Following the launch of the first Bitcoin ETF, BITO (BITO), by ProShares, BTC (BTC-USD) reached an all time high. Meanwhile, Bitcoin whales are on the rise again, as 254 new whales entered the market.

The Fundamental Look

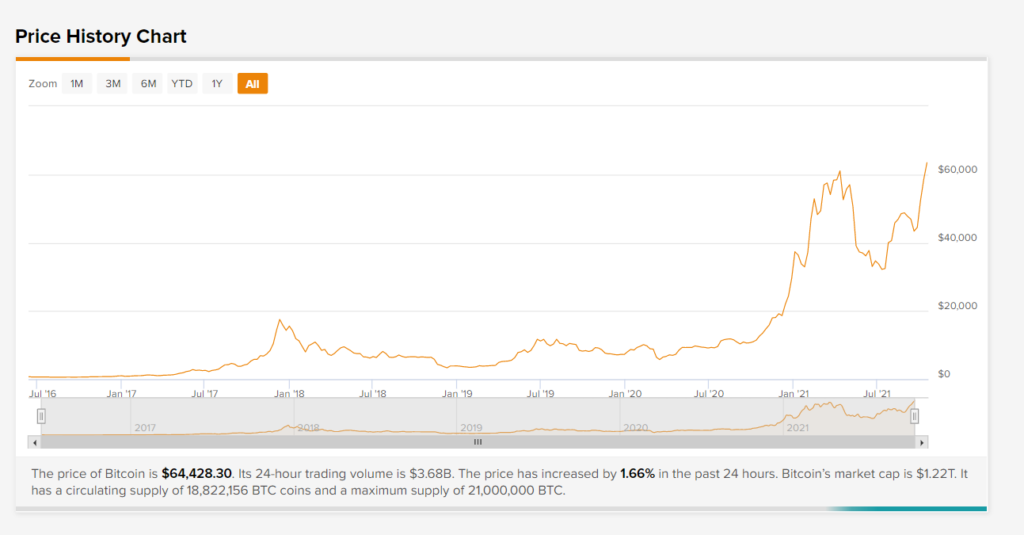

Uptober, so far, has turned out great for the world’s largest cryptocurrency by market capitalization. Uptober is a term coined by Crypto Twitter to describe the month of October, which is expected to be bullish for Bitcoin. Following a surreal bounce-back over the last couple of weeks, BTC reached over $66,000, up more than 5% on Wednesday.

Bitcoin’s price crossed the $66,000 mark, reaching an all-time high, as ProShares finally launched its future-focused Bitcoin ETF with the stock ticker $BITO on the New York Stock Exchange. Since the beginning of October, BTC prices have surged almost 33%, primarily due to the anticipated approval of the first Bitcoin ETF by the U.S. Securities and Exchange Commission.

Per the ProShares team, the newly launched ETF has experienced just shy of $1 billion volume, after 24.313 million BITO shares were traded during the opening session. Meanwhile, Grayscale Bitcoin Trust (GBTC) has filed an application with the SEC to convert GBTC into a spot BTC exchange-traded fund.

Another Bitcoin ETF, the Valkyrie Bitcoin Strategy ETF, is most likely to be launched by the end of this week. Meanwhile, Paris-based Melanion Capital is preparing its own Bitcoin-linked ETF for launch on France’s primary stock exchange, Euronext Paris, on October 22. As such, crypto experts and analysts predict an extended bullish run for BTC – one that could continue through the end of the year.

Owing to BTC’s steady march towards a record all-time high, the number of BTC whales accumulating the ‘de facto internet store of value’ has surged substantially. According to a recent report from Santiment, the number of addresses holding between 100 and 1,000 BTC has increased by 1.9% in the past five weeks. With 254 new whales joining the ranks, these BTC whales now command about 21.3% of the total circulating supply of Bitcoin.

In adoption news, blockchain analysis firm Chainalysis announced its plans to purchase an “undisclosed” amount of BTC through the New York Digital Investment Group’s brokerage services. Finally, pop icon Mariah Carey joins the Bitcoin celebrity list by partnering with Gemini cryptocurrency exchange to boost Bitcoin adoption and support girls of color in their pursuit of STEM degrees.

Whales of the Week

- October 14: 8,300.059 BTC moved from multiple addresses to an unknown wallet

- October 15: 4,317.835 BTC moved from multiple addresses to an unknown wallet

- October 15: 7,519.410 BTC moved from multiple addresses to an unknown wallet

- October 15: 9,810.000 BTC moved between unknown wallets

- October 16: 3,500.000 BTC moved from multiple addresses to Binance

- October 17: 6,564.860 BTC moved from multiple addresses to an unknown wallet

- October 18: 3,681.998 BTC moved from multiple addresses to an unknown wallet

- October 19: 24,032.661 BTC moved from multiple addresses to an unknown wallet

- October 19: 10,000.000 BTC moved from multiple addresses to Xapo

- October 19: 10,000.000 BTC moved from multiple addresses to Binance

- October 19: 8,000.000 BTC moved from multiple addresses to Xapo

The Technical Take

The feverish anticipation of the bitcoin ETF, combined with heightened futures and options activity, has seen BTC-USD prices push higher over the week towards all-time highs. It surged 11.59% over the last seven sessions, relative to the 6.06% gain in ETH-USD and the stark -3.11% underperformance in ADA-USD.

Yet, despite the noteworthy gains in the BTC-USD pair, several indicators suggest that Bitcoin might be due for a near-term correction, namely due to the Relative Strength Index trending above 70.0 in overbought territory. The Stochastic Oscillator is moving similarly in an overbought zone, heightening the possibility that prices encounter tough resistance at the all-time high.

However, the momentum is clearly to the upside near-term, and any breakout above the all-time high around $64,800 could spark an extension higher. Looking at the Fibonacci levels, a move above resistance at $65,550 could spark a run towards the 1.272 level, which corresponds with $71,378.04. The next major upside level is at the 1.414 Fibonacci level at $74,945. However, traders shouldn’t ignore psychological resistance at $70,000 if an upside breakout materializes.

On the downside, it is worth monitoring support at the $60,000 level, along with the 0.786 Fibonacci level at $59,156.62. A more dramatic pullback could push BTC-USD as low as the 50-day moving average, which is hovering around $50,000, but this would mark a serious technical correction in the pair.

Disclosure: At the time of publication, Reuben Jackson did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.