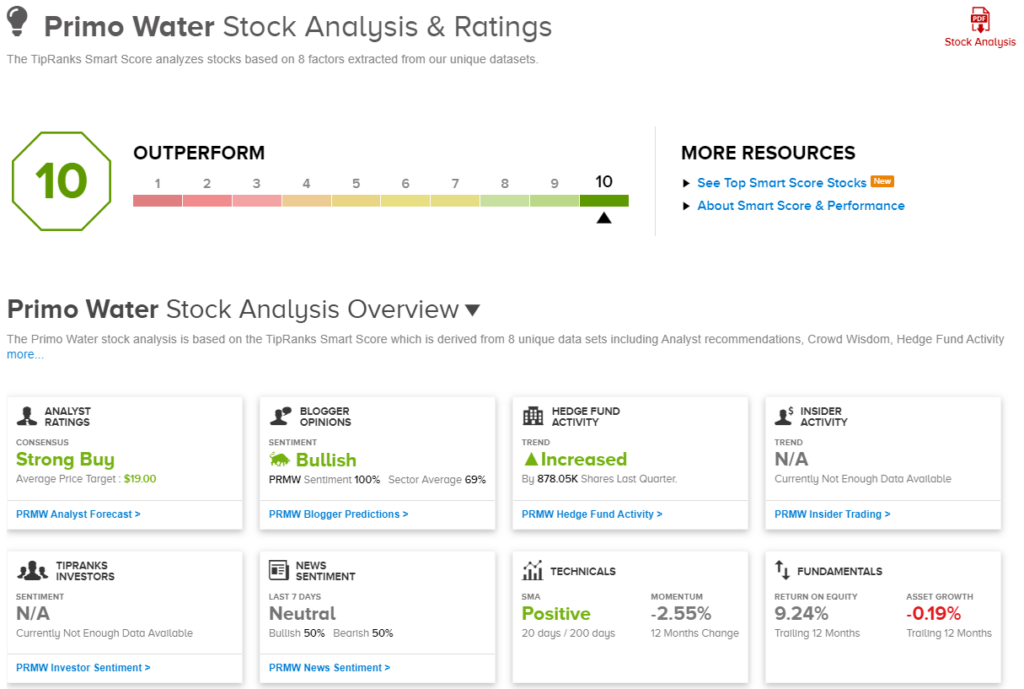

Gains of that magnitude are sure to open up plenty of opportunities for proactive investors – but the key will be finding the right stocks. The markets toss up a huge volume of raw data, and that data stream is sure to increase should buying trends turn bullish and trading volumes rise. Fortunately, investors can turn to the Smart Score tool, an automated data collection and collation algorithm that uses AI and natural language technology to gather and sort the voluminous data generated by the never-ending action of the stock market.

The Smart Score gathers this data on every publicly traded stock – and it uses that data to rate each stock according to a set of factors known to correlate with future share outperformance. The stocks are scored on a simple rating on a scale of 1 to 10, letting investors see at a glance just where the stock is likely to go in coming months. The ‘Perfect 10s,’ stocks with the highest possible Smart Score, are shares that may deserve a second look.

We’ve taken the details on two of these Perfect 10s, top-scoring stocks that are primed for gains going into 2024; here they are, presented along with comments from the Street’s analysts.

Don’t miss

- BMO Optimistic About Fintech Stocks in 2024; Here Are 3 Top Picks to Keep an Eye On

- Mobileye, Goodyear Among Top Picks as Deutsche Bank Assesses Auto Stocks

- Bank of America Says the S&P 500 Will Hit a New Record High in 2024 — Here Are 2 Stocks to Play That Bullish Sentiment

NCR Voyix (VYX)

You may not know the name NCR, but you’ve probably used some of the company’s products at some point – or had someone use one for you. NCR started out in Dayton, Ohio, back in 1884, as an early manufacturer of cash registers – and it still holds a strong position in that market today. NCR Voyix, the company’s current incarnation, is the result of a spin-off transaction announced last year. Parent company NCR announced that it would split its digital commerce and ATM divisions into separate companies; NCR Voyix, now trading as VYX, inherited the digital commerce side. The split was completed on October 16 of this year.

NCR Voyix is now the world’s leader in enterprise technology for banks, retailers, small businesses, restaurants, and telecom operators. The company offers solutions for the digital transformation that is changing the way businesses relate with their customers, and the way that companies’ front ends connect to the back offices. The company offers solutions for point-of-sale, in-person and digital transactions, consumer engagement, digital banking – the list of services is long, reflecting the many facets of the business.

The company has yet to report quarterly earnings as a new entity. The combined final financial release for FQ3 prior to the split showed that VYX had $2 billion in quarterly revenue, for a 1.5% year-over-year increase, while at the bottom-line, non-GAAP EPS came to 95 cents. For the fiscal year 2023, as a standalone firm, the company stated it is on track to deliver almost $4 billion in annual revenue with around half of that generated from recurring revenues.

For Needham analyst Mayank Tandon, this stock presents a sound opportunity for investors. He points out that the company has a strong core business and high potential to hit its targets. Tandon writes, “We view VYX as a leading provider across its core operating segments, and with a blue-chip customer base and broad and growing suite of comprehensive solutions for customers, we expect management to drive improved growth following the VYX/NATL separation. We are also confident in VYX’s ability to reach its LT (2027) growth and profitability targets given the company’s leading competitive position and massive and growing market opportunity.”

Quantifying his stance, Tandon rates the shares as a Buy. He puts a $22 price target here to suggest a 43% upside in the next 12 months. (To watch Tandon’s track record, click here)

This stock has earned a unanimous Strong Buy consensus rating from the Street’s analyst consensus, based on 5 positive reviews set in recent weeks. The shares are trading for $15.37 and the $21.40 average price target implies a 39% increase from that level. (See VYX stock forecast)

Primo Water Corporation (PRMW)

Next up on our list of ‘Perfect 10’ stocks is Primo Water, a company that supplies multi-gallon bottles of drinking water to its customers. Primo bills itself as a pure-play provider of water solutions, specializing in deliveries of large-format bottles for water cooler dispensers, at the buyers’ locations. Primo offers plans for both residential and commercial customers, and can provide both dispensers, the water bottles, and the bottle refills.

Given water’s essential nature, Primo has no lack of customers. The company boasts some 2.2 million direct customers globally, in 21 countries, supplied through 49,000 retail locations. Overall, Primo sells approximately 1 billion gallons of fresh drinking water every year. Primo offers several plans for its water customers, including Water Direct, Water Exchange, and Water Refill. The company’s solutions include dispensers, direct delivery, refills, and filtration systems. The company realized $2.2 billion in net sales last year.

That provides a solid foundation for this year’s business, which is on track to exceed last year’s revenue. Primo reported $622 million at the top line for 3Q23, the last quarter reported, for a 6% y/y revenue increase. The quarterly revenue, however, did miss the forecast by $2.66 million. The firm’s quarterly EPS of 33 cents beat the forecast by 6 cents per share.

This stock has caught the eye of CIBC analyst John Zamparo, who outlines the company’s background and its appeal for investors, saying, “Primo has become a near pure-play water business with the majority of its revenue derived from its Water Direct/Exchange and Water Refill/Filtration business. Formed from the combination of the legacy Primo Water and Cott Beverages businesses in 2020, PRMW has repositioned itself into a more predictable, simple, higher-margin business with reasonable organic growth and attractive tuck-in M&A potential.”

“The recent announcement to sell the majority of PRMW’s international assets at ~11x EBITDA (the company announced a sale of most of its European operations in early November) positions PRMW well for lower leverage (~1.8x), greater capital returns, and accelerated M&A. On an organic basis, we believe PRMW is capable of mid-single-digit revenue growth and high-single-digit EBITDA growth over time,” Zamparo goes on to add.

These comments form the basis for Zamparo’s Outperform (Buy) while his price target of $20, points toward a one-year share appreciation of 36%. (To watch Zamparo’s track record, click here)

Once again, we’re looking at a stock with a Strong Buy consensus rating, based on unanimously positive – 3 of them, this time – analyst reviews. The stock has a price of $14.71 and its $19 average target price implies a 12-month upside potential of 29%. (See PRMW stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.