Every investor wants to get the best returns, and that means building a portfolio based on the best stocks. The only ‘trick’ to succeeding in the market is knowing how to find those stocks – but it’s quite a trick, since the reams of data generated by thousands of traders dealing in thousands of stocks makes an imposing barrier.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

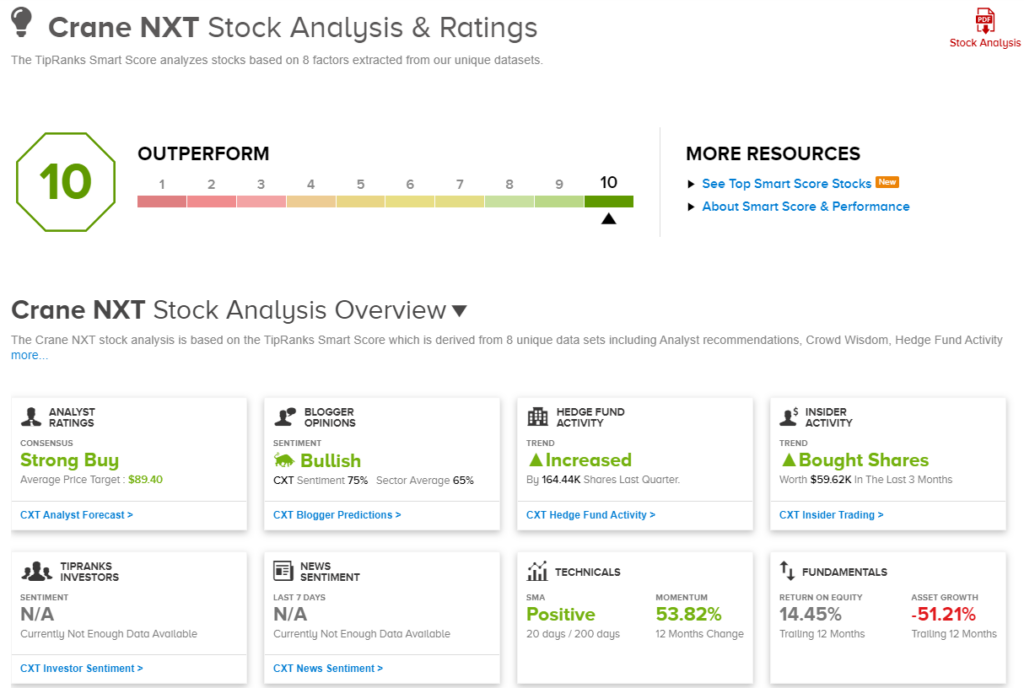

Fortunately, investors can turn to the Smart Score tool, an AI-driven algorithm created by TipRanks that gathers, sorts, and collates the real-time data from millions of stock trades every day – and makes the results available to investors looking for a ready guide on any stock. The Smart Score rates each one according to a set of factors that are proven to correlate with future share outperformance, and distills that down to a single score, on a 1 to 10 scale. The ‘Perfect 10s’ indicate shares that deserve a closer look.

So let’s open up the TipRanks database and take a look at a couple of Perfect 10 stocks. These are names that have earned the highest rating from the Smart Score, ticking off the right boxes to indicate solid potential for the year to come. Let’s see what else they have to offer.

Crane NXT (CXT)

The first ‘Perfect 10’ on our list is a newly public firm, formed earlier this year as part of a spin-off form the parent company, Crane Holdings. Crane NXT started its independent existence in April, on completion of the spin-off transaction, making its trading debut on April 4.

Crane NXT is an industrial technology company, offering products to secure, detect, and authenticate customers’ important documents and property. The company is a leader in the advanced micro-optics tech used to secure physical products such as documents and currency. Its other products include the top-end electronics and software to facilitate detection and sensing technology and devices. Crane NXT has a global footprint, and employs some 4,000 people in the US, the UK, Mexico, Japan, and Europe.

Investors can be buoyed by Crane NXT’s last financial release, from 2Q23, which showed a top line of $352.4 million and non-GAAP earnings of $1.12 per share. These results beat the forecasts by $15.87 million and 21 cents, respectively; the revenue total was also up 5.5% year-over-year.

Covering this stock for Oppenheimer, analyst Ian Zaffino likes the potential for continued revenue growth and writes, “Crane Currency has good visibility and the demand for more sophisticated authentication technology should help drive ~MSD % top-line growth. CPI has remained solid, as the company delivers on its large backlog and benefits from competitor stumbles. We believe the company will be highly acquisitive, particularly in authentication, as it looks to grow revenues to ~$3B by 2027, from $1.4B in 2023E.”

These comments support Zaffino’s Outperform (Buy) rating on the shares, and his $70 price target points toward a 38% upside on the one-year horizon. (To watch Zaffino’s track record, click here)

The Strong Buy consensus rating on CXT is backed up by 5 analyst reviews that include 4 Buys and 1 Hold. The shares are priced at $50.77 and their $89.40 average price target is even more bullish than Oppenheimer’s, implying a one-year gain of 76%. (See CXT stock forecast)

Carnival Corporation (CCL)

Next up is a stock that may not be the first one we think of right now – but the entertainment and leisure sector has been doing well since the end of COVID-policy restrictions, and that includes the cruise lines. Carnival Corporation is one of the world’s largest cruise lines, with a market cap of almost $14 billion and a fleet of more than 90 vessels operated across its cruise line brands. The company saw hard losses in revenues and earnings during the pandemic period, but has been reclaiming some lost ground recently.

Carnival has been gaining on high customer demand around the world. The company reports that the North American, Australian, and European markets have all performed ahead of expectations in recent months, that its ‘occupancy gap’ has been closed by 11 points over the past 12 months, and that quarterly net per diems have been running consistently ahead of the company’s 2019 pre-pandemic levels.

All of that fed into the recent fiscal third-quarter results, which showed a company record in quarterly revenues of $6.9 billion. This result beat the forecast by $160 million and was up 58.9% year-over-year. At the bottom line, the company recorded its first quarterly profit since the pandemic, with the adjusted net income of $1.18 billion giving a non-GAAP EPS of 86 cents, 13 cents better than had been expected.

Despite the strong results, shares trended south in the subsequent sessions, for reasons Stifel’s Steven Wieczynski thinks are unfair. Moreover, the 5-star analyst sees high customer demand as the key point here, and believes the stock will ride higher on that factor. He writes, “CCL posted a strong quarter and their forward outlook was beyond healthy, yet shares got punished because of fears around costs/ fuel. You do realize CCL had already warned about higher costs throughout 2024, right? You do realize a lot of the higher costs are tied to marketing in order to capture the strong demand environment? Did investors believe costs were going to be flattish next year or did the ~+2% cost ‘guidance’ scare folks? We have a lot of questions that will never be answered, but we do believe, similar to last quarter, as investors dig in and understand how strong the demand/ pricing environment is for 2024, shares will quickly correct.”

Wieczynski goes on to rate CCL as a Buy, and his $20 target price implies an 81% one-year upside potential. (To watch Wieczynski’s track record, click here)

With 13 recent analyst reviews, breaking down to 10 Buy and 3 Holds, CCL shares have a Strong Buy consensus rating from the Street. The stock’s $11.03 selling price and $18.27 average price target suggest a 66% gain for the next 12 months. (See Carnival’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.