After a brief pullback early this January, markets are rising again. Investor sentiment is finding support from a combination of factors: falling inflation and the prospect of interest rate cuts later this year. The real estate sector, in particular, will gain from such a change of conditions; lower inflation will bring down home prices, while lower interest rates will make mortgages more affordable.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The prospect of lower prices and more affordable financing is bullish for housing stocks, and one number will show just how bullish – the Federal Reserve is expected to cut interest rates by as much as 200 basis points by this time next year. Such a cut could send mortgage rates tumbling back down to 4%, and real estate sector experts are predicting a surge in the US housing market later this year.

A surge in the housing market will naturally bring investor interest in housing-related stocks, in building companies, and in builder supply companies. Covering this developing situation for investment bank Oppenheimer, analyst Tyler Batory is working to find particular housing stocks on which it’s ‘time to hit buy.’ He’s taking the classic stance, seeking out idiosyncratic reasons for potential gains in housing stocks.

We used the TipRanks platform to look up the Wall Street views on two of Batory’s picks. Let’s take a closer look.

Builders FirstSource (BLDR)

The first stock we’re looking at here is Builders FirstSource, the US construction market’s largest supplier of structural building products, services, and value-added components. The company markets mainly to residential builders and contractors with their hands in the new residential construction, home repair, and remodeling segments. These are vital segments of the housing industry, and they rely on the ability of homebuyers to access affordable mortgages – and of homeowners to access affordable refinancing options.

Builders FirstSource got its start back in 1998, and the company’s network now includes 570 manufacturing and distribution facilities spread across 43 states – and operating in 89 of the nation’s top 100 Metro Statistical Areas. Backing up this widespread network, Builders FirstSource offers its enterprise customers a first-class combination of talent, local market knowledge, industry expertise, and a top-of-the-line array of building products and supplies.

The supplies and products on offer from the company cover pretty much everything that construction firms and contractors need to complete their projects. Builders FirstSource can provide ready frame lumber, manufactured components, siding and exterior materials, roofing shingles, decking, and waterproofing – and that list only covers the outside of the structure. The company also has in-stock items necessary in completing interiors, such as doors, insulation, stairs, and various associated parts. It all makes this firm a one-stop shop for construction supplies.

Despite the inflationary and interest rate headwinds that faced the home construction industry last year, new home builds were up approximately 4.5% year-over-year – and Builders FirstSource, providing the raw materials that home builders cannot do without, saw strong share gains. The company’s stock appreciated more than 135% in the last 12 months.

The strong share performance came even as revenues were slipping. The company’s top line in the last reported quarter, 3Q23, was $4.5 billion, down more than 21% y/y, and some $380 million below the estimates. The firm’s earnings came to $4.24 per diluted share, based on an adjusted net income of $533.6 million. The net figure was down more than 34% y/y, while the EPS was down from $5.20 in the prior year period. Nevertheless, the 3Q23 non-GAAP earnings did beat the forecast by 32 cents per share. The company attributed the decline in revenue to a combination of weakness in the housing market plus commodity inflation.

For Oppenheimer’s Batory, this stock presents a clear opportunity. He notes that BLDR should gain as the housing sector rebounds, and also points out that the company’s value-added product lines provide some insulation against hard times.

“The company has a market leading position in a fragmented industry and should benefit from our optimistic view of single-family housing starts in 2024. Growth in value-added products increases the amount of revenue tied to services and is a positive for gross margin and returns. Cash flow dynamics are attractive, providing ample capital for BLDR to execute on its roll up M&A strategy and repurchase shares. We see BLDR as a best-in-class operator that deserves a premium multiple,” Batory explained.

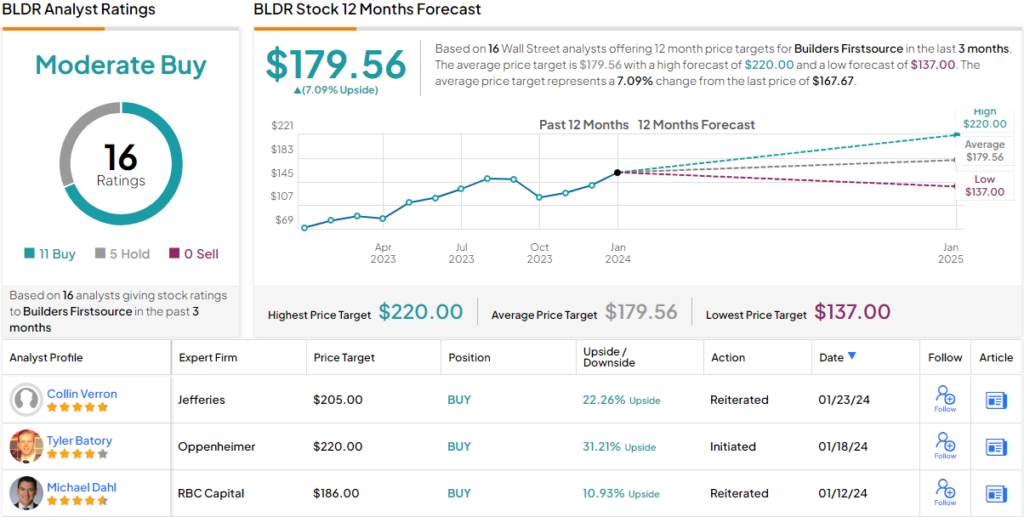

To this end, Batory rates BLDR shares as Outperform (i.e. Buy), and his price target, of $220, implies a 31% upside potential for the coming year. (To watch Batory’s track record, click here)

Overall, there are 16 recent analyst reviews on record for BLDR shares, and their 11 to 5 breakdown, favoring Buy over Hold, gives the stock its Moderate Buy consensus rating. The shares are priced at $167.67, and their $179.56 average target price suggests a modest one-year increase of 7%. (See BLDR stock forecast)

Masonite International (DOOR)

Houses need a lot of things, and one that is easy to overlook – at least, for the casual prospector – is the door. Doors are everywhere in our world, at the entries to our homes, to our rooms, in our schools and offices, but we don’t often think about them. Masonite, a Tampa-based construction contractor, is a leading name in the world of doors, designing, manufacturing, marketing, and distributing doors of all types on the global market.

Since its founding a century ago, the company has built itself into the world leader in doorway and entry systems. Masonite offers lines of doors for both interior and exterior use in the residential and non-residential markets. The company describes its products as ‘doors and door systems,’ and offers components as well as simple doors.

For the company’s customers – more than 7,000 strong worldwide – Masonite’s product lines offer something of everything. The company makes doors, doorframes, roller doors, doors in wood, metal, fiberglass, plastic. There are doors designed specifically for residential homes, and others for commercial use, and there are even doors built with smart-home technology in mind.

Masonite last reported financial results for 3Q23 and missed the forecasts on both revenues and earnings. The net sales total came to $702 million, down 2% y/y and $9.18 million below expectations. The bottom line, the company’s non-GAAP earnings per share, was reported as $2.04, down 19% from the prior year and 2 cents per share below what had been anticipated. At the same time, Masonite’s cash flows were strong; the company reported $310 million in year-to-date operating cash flow and had $360 million in unrestricted cash at the end of the quarter. In the prior-year period, Masonite reported a nine-month cash from operations of $83 million.

Turning again to analyst Tyler Batory, we find the Oppenheimer housing expert bullish here, on expectations that Masonite can benefit from improvements in the residential construction industry. He says of this firm, “Exposure to growth in single-family housing starts should be a tailwind. The company focus on innovation and de-commoditizing its product offerings should contribute to pricing power. EBITDA margin is higher today than pre-COVID, with opportunities for further expansion in the years ahead. DOOR generates substantial FCF with a conversion ratio over 90%. Terminating the acquisition of PGTI (announced 1/17) demonstrates financial discipline deploying capital.”

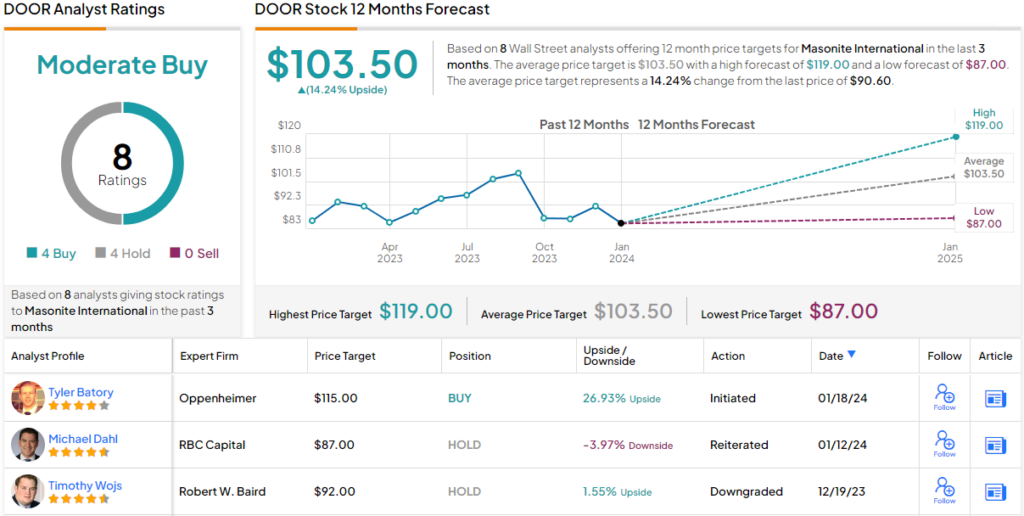

These comments support Batory’s Outperform (i.e. Buy) rating here, while his $115 price target suggests that DOOR will appreciate by 24% on the 12-month horizon. (To watch Batory’s track record, click here)

All in all, there is an even split among the Street’s analysts here – the 8 recent reviews include 4 Buys and 4 Holds, for a Moderate Buy consensus. The current trading price of DOOR is $90.60 and the average target price, $103.50, points toward a potential upside of 14% in the year ahead. (See DOOR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.