The auto industry has had its ups and downs lately, which has made it a bumpy run for car stocks so far in 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Covering the scene for Deutsche Bank, analyst Emmanuel Rosner has taken a ‘powertrain agnostic’ approach; that is, he’s looking at the peripherals. Rosner sees openings for investors in the automotive equipment markets, noting that even in an economic downturn, our cars will still need add-ons in safety tech and basics like tires.

Describing the industry’s condition, Rosner writes, “After lots of ups and downs for the sector in 2023, including some positive momentum on volume recovery, high hopes for EV adoption, resilient vehicle pricing, but also UAW labor negotiation and strikes, and EV/AV slowdown, we do not expect the 2024 environment to become materially easier.”

He goes on to add some specifics for investors to consider, saying, “We view the lack of LVP growth and often adverse vehicle mix, cuts to EV expectations, and large labor cost inflation as top of mind heading into 2024. As such, among OEMs and suppliers, we favor names that are powertrain agnostic, and with strong self-help, broader diversification in customer mix, geographical and end market exposure.”

We’re taking Rosner’s advice, and following his recommendations on two particular auto stocks, which he classes as ‘top picks’ for Deutsche Bank.

In fact, Rosner is not the only one singing these stocks’ praises. According to the TipRanks platform – they are rated as Strong Buys by the Street’s analysts. Let’s take a closer look.

Don’t miss

- Here Are 3 Favorite Stock Ideas From Deutsche Bank — Including One With 60% Upside Potential

- Bank of America Says the S&P 500 Will Hit a New Record High in 2024 — Here Are 2 Stocks to Play That Bullish Sentiment

- These 3 stocks are Cowen’s best ideas for 2024 including AstraZeneca and Datadog

Mobileye Global (MBLY)

First up is Mobileye, a tech company that has built itself into the gold standard for automotive sensor and driver assistance technologies. Mobileye’s sensors can be either factory installed or retro-fitted to existing vehicles; either way, the system helps drivers maintain a safe distance from potential road hazards, everything from other cars to lane markers, road shoulders, and crash barriers. The company has working arrangements with over 50 of the industry’s original equipment manufacturers, and Mobileye sensors are installed on more than 125 million vehicles globally.

The basic idea behind Mobileye’s system was simple: high-end digital cameras could become the ‘eyes’ of the car, and the central feature of a life-saving driver-assistance technology. That idea has borne fruit, leading to a line of Mobileye products scalable for vehicles of all sizes and purposes. The company has really come into its own in the autonomous vehicle niche, where the Mobileye sensor systems are used to provide a superior level of 360-degree, all-condition vision for self-driving cars.

For customers, the system offers options to fit the skill levels and preferences of all drivers. Customers can choose front and rear cameras, 360-degree vision coverage, and LiDAR sensors for improved vision at night and in adverse weather conditions.

Demand for improved safety technology is up in the automotive industry, and Mobileye has been driving that toward improved revenue and earnings over the past several quarters. In the company’s last quarterly financial release for 3Q23, the top-line revenue came to $530 million; this beat the forecast by $2.12 million and also grew by nearly 18% year-over-year. At the bottom line, Mobileye brought in a non-GAAP earnings per share of 22 cents, scoring 5 cents ahead of the pre-release estimates. For 2023, through the end of Q3, Mobileye reported a sound balance sheet, generating $285 million in net cash from operations and finishing the third quarter with $1.2 billion in cash and liquid assets – and no debt.

All in all, Rosner points out that Mobileye’s solutions are a perfect fit for the likely evolution of the auto industry, and he writes, “We believe MBLY is one of the ‘last man’ standing in vehicle autonomy, with solutions essentially powertrain-agnostic and equal CPV in an EV or ICE alike. Indeed, as Cruise’s fallout demonstrates the reality of challenging commercialization of true robotaxis, we believe MBLY’s modular and scalable approach to higher ADAS in a cost effective manner may become increasingly appetizing to global OEMs. The company has indicated that it is speaking to 10 OEMs that represent 34% of global production, and has high confidence that several of these programs will be converted to firm orders in the next 5-6 months.”

“As customer design wins are expected to come in the next few months, we believe the company has large potential positive catalysts on the near horizon to demonstrate its considerable potential for long-term growth,” Rosner added.

Looking ahead, the Deutsche Bank analyst sees this stock fit for a Buy rating, with a $50 price target to imply a 25% upside in the next 12 months. (To watch Rosner’s track record, click here)

Overall, the Strong Buy consensus rating here is based on 14 analyst reviews, with a lopsided ratio of 13 Buy recommendations to 1 Hold recommendation. The shares are currently trading at $39.89, and the average price target of $50.50 suggests a potential gain of 27% in the coming year. (See Mobileye stock forecast)

Goodyear Tire (GT)

The second stock we’ll look at here, Goodyear Tire, is one of the world’s iconic brands, known for its quality products – and for its eponymous Goodyear Blimp that has long been a staple at sporting events and parades. Goodyear got its start ‘way back in 1898, and over the past 125 years, the firm’s operations have grown to encompass 57 facilities in 23 countries, employing some 74,000 people. Goodyear has long been the largest tire company in the US market and is consistently ranked among the top five tire companies globally.

Goodyear’s business benefits from two underlying facts of all modern vehicles: that they won’t go anywhere without good tires, and that those tires will wear out and need replacing. This makes Goodyear’s chief product an essential item in much of the world, with a large and expanding market. In dollar terms, the automotive tire market was valued at $126 billion in 2022, and that number is expected to reach $176 billion by 2027. That’s a large market, and growth of $10 billion annually gives plenty of room to grow with the market.

In addition to the natural growth of the tire industry, Goodyear is finding support from an unexpected direction – the push to expand the role of EVs on our roads. Due to their large battery packs, EVs are typically heavier than combustion-engine vehicles in the same class, which means they wear out their tires faster and require a more rapid replacement cycle – and that in turn means increased business for tire companies like Goodyear.

When we look at Goodyear’s last few years’ worth of revenue data, we find that the company’s top line has been remarkably stable – at or near $5 billion per quarter – and that makes sense in light of the steady demand for car tires. Earnings have been more volatile, responding to shifts in product pricing and availability and costs of raw materials. A look at the last quarter reported, 3Q23, shows that Goodyear brought in $5.14 billion at the top line; this was 3% below the year-ago figure and almost $140 million under the forecast. The bottom line came to 36 cents per share by non-GAAP measures, beating the estimates by 17 cents per share.

Shares in GT are up 39% so far this year, and have been trending upward since early November. The stock got a boost in part from Deutsche Bank’s assessment, that the rally will likely continue, and analyst Rosner explains the bank’s position, saying, “With a credible operational turnaround path, strategic portfolio optimization through large noncore divestitures, and new leadership coming in to execute, we see strong potential for the company to improve its profitability and narrow the gap with its peers through self-help, de-leverage its balance sheet, and unlock large shareholder value.”

In fact, Rosner believes that Goodyear is uniquely positioned to deliver strong growth, and he doesn’t hold back form describing that potential: “Indeed, after years of chronic underperformance, we believe Goodyear has the potential to become one of more compelling investments in US autos over the next year, reflecting its idiosyncratic opportunity to fix profitability and cut leverage through well-identified self-help actions, under new leadership. Goodyear also is a powertrain-agnostic turnaround story, without the uncertainty of an EV slow-down.”

The analyst goes on to rate GT shares as a Buy, and he sets a $21 price target that points toward a 49% upside for the stock on the one-year horizon. (To watch Rosner’s track record, click here)

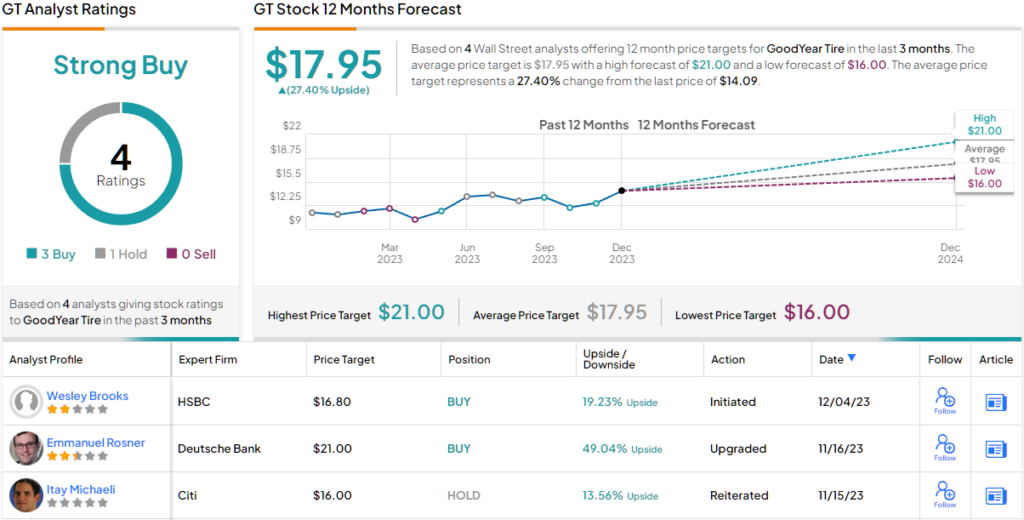

Overall, this is a stock that has slipped under the radar a bit, it only has 4 recent analyst reviews, but those reviews have a 3 to 1 split favoring Buys against Holds for a Strong Buy consensus. The average target price here, $17.95, implies a 27% one-year increase from the current share price of $14.09. (See Goodyear stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.