In a financial environment riddled with unprecedented levels of uncertainty, investors are at wits’ end. When it comes to finding an investment strategy that will yield returns, traditional methods might not be as dependable. So, how should investors get out of the rut?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In times like these, a more comprehensive stock analysis can steer investors in the direction of returns. Rather than looking solely at more conventional factors like fundamental or technical analyses, other metrics can play a key role in determining whether or not a particular stock is on a clear path forward.

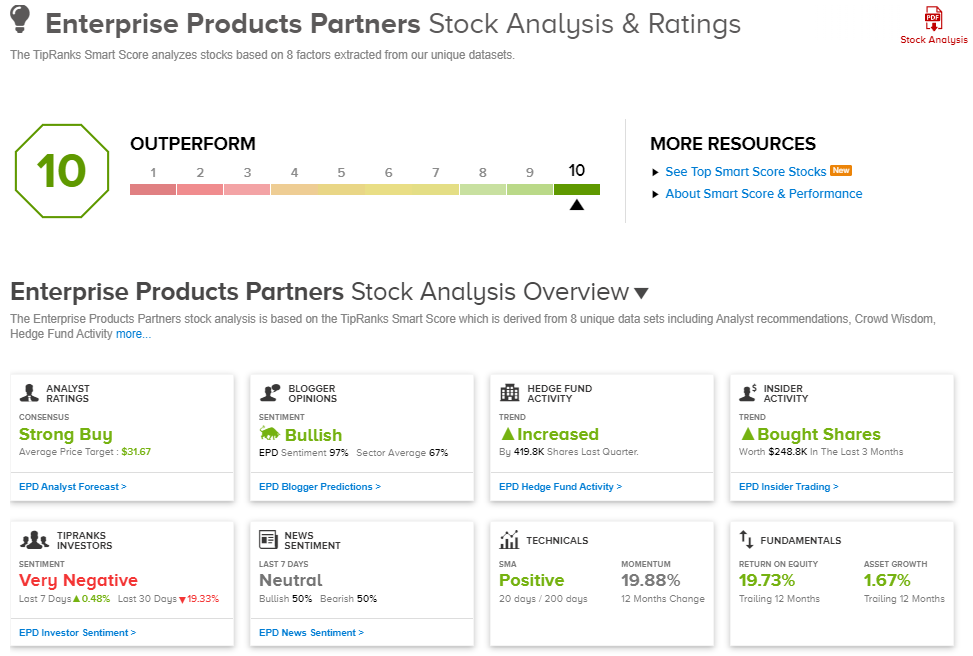

TipRanks offers a tool that does exactly that. Its Smart Score measures eight key metrics including fundamentals and technicals while also taking into account analyst, blogger and news sentiment as well as hedge fund and corporate insider activity. After analyzing each metric, a single numerical score is generated, with 10 being the best possible result.

Using the Best Stocks to Buy tool, we were able to pour through TipRanks’ database, filtering the results to show only the names that have earned a “Perfect 10” Smart Score and offer a high-yield dividend payment, of 7% or better. We found two that managed to tick all of the boxes. Let’s jump right in.

Enterprise Products Partners (EPD)

We’ll start with Enterprise Products Partners, a midstream company in the energy industry. Midstream refers to the companies that connect well heads, where hydrocarbons are extracted, with the customers further down the distribution line; midstream firms control networks of pipelines, rail and road tankers, barges, refineries, processing plants, terminal points, and storage tank farms. Enterprise makes its business in this area, moving crude oil, natural gas, natural gas liquids, and refined products through its network, which is centered on the Gulf Coast in Texas and Louisiana but extends into the Southeast, Appalachia, the Great Lakes, the Mississippi Valley, and the Rocky Mountains.

This adds up to a lucrative business, and in the recent 3Q22 financial results, Enterprise reported a net income of $1.39 billion, 17% year-over-year. On a per-share basis, diluted EPS came to 62 cents, 10 cents better than the year-ago result.

Of particular interest to dividend investors, the distributable cash flow rose 16% y/y to reach $1.9 billion. This was more than enough to fully cover the company’s declared dividend payment of 47.5 cents per common share. On an annualizes basis, the dividend comes to $1.90 per share, and offers a solid yield of 7.6%. The company has a reliable dividend payment history going back to 1998.

Covering this stock from Raymond James, 5-star analyst Justin Jenkins describes Q3 as ‘another steady quarter,’ and writes, “The unique combination of asset integration, balance sheet strength, and ROIC track record at Enterprise (EPD) remains best-in-class. We see EPD as well-positioned in midstream from a volatility vs. recovery perspective, with most segments performing well… Financial momentum only expands the opportunity for capital returns, with distribution growth in progress and buybacks hopefully becoming more material over time. Meanwhile, EPD still trades at an attractive 7.6% yield…”

To support his bullish thesis, Jenkins rates EPD shares a Strong Buy, and his price target of $32 implies a gain of 29% on the one-year time frame. (To watch Jenkins’ track record, click here)

The view from Raymond James is hardly the only bullish take here; this stock gets a Strong Buy consensus rating based on 10 recent analyst reviews that include 9 to Buy and 1 to Hold (i.e. Neutral). The shares are selling for $24.75 and their $31.67 average price target suggests an upside of 28% over the next 12 months. See EPD stock analysis.

Rithm Capital (RITM)

The second stock we’ll look at is Rithm Capital, a real estate investment trust (REIT). REITs are perennial dividend champs, as tax code regulations require them to return a high share of profits directly to investors – and dividends are a convenient mode of compliance. Rithm, which until August of last year operated as New Residential, has its hands in both lending and mortgage servicing to investors and consumers. The firm’s portfolio is made up of a variety of instruments, including loan originations, real estate securities, commercial property and residential mortgage loans, and MSR-related investments. That last, MRSs, makes up 26% of the portfolio; mortgage servicing makes up 42% of the total. The company boasts over $7.5 billion in net equity investments.

In its last reported quarter, 3Q22, Rithm showed a total of $153 million in earnings available for distribution. This came out to 32 cents per common share. These figures compare well to the $145.8 million total and 31-cents per share reported in the year-ago quarter.

More importantly, the ‘earnings available for distribution’ easily covered the 25 cent common share dividend declared in September. At the $1 annualized rate, Rithm’s dividend yields an impressive 11%.

Among the bulls is BTIG analyst Eric Hagen, who has been covering Rithm, and he’s impressed with what he sees.

“We like the stickiness of the cash flows in a seasoned MSR portfolio, which we think supports the financing and liquidity support it carries behind the asset. Over the near term we see less room for dividend growth, which to a degree reinforces the discounted valuation. That said, with a longer-term view, we think the quality of the return for the level of risk in the stock is being undervalued… We think scalability is one of the key division points we see for valuations across the capital structure in our coverage right now, particularly among most originator/servicers where the leverage leans more toward unsecured debt”, Hagen opined.

Hagen goes on to give RITM shares a Buy rating, and he sets a price target of $13 to indicate potential for a robust upside of 44% in the coming months. (To watch Hagen’s track record, click here)

Like Hagen, other analysts also like what they’re seeing. With 6 Buys and just 1 Hold, the word on the Street is that the stock is a Strong Buy. In addition, the $11 average price target implies 22% upside potential. See RITM stock analysis.

Stay abreast of the best that TipRanks’ Smart Score has to offer.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.