Ready to go bottom fishing again? Any good angler can tell you that there’s plenty of good eating just waiting at the bottom of the creek, or the pond, or the lake. The same concept also holds for stocks – investors can always find some quality equities down at the market bottoms.

Stocks get down there for a multitude of reasons, and the reasons aren’t always related to any fundamental flaw in the company or its share trading policies. Sometimes, it’s some idiosyncratic business move, or over-reaction to a related news item, or even just the bad luck of getting swept up in a general market downturn.

So, how are investors supposed to distinguish between the names poised to get back on their feet and those set to remain down in the dumps? That’s what the pros on Wall Street are here for.

Using TipRanks’ platform, we pinpointed two beaten-down stocks the analysts believe are gearing up for a rebound. Despite the hefty losses incurred in 2022, the two tickers have scored enough praise from the Street to earn a “Strong Buy” consensus rating.

Synaptics, Inc. (SYNA)

The first company we’ll look at, Synaptics, lives where man meets machine. This company develops the tech that makes our high-end computer interfaces work. Synaptics’ product line includes wireless connectivity, video interface ICs, graphic chips, audio DSPs, multimedia processors, touch pad modules, fingerprint sensors, touch controllers, and more. Synaptics has also developed its proprietary Katana platform, an ultra-low power AI that act autonomously on data from audio and visual sensors.

There’s no shortage of demand for computer systems – or for their interfaces, which has been a boon for Synaptics’ business in the past few years. The company’s revenues and earnings grew slowly but steadily through 2021 and into 2022, with the most recent quarterly results, for Q4 of fiscal year 2022 hitting the highest levels of the past eight quarters. The top line reached $476.4 million, up 45% year-over-year. The revenue gain was driven by a robust 87% y/y increase in IoT sales.

High sales led to high earnings, and the non-GAAP diluted EPS came in at $3.87, a company record – and 20 cents higher than the $3.67 forecast. The company also reported a non-GAAP operating margin of 39.2%.

Looking at the full fiscal year 2022, Synaptics saw total net revenues of $1.74 billion, a 30% increase from the prior fiscal year’s total of $1.34 billion. Even so, the company’s stock price has fallen dramatically, by 61% year-to-date.

Overall strength in the business niche, and an ability to bring in revenue gains, caught the attention of Craig-Hallum’s 5-star analyst Anthony Stoss.

“While the company cited PC/Mobile softness due to China lockdowns and political unrest in Europe, continued strength in IoT is more than offsetting the weakness. As SYNA continues to execute, we expect the company to beat its goal and potentially post 7%+ growth in FY23 barring longer than expected supply constraints… SYNA has already surpassed their previous 57% GM target and with the company sporting 60%+ GMs, we view SYNA in a class of its own among select semiconductor companies,” Stoss opined.

Stoss used his commentary to support his Buy rating on the stock, and his $180 price target implies a 59% gain for the year ahead. (To watch Stoss’ track record, click here)

Tech companies have no trouble getting attention from the Wall Street analysts, and Synaptics has 8 recent analyst reviews, including 7 Buys against 2 Holds, for a Strong Buy consensus rating. The shares are trading for $112.98, and the average price target of $185 indicates room for ~64% share appreciation in the next 12 months. (See Synaptics stock forecast on TipRanks)

Rapid7 (RPD)

Rapid7, the second stock we’re looking at, boasts over 10,000 customers who depend on the company’s cybersecurity product offerings, including cloud supported packages for visibility, analytics, and automation. By simplifying complex data sets, Rapid7 makes it possible for users to automate routine security tasks, investigate and shut down cyberattacks, monitor malicious behavior, and reduce system vulnerabilities.

In the recent 2Q22 report, Rapid7 showed a total revenue of $167 million, an increase of 32% from the prior year’s Q2. The total top line was powered by a 34% y/y increase in product revenue, which made up $159 million of the total. Rapid7 saw strong annualized recurring revenues (ARR) of $658 million, up 35% y/y, and ARR customer growth of 18%.

While this cybersecurity company’s top line was climbing, earnings came in negative. The non-GAAP diluted EPS was listed as a 1-cent loss, compared to the 7-cent profit in the year-ago quarter, and free cash flow turned from a net of $5 million in 2Q21 to a negative $1.25 million in the current report.

The mixed results put investors on edge, with shares slipping 54% year-to-date.

In his coverage of RPD for Piper Sandler, 5-star analyst Rob Owens makes it clear that he believes the investor worries here ae overblown.

“All things considered, this is the quarter we would have expected out of RPD. The company’s results and subsequent guide are relatively consistent with current challenges seen across the space. We do believe the tone around incremental margin and dedication to delivering a more compelling FCF margin moving forward was a theme management delivered. We still view RPD as a unique opportunity to play trends on consolidating mid-market security spending given its strong portfolio,” Owens opined.

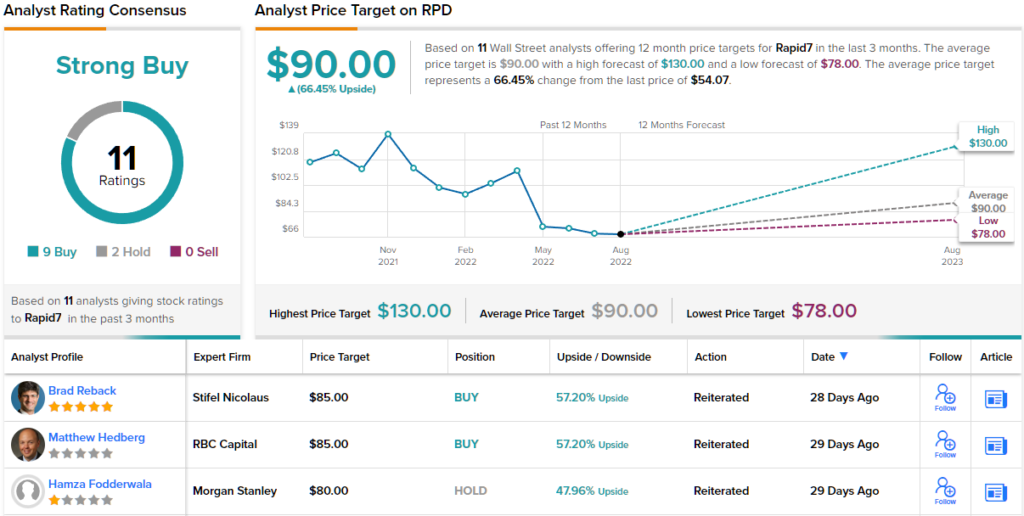

To this end, Owens puts an Overweight (i.e. Buy) rating on the stock and sets a price target of $90 to show his confidence in a 66% one-year upside potential. (To watch Owens’ track record, click here)

Overall, Rapid7 shares have a Strong Buy rating from the analyst consensus, showing that Wall Street agrees with Owens’ assessment. The rating is based on 9 Buys and 2 Holds set in the past 3 months. Shares are selling for $54.07, and the average price target, at $90, implies ~66% upside potential. (See Rapid7’s stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.