Consumer spending is no longer booming as it was during the stimulus-fueled days. Despite the cooler environment, many retailers are looking to flex their artificial intelligence (AI) muscles with tech capabilities that may be more advanced than you’d think.

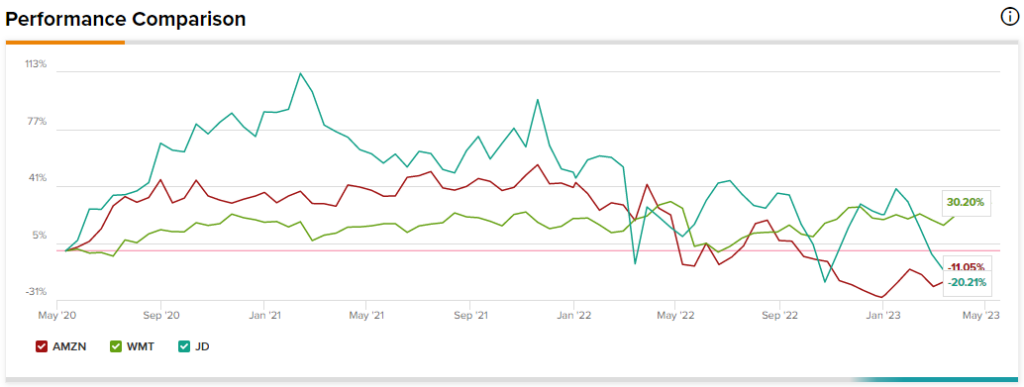

Therefore, we’ll use TipRanks’ Comparison Tool to consider three AI-savvy retailers — AMZN, WMT, and JD — with “Strong Buy” consensus ratings from Wall Street.

Amazon (NASDAQ:AMZN)

Amazon is a FAANG heavyweight that’s still down a great deal (around 43%) from its 2021 highs. Amazon may be a relative laggard in the FAANG group, given the impressive recovery the basket has enjoyed in recent quarters. That said, I would look to Amazon to catch up as investors come to respect its own AI capabilities.

Though the company may not have its own version of ChatGPT facing consumers just yet, there’s a good chance that AI could provide Amazon stock with quite a bit of “rally fuel” over the next 18 months.

Many analysts are more upbeat about Amazon at these depths than other FAANG firms, even though the Retail and AWS (Amazon Web Services) segments haven’t been immune to macro headwinds.

Still, Amazon shouldn’t be viewed as just a retail or cloud play, even though such segments contribute a massive chunk of overall revenues. With the Bedrock ML (machine learning) platform reveal and a long overdue upgrade in store for Alexa, it’s not hard to imagine Amazon being the next beneficiary from this year’s surge in AI hype.

According to a report by Business Insider, the company is reportedly looking to bring advanced ChatGPT-like chatbot tech to Alexa. The tech may be every bit as impressive as ChatGPT, and if it is, it may be tough to derail Amazon stock from here, even if a looming recession weighs on retail and the cloud for a while longer.

It’s hard to tell what will power Amazon’s next leg higher, but whether it’s AI or a return to growth for retail and the cloud, it seems tough to pass up Amazon stock at these levels.

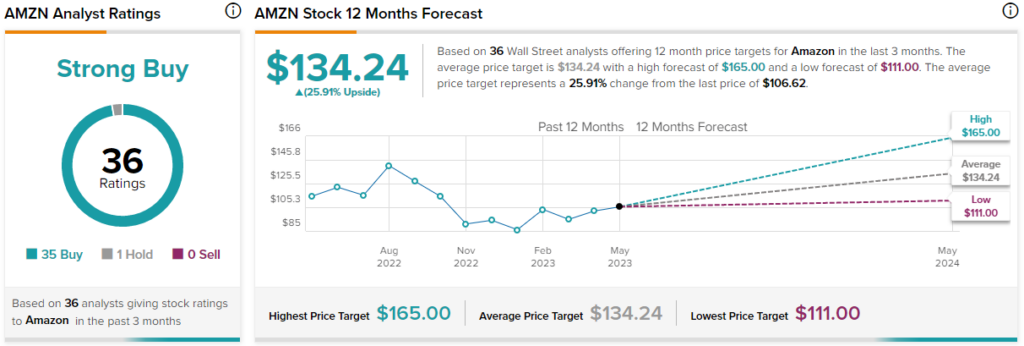

What is the Price Target for AMZN Stock?

Amazon is a “Strong Buy,” with 35 Buys and just one Hold on the name. That’s overwhelming confidence by the analyst community. The average AMZN stock price target of $134.24 implies a 5.9% gain from here.

Walmart (NYSE:WMT)

Walmart is a brick-and-mortar retail heavyweight that’s delved into the tech space in recent years. Undoubtedly, the impressive e-commerce presence and the Walmart+ subscription model are what we’ve come to expect from the long-time retailer in this digital age. As we enter the AI age, I expect Walmart will also get in on the action.

Walmart’s getting tech-savvier over time. Though it may struggle to catch up to the original e-commerce disruptor, Amazon, Walmart has shown it’s more than competent enough to hold its own and harness tech to do a bit of disrupting of its own. The firm has done a great job of adapting, and for this reason, I’m staying bullish.

Last week, Walmart made headlines for tapping into AI to negotiate with certain suppliers. Given its behemoth size, Walmart already has a tremendous degree of purchasing power. With an AI negotiator (from Pactum AI, an autonomous negotiation company) on its side, it may have that much more power as it seeks to obtain better deals for investors and its loyal customer base.

Walmart is unlikely to just be dabbling in the AI waters. As more AI tools and features become more commonplace, expect Walmart to quickly hop aboard. Whether we’re talking AI that can help improve operating margins or enhance the digital customer experience, it’s about time we think of Walmart as more of a tech-driven retailer than an old-fashioned one that stands to lose share from the rise of next-gen technologies.

At 35.9 times trailing price-to-earnings, Walmart’s trading on the high end of its five-year historical range (of around 33.7 times). The slight premium seems worth it, though, given Walmart’s willingness to use AI tools that may help drive growth and margins.

What is the Price Target for WMT Stock?

Walmart comes in at a Strong Buy based on 24 Buys and five Holds. The average WMT stock price target of $165 implies a mere 7.9% gain from here.

JD.com (NASDAQ:JD)

JD is a Chinese digital retailer that’s down 66% from its 2021 highs. The stock has been sliding since its most recent earnings report in March, as the firm slightly missed revenue expectations. The quarter seems to have signaled a fading of the Chinese economic recovery.

Despite the recent slide, JD looks like another candidate that could use AI to help it better navigate a rough economic patch. Though there are added risks of buying Chinese ADRs (American depository receipts), I remain bullish on the stock, primarily due to the potential growth that could be in store once China is finally ready to recover.

Earlier this year, JD.com pulled the curtain on its own ChatGPT-like generative AI platform ChatJD. Only time will tell how JD’s AI stacks up against American offerings. Regardless, I view JD as a firm that could use AI to help stop the bleeding in its stock.

However, as JD is getting in on the AI race, questions linger about what regulators will do should a corporate AI product become too powerful. Due to this regulatory uncertainty, JD deserves to trade at a discount, but at this juncture, analysts think there’s too large of a discount applied to shares.

What is the Price Target for JD Stock?

JD’s a Strong Buy, with 13 Buys and four Holds. The average JD stock price target of $62.24 implies a whopping 74.7% upside potential.

Conclusion

Even with a seemingly likely, albeit shallow and slow-moving recession that may be in the cards for 2023, I’d look for the challenged retailers to pursue technological efforts to help them weather the storm and come out on the other side of a potential recession with strength.