Investors are always on the lookout for a reliable tool to separate the true sound stocks from those that are just riding the tide.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That’s a job tailor-made for the Smart Score, TipRanks’ comprehensive data tool that collects and collates the aggregated data of the stock market – and returns a simple score for each of thousands of stocks.

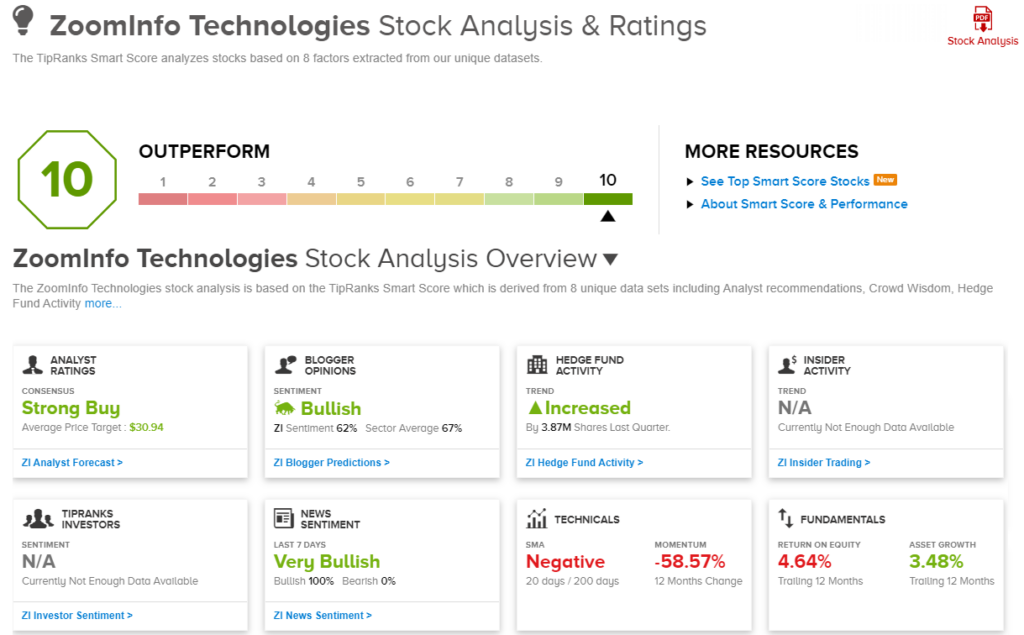

The Smart Score uses a set of sophisticated AI algorithms to evaluate every stock by a set of 8 factors – and the factors are all known to match up with future outperformance. Based on how they measure up to the factor set, stocks are scored on a scale of 1 to 10, with a ‘Perfect 10’ being the highest rating. The factors run from news and investor sentiment to performance fundamentals, and a closer look at the some of the ‘Perfect 10s’ will give an idea of what investors should be seeking.

So, let’s open up the TipRanks database and take a closer look. Here are two Perfect 10 stocks that boast Strong Buy consensus ratings and also offer robust growth and solid fundamentals.

ZoomInfo Technologies (ZI)

We’ll start with ZoomInfo, a cloud computing software company. ZoomInfo offers businesses a series of platforms, for sales, marketing, recruiting, and operations, with the tools to meet a range of enterprise needs. The platforms, which are optimized for B2B use, leverage a combination of AI and data management to give users comprehensive, accurate information, when they need it and how they need it.

Better, for customers, ZoomInfo’s platforms are designed to work together, lining up the sales and marketing teams around commons data pools, and putting all users on the same page. ZoomInfo streamlines the go-to-market process for its enterprise customers, allowing for improved efficiency, productivity, and growth.

That said, ZoomInfo’s shares are down 32% so far this year, badly underperforming the broader markets. Wall Street has pointed toward a difficult demand environment for the company’s product lines, as businesses tighten their belts for an economic slowdown.

That said, we have to point out that ZoomInfo remains profitable. In the most recent quarterly release, 1Q23, non-GAAP EPS of $0.24 beat the forecast by 2 cents and gained 33% year-over-year. On the top-line, ZI’s $300.7 million in revenue was in-line with expectations – and was up 24% year-over-year. At the end of the quarter, the company boasted of 1,905 customers with more than $100,000 or more in annual contract value. The company was also able, despite the difficult environment, to generate over $121 million in unlevered free cash flow in the first quarter.

On the Smart Score, ZoomInfo gets its Perfect 10 rating on account of several positive indicators. The hedges are putting their money on this one; of the hedge funds tracked by TipRanks, holdings in ZI increased by 3.9 million shares last quarter. The financial bloggers are mostly positive, while the news coverage is 100% bullish.

The financial results form the basis of D.A. Davidson analyst Gil Luria’s take, who asks the obvious question here: “Why recommend buying a company about to have a really tough year?” He goes on to answer it, in terms that should cause investors to take hear: “Because it is one of the few software companies that has actual valuation protection. We don’t mean ‘it used to trade at 32x Revenue, so it can’t possibly go below 8x Revenue’. We mean that at 18x profitability (unlevered FCF) there really isn’t much downside to the multiple…. While ZI has been public less than three years, it has at least 5 years of consecutive growth and high increasing profitability, creating a viable track record. This is important for providing confidence in the cash flow generation ability.”

These comments back up Luria’s Buy rating, and his $30 price target implies a one-year upside of 46%. (To watch Luria’s track record, click here)

Overall, this stock carries a Strong Buy consensus rating from the Street’s analysts, based on 18 reviews that include 15 to Buy and 3 to Hold. The stock’s $30.94 average price target suggests its shares will appreciate 50% in the year ahead. (See ZoomInfo’s stock forecast)

Endeavor Group Holdings (EDR)

Entertainment is big business, for no matter how the economy goes, people will want to fill their leisure hours. And Endeavor Group fills that space. It is one of the country’s largest talent promotion firms, with a market cap well above $10 billion, has a global footprint in sports and entertainment, giving a home to world-class brands, events, and experiences. The company’s subsidiaries include major entertainment agencies, such as WME; the sports, fashion, and media firm IMG; and the premier name in professional mixed martial arts, UFC.

Endeavor’s wide-ranging network is composed of several divisions, including talent representation, sports operations, event & experiences management, experiential marketing, brand licensing, and media production & distribution. The company has leveraged demand for quality entertainment into consistent $1 billion-plus quarterly revenues in recent years.

Endeavor will announce its 1Q23 results this week (Tuesday, May 9), but we can prepare for the release by looking back at 4Q22. Those results, released in February, showed a top line of $1.26 billion; this result skimmed under the forecast by $9.6 million and was down 16% year-over-year; however, it marked a 3.3% increase from the previous quarter. At the other end of the scale, the company showed a net income loss of $225.7 million, widening from the loss of $19.5 million in the same period a year ago, although Endeavor pointed out it made roughly $500 million in debt payments throughout the year, the majority in Q4.

This company has long been known for its smart execution of large-scale strategies – and in April it announced a new move in that direction. Endeavor will be combining UFC and WWE – mixed martial arts and professional wrestling entertainment – into a single world-wide sports and entertainment company, with a value estimated at $21 billion or more. Endeavor will control the new company, with a 51% interest, while WWE’s existing shareholders will own 49%.

The Smart Score shows a solid base for this stock. While the hedges sold shares last quarter, the bloggers were 80% positive, the news coverage was 100% positive, and individual investors added more than 11% to their EDR holdings in the last 30 days. The stock’s 12-month momentum registers as 25.5%, and its trailing 12-month return on equity is a positive 8.26%. Overall, it’s a Perfect 10.

Scale and audience interest are some of the key factors here for Guggenheim analyst Curry Baker, who writes, “We believe that Endeavor has created a unique, global platform at a scale capable of driving a powerful network effect that reinforces the value of its platform (both to clients and its owned assets). Management has a successful track record of aggressively pursuing scale through organic growth and a disciplined M&A strategy that leverages its distinctive ecosystem (we are particularly optimistic on the pending combination of WWE/UFC…).”

“Key drivers ahead include: 1) repricing the UFC and WWE domestic media rights, 2) strong consumer demand tailwinds for live sports and events (including the next three Olympic Games starting with Paris next year), 3) the demand for content globally is greater than ever, and 4) the emerging multi-billion dollar North American sports betting market,” Baker went on to add.

Looking ahead, Baker sees fit to give EDR a Buy rating, with a $33 price target that points toward a 31% upside on the one-year time horizon. (To watch Baker’s track record, click here)

The Street has taken an upbeat view of EDR, and given the stock a unanimous Strong Buy consensus rating based on 9 recent positive reviews. The shares are trading for $25.10 and the $31 average price target suggests an upside potential of 23% by this time next year. (See EDR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.