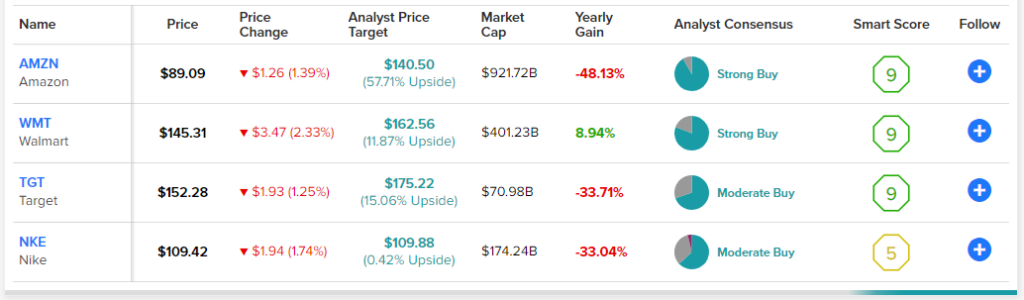

Retail stocks have been under considerable pressure of late, thanks in part to mounting recession fears and lingering supply-chain issues. Consumer sentiment looks to be in a questionable spot going into the holiday season. Despite the numerous layoff announcements, inflation’s impact on consumer budgets, and fading appetite for certain discretionary goods, retailers like Amazon (NASDAQ:AMZN) experienced their best Black Friday weekend ever. Walmart (NYSE:WMT), Target (NYSE:TGT), and Nike (NYSE:NKE) are worth watching as well.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Indeed, the consumer has been quite resilient. Heading into the holiday season, questions linger as to whether the Black Friday blowout will translate into better-than-expected holiday sales. In any case, many of us long for good deals following another year of price increases across a wide range of products.

As the focus shifts to the holidays and Boxing Day 2022, we could witness more bargain-hunters looking to stretch their dollar on nice-to-have discretionary goods. Whether consumer strength lasts into the new year is the million-dollar question. Regardless, the consumer could be key to softening the blow of the jabs the Federal Reserve is throwing at the economy with its rate hikes.

Amazon and Walmart: Retailers to Watch Going into the Holidays

All eyes will be on the retail behemoths Amazon and Walmart going into the holiday season. The two beasts are going into the period of seasonal strength from different angles. Amazon stock has been decimated this year, with investors turning against tech and growth stocks. Meanwhile, investors have warmed up to Walmart, with a growing grocery business that’s continuing to pay dividends in the face of challenged consumer balance sheets.

As recession headwinds max out, retailers with greater discretionary exposure could outpace the resilient staples-focused retailers. Such a scenario makes AMZN stock a far better bet than WMT.

Still, it’s hard to time when the retail tides will turn. At $148 and change per share, Walmart stock goes for a jarring 46.1 times trailing earnings. That’s a high price to pay for a $392 billion retail behemoth that’s not exactly on the cutting edge of e-commerce.

On the flip side, AMZN stock retains a lofty valuation (83 times trailing earnings), even after shedding 52% of its value from peak to trough. Undoubtedly, Amazon Web Services (AWS) and other high-tech divisions make Amazon more vulnerable to the tech-centric valuation reset. Regardless, I do think it’s a mistake to bet against Amazon, as it continues to expand its disruptive presence across the massive e-commerce industry.

Amazon’s move into fulfillment could capture the hearts of smaller retailers, giving DIY e-commerce sites a harder run for their money. Indeed, Shopify (NASDAQ:SHOP) is one of the retail innovators that could feel the pinch.

I think the impressive Prime Day signifies that the consumer isn’t ready to succumb to macro headwinds, and if the Fed can achieve a soft landing, a late-year 2023 economic rebound may very well be in the cards.

As for Walmart, the company is fresh off a quarterly beat ($1.50 EPS vs. $1.32 for Q3) and raise. Indeed, few firms have been able to raise the bar amid headwinds. Though Walmart is better positioned than retail rivals to tackle a more severe recession, I’d argue that a lot of the defensive characteristics are already baked in at these prices.

Target and Nike: Low Bars Make for Positive Surprises

Target and Nike have been pretty big losers this year, both down about 33% year-to-date. Target’s large discretionary mix hasn’t done it any favors this year, as consumers flocked to firms with greater grocery exposure.

Top apparel maker Nike has also felt the heat, with supply-chain issues and demand concerns weighing heavily on the stock. Inventory climbed by 44% in the first quarter of Fiscal 2023. Though discounts will have a negative effect on margins, one has to have faith in the brand. Once the consumer is rich with disposable income again, Nike will be ready to jump higher.

Nike stock has already begun its climb out of its 54% peak-to-trough plunge. At 31.6 times trailing earnings, though, Nike stock could still be at risk of further downside if next year’s recession doesn’t include a soft landing and swift recovery.

The Bottom Line

Retail stocks have been beaten down so hard as we head into the holidays. Though it’s hard to tell when retail will be out of the woods, I’m a bigger fan of the valuations in the risk-on discretionary-centric names. They’ll have more downside as a recession nears but more upside once the tides do turn.