Every investor just wants to find the perfect stock – but finding the shares that check every box can be a challenge. The stock markets put up a massive wall of data. The collective information is piled up by thousands of traders dealing in thousands of stocks – multiple millions of transactions every day. It’s an imposing edifice of information.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fortunately, investors can always turn to the TipRanks Smart Score, a data tool based on AI and natural language processing and designed to gather, collect, and curate the accumulated data of the stock markets – and to put that data to work for the rest of us.

The Smart Score runs that data through the lens of its algorithm and compares every stock to a set of factors known to correlate with future share outperformance. The aggregated results are distilled into a single score, a simple rating on a scale of 1 to 10, letting investors know at a glance the likely course forward of any given share. A ‘Perfect 10’ is a clear indicator that a stock deserves a closer look, based on the data. With the Smart Score, the art of stock picking is more of a science.

So let’s make use of the Smart Score and look at 2 top-scoring stocks that the analysts say are on track to double or more. Here are the details.

Praxis Precision Medicines (PRAX)

The first stock we’ll look at is Praxis Precision Medicines, a clinical-stage biopharmaceutical company with a focus on developing new therapies for genetic epilepsies and other conditions of the central nervous system. These are conditions characterized by neuronal excitation-inhibition imbalance. The company is working to derive its drug candidates from two development platforms, the small molecule platform Cerebrum and the antisense oligonucleotide, or ASO, platform Solidus. Working from these platforms, Praxis has put together a research pipeline with 9 drug candidates, 5 at the preclinical level and 4 in the human trial clinic.

Of the company’s drugs in the clinic, the leading candidate is ulixacaltamide, a potential treatment for essential tremors. Ulixacaltamide is a highly selective small molecule inhibitor of T-type calcium channels, used to block abnormal neuronal burst firing in the CTC circuit, which can be correlated with tremor activity. The drug candidate is the centerpiece of Praxis’s research program.

Getting into details, we find that Praxis has ulixacaltamide undergoing a Phase 3 trial, the Essential3 program that was initiated late last year. Essential3 is expected to be completed this year, and the company plans on releasing topline data during 2H24. Positive results will be used to support the company’s New Drug Application (NDA) submission for ulixacaltamide during 2025.

Also of note, Praxis recently released results from the Phase 2a study of PRAX-628, a new drug under investigation in the treatment of focal epilepsy. Results of the study showed a 100% response rate among patients using the drug. In the 15mg cohort, 80% of patients showed a complete response, and 20% showed a partial response; in the 45mg cohort, 100% of patients showed a complete response.

This stock caught the eye of Baird analyst Joel Beatty, based on the strength of the pipeline program, noting: “We believe PRAX’s ulixacaltamide is a promising agent for the treatment of essential tremor, and we see positive risk/reward heading into topline phase 3 results in 2H24. Nearer-term, we believe phase 2b results in late 1H24 for competitor suvecaltamide (JAZZ) could have meaningful readthrough to PRAX, with the potential for ~30% upside/~15% downside. PRAX also has three differentiated mid-stage agents for epilepsies that we believe provide meaningful value, especially PRAX-628.”

Beatty goes on to rate PRAX as Outperform (i.e. Buy), with a $117 price target that points toward a 112% upside for the next 12 months. (To watch Beatty’s track record, click here)

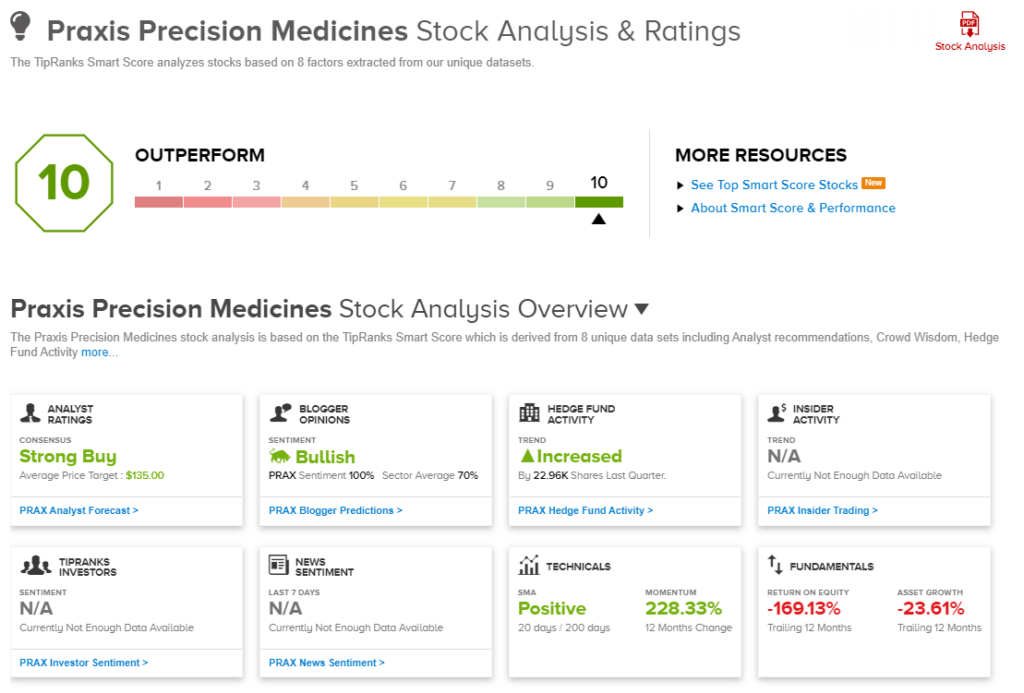

Overall, Praxis has earned both a ‘Perfect 10’ from TipRanks and a Strong Buy consensus rating from the Street’s analysts, based on 6 recent reviews that include 5 Buys and 1 Hold. The stock is currently selling for $54.19, and its $138.80 average target price implies a one-year upside potential of ~152%. (see PRAX stock analysis)

Jasper Therapeutics (JSPR)

The second stock we’ll look at is another biopharma, a medical tech company that uses mast cells and stem cells as the base to develop treatments for chronic disease conditions. Both stem and mast cells have high potential as the source of bio-immune agents designed for specific patients. Stem cells are found in various parts of the body and are the precursors to more mature cells and tissue structures; mast cells are a form of white blood cell found embedded in various connective tissues. Both cell types function in the immune system and function in repairing systemic damage.

Jasper’s research program is based on briquilimab, a new drug candidate designed to act on both stem and mast cells. The drug candidate is a targeted anti-c-Kit monoclonal antibody, which can deplete mast cells and diseased stem cells, and in early testing has demonstrated a strong safety profile. Briquilimab is currently under investigation in the treatment of a wide range of diseases, including chronic spontaneous and inducible urticaria, Fanconi anemia (FA), myelodysplastic syndromes (MDS), and sickle cell disease (SCD), among others.

The company is currently running Phase 1b/2a trials of briquilimab, BEACON, and SPOTLIGHT, in the treatment of chronic spontaneous and inducible urticaria. Results from the initial cohorts of the BEACON trial are expected for release during 3Q24, and the company announced dosing of the first patient in SPOTLIGHT this past March.

In addition, Jasper announced positive data from the Phase 1b/2a trial of briquilimab in the treatment of Fanconi Anemia. The drug candidate was used as a conditioning agent during the trial, and patients treated with the drug showed full donor engraftment and full blood count recovery.

Briquilimab has high potential, and that forms the key to RBC analyst Gregory Renza’s stance on the shares.

“We see JSPR’s lead asset, briquilimab (anti-c-Kit mAb), as a franchise builder that could tap into the substantial mast cell disease market ($100+B). The lead programs in urticaria have been de-risked through external validation and represent the first proof-point that could unlock significant opportunity ($1.6B peak sales),” the 5-star analyst opined.

Renza goes on to lay out some additional reasons why investors should buy into this stock, adding, “Our valuation is driven by briquilimab’s potential in urticaria: 1) enhanced and expedited time to response; 2) less frequent dosing; and 3) favorable safety profile through its deep and rapid mast cell depletion. We anticipate clinical updates in 3Q24 (CSU) and 2H24 (CIndU) as potential initial validation points and near-term catalysts. Additionally, we note the broader upside potential from a new mast cell disease program in 2024 and ongoing pipeline activities in low- risk MDS and other hematologic conditions.”

These comments support Renza’s Outperform (i.e. Buy) rating on JSPR shares, and the analyst’s $70 price target suggests that the stock has an upside of ~190% waiting in the wings for the year ahead. (To watch Renza’s track record, click here)

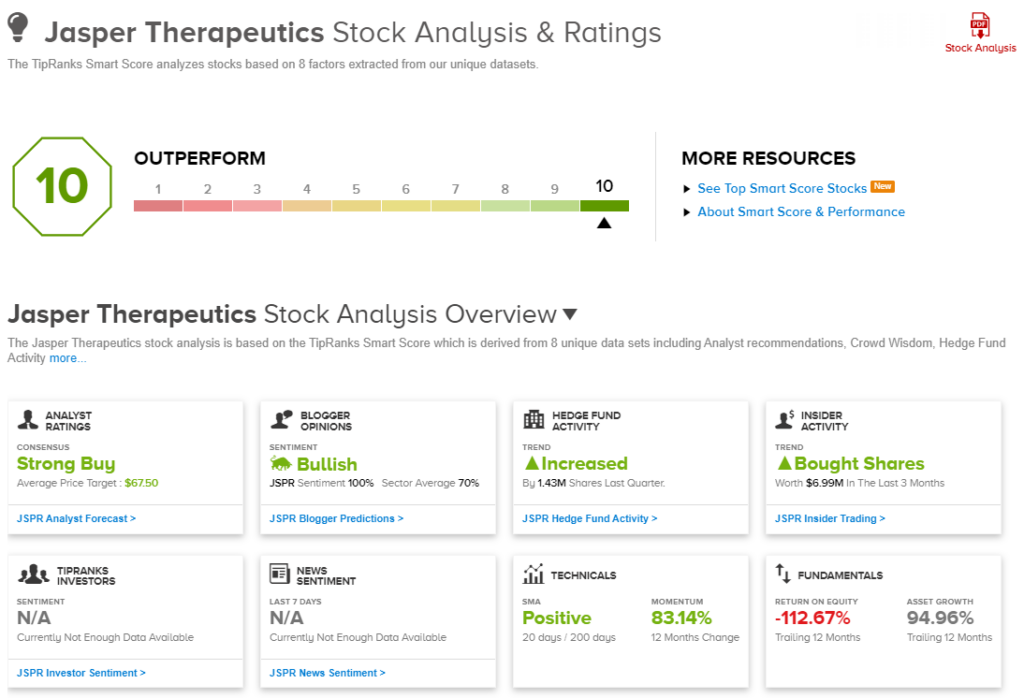

The RBC outlook is no outlier – Jasper’s 5 recent analyst reviews are unanimously positive, giving the stock a Strong Buy consensus rating. This ‘Perfect 10’ stock is currently trading for $24.15, and its $67.50 average price target implies an upside this year of 179.50%. (See JSPR stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.