It’s been an incredibly bearish year for markets, but there is hope as we head into December. The holiday season tends to bring cheer for investors ahead of what some refer to as a “Santa Claus rally.” Indeed, if such a seasonal surge is in the cards for stocks, it could have the potential to be outsized, given how far stocks have fallen throughout the year. Tech stocks, especially, could be big market movers.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Though the market received relief in November, it’s likely that CPI will dictate where markets go from here. Better-than-expected inflation data could induce more big up days and allow the Fed greater monetary policy flexibility going into the new year. Conversely, worse-than-expected inflation could bring forth considerable volatility and jeopardize the hopes of any year-end rally.

Undoubtedly, investors should stick with companies they know and love while insisting on reasonable valuations. We all learned the hard way that chasing expensive stocks can negatively affect one’s returns.

It’s hard to tell what to expect from November’s CPI numbers. With protests in China over its zero-COVID policy, market volatility seems like a guarantee for December. Volatility works in both directions, though many may only refer to the downside as volatility.

Expect Big Action from Technology Stocks in December

As we head into the holidays, the tech group could continue to exhibit extreme levels of volatility. Although many tech stocks seem to have bottomed, inflation still seems to be calling the shots.

Unsurprisingly, technology names, big and small, are likely to be among the market’s movers in December. With big tech showing cracks in its armor, the FAANG group could swing wildly.

Further, the Cathie Wood types of innovation stocks may also be in for double-digit percentage moves in either direction. At writing, Cathie Wood’s ARK Innovation Fund (ARKK) is down more than 77% from its 2021 all-time high.

Her funds haven’t had much in the way of relief. Despite the crash, Cathie Wood remains fully focused on the long haul. She’s sticking with innovation and is likely to scoop up more of her favorite innovators while shares are a fraction of where they were just a few months ago.

Whether disruptive tech can make a comeback remains to be seen. Regardless, Wood expects big things from the group by 2030. Though she seems overly bullish, I wouldn’t be surprised if quality disruptors begin to distance themselves from less-disruptive plays that just happened to melt up amid the euphoric rally from last year.

Disruptive Tech: Can It Catch a Bottom?

Disruptive tech has been obliterated, and there may very well be more pain on the horizon if there are more big hikes from the Fed than expected. Even if a pause in rate hikes is on tap for 2023, keeping rates as high as they are now may not be enough to give disruptive tech stocks a lift. They may need to deliver solid quarterly results to drag their share prices out of a rut.

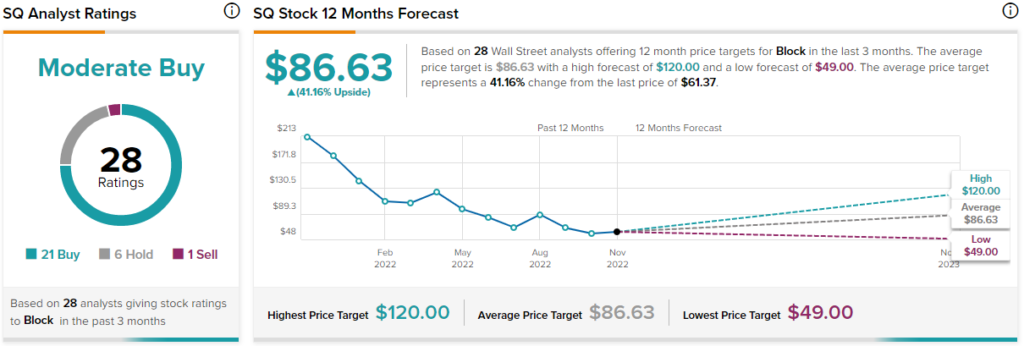

Block (NYSE:SQ) is a Cathie Wood favorite that seems like a great deal following last year’s fintech fumble. At $61 and change, Block is down more than 77% from its all-time high. With intriguing blockchain projects going on behind the scenes and a fresh quarterly beat in the books, Block stock may be one of the disruptors that deserves a break, and it may get one in the final month of the year.

Block’s Cash App saw gross profits hit $774 million, up just north of 50% year-over-year. With recession fears, higher rates, and confusion surrounding the company’s name change (from Square to Block), the bar is set low for the fintech innovator.

Even as Block continues delivering in its quarterly reveals, it’ll be tough to escape the pull of the CPI report and speculation over where rates will settle in the new year.

Personally, I’m bullish on Block stock. It’s unbelievably cheap at about 2x sales. Indeed, such a multiple implies a horrid recession and high interest rates. Analysts even expect about 41% upside potential based on the average 12-month price target of $86.63.

FAANG Stocks: Feeling the Pressure

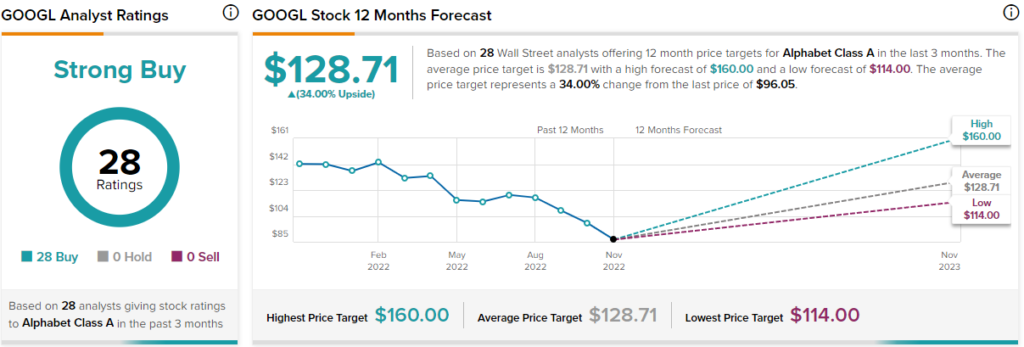

FAANG stocks, like Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) have been under considerable pressure after holding their own in the earlier innings of the market sell-off. As big tech looks to layoffs and productivity enhancements going into the new year, there’s a good chance that the profitable tech leaders can hold up as the recession storm hits.

Alphabet is still a cash cow with many exciting, albeit pricy, side projects. Though the pace of innovation has slowed of late, with the firm pulling the plug on various unprofitable or moonshot projects (think Google Stadia), Alphabet still has a wide moat and room for fundamental improvement. Activist investors are encouraging Alphabet to take “aggressive action” to cut costs.

Regardless of what happens next, GOOG stock’s drop seems overdone, and analysts agree as well, given its Strong Buy rating and $128.71 price target. The FAANG titan trades at 19.6x trailing earnings. Up or down, GOOG stock could continue to be a choppy ride for investors in December.