As the COVID pandemic continues to recede, and as reopened economies continue to bounce back from the pandemic distortions, we are now starting to see the return of normal regional variations in economic activity.

One result – a report from Seaport suggesting strength in Macau casino stocks, while the US gaming and leisure industry is facing headwinds.

In part, this is because the US lifted restrictions earlier than China; the casinos in Macau are still benefiting from a post-restriction honeymoon, and they are likely to post strong financial results this year and next, while in the US, casinos are facing a combination of increased leisure competition right now and the prospect of an economic downturn later this year.

Seaport analyst Vitaly Umansky lays out the likely tracks in both gaming markets, writing, “Our gaming thesis is largely driven by continued recovery and growth in the Macau and Singapore market in 2024 and 2025. While we have a long-term positive view on Las Vegas (and to a lesser extent the US regional market), we forecast headwinds in 2024 in both Vegas gaming and in the US regional markets (with negative growth probable). As such, in general, we have a more positive view on the Macau pure play stocks.”

We can follow Umansky’s line of thought by looking at his recent recommendations on Macau-related casino stocks. According to the TipRanks data, these stocks also have general approval from Wall Street; let’s take a closer look at them, and find out why they could be good bets right now.

Melco Resorts & Entertainment (MLCO)

First on the list is Melco, a casino entertainment operator with properties in Macau, the Philippines, and Cyprus. Melco’s properties are more than just casinos – they are operated as full service resorts, offering tourists and guests a wide range of entertainments, leisure activities, and gaming – but also spas, first-class hotel accommodations, fine dining, and nightlife. In short, it’s everything a vacationer is looking for, packaged together in one place.

The company currently operates six separate properties, four in Macau, one in Manila, and one in Cyprus. The properties in Macau include City of Dreams, Altira Macau, and Studio City, a resort with a cinematic theme, as well as the largest non-casino-based electronic gaming machine operation in Macau, the Mocha Clubs. These are supplemented by subsidiary operations of City of Dreams Manila and, in Cyprus, City of Dreams Mediterranean. Together, these properties support a company with a market cap of more than $3 billion.

Melco’s recent quarterly releases show a big post-COVID bounce. In the last reported quarter, 4Q23, Melco’s top line came to $1.09 billion in US currency, a figure that was up 223% year-over-year. On the bottom-line, however, earnings showed a net loss for the quarter of 36 cents per share. We should note that, while Melco’s revenues are making a strong comeback, the company’s stock price has not rebounded; over the past 12 months, MLCO shares have fallen by over 52%.

That combination of a drop in share price while revenues are rising presents an opportunity, as far as Seaport’s Umansky is concerned. He writes of Melco, “Our top pick on valuation is MLCO… Going forward, we forecast MLCO to have stable share in 2024 and declining marginally in 2025 as other properties ramp up, base mass visitation increases, and other operators focus efforts on premium customers with new larger scale product (i.e., Sands and Galaxy). However, MLCO has historically been a strong operator in Macau, especially in premium mass. Melco should benefit strongly from adoption of smart digital tables (as MGM has done), especially with the renewed focus on analytics and strategic marketing where the smart digital table marketing and data tools are of significant value. The critical drivers for MLCO over the next 1-2 years will be to take premium gaming market share and ramping up Studio City with the phase 2 expansion.”

For Umansky, this adds up to a Buy rating for the stock, and his price target of $10 suggests a 45% upside in the next 12 months for Umansky. (To watch Umansky’s track record, click here)

Overall, Melco has earned a Moderate Buy rating from the Street, based on 4 reviews with an even split of 2 Buys and 2 Holds. The shares are priced at $6.89 and their $9.03 average price target points toward a 31% increase on the one-year horizon. (See MLCO stock forecast.)

Las Vegas Sands (LVS)

The second stock we’re looking at is Las Vegas Sands. While it is domiciled in Nevada, its resort properties are located in the East Asian cities of Macau and Singapore. Out of the six properties the company owns and operates, Macau is home to five, an extensive operation that bears some scrutiny.

The resorts in Macau are the Venetian, Sands, the Londoner, the Plaza and Four Seasons Hotel, and the Parisian. Together, these properties offer a wide variety of themes, accommodation levels, and entertainment, and boast a total of 12,136 suites and rooms for guests. The gaming and retail space among these five resorts are extensive and add up to more than 6.54 million square feet. The company also works to attract business clients and conferences, and its five Macau resorts offer a combined 2.46 million square feet of meeting and conference space.

All of that is the foundation that supports Las Vegas Sands’ rising revenues. The company’s top line has been trending upward since the end of 2022, and the last 7 quarters have all shown sequential revenue gains, including in the just released its 1Q24 results. Revenue reached $2.96 billion, up from the $2.92 billion generated in Q4, and by 39.6% from the same period last year while also edging ahead of expectations by $20 million. There was similar success at the other end of the scale, as adj. EPS of $0.75 trumped the forecast by $0.13.

Turning again to Seaport analyst Umansky, we find him upbeat here, based on the positive risk/reward and the solid outlook. “Our top pick overall based on risk/reward and fundamental outlook is LVS (and its Macau subsidiary Sands China),” Umansky said. “The critical drivers of LVS’ medium term success (1-2 years) are 1) recovery of the base mass market to pre-Covid levels in Macau, 2) continued ramp up of The Londoner in Macau (and successful redevelopment of its south casino and Sheraton hotel), 3) continued growth in Singapore on the back of newly refurbished hotel and other offerings (a $1.75bn capex) that significantly increased suite capacity to cater to premium casino customers.”

Quantifying his stance on LVS, Umansky gives the shares a Buy rating. His price target, currently set at $63, implies the stock will gain 25.5% in the coming year.

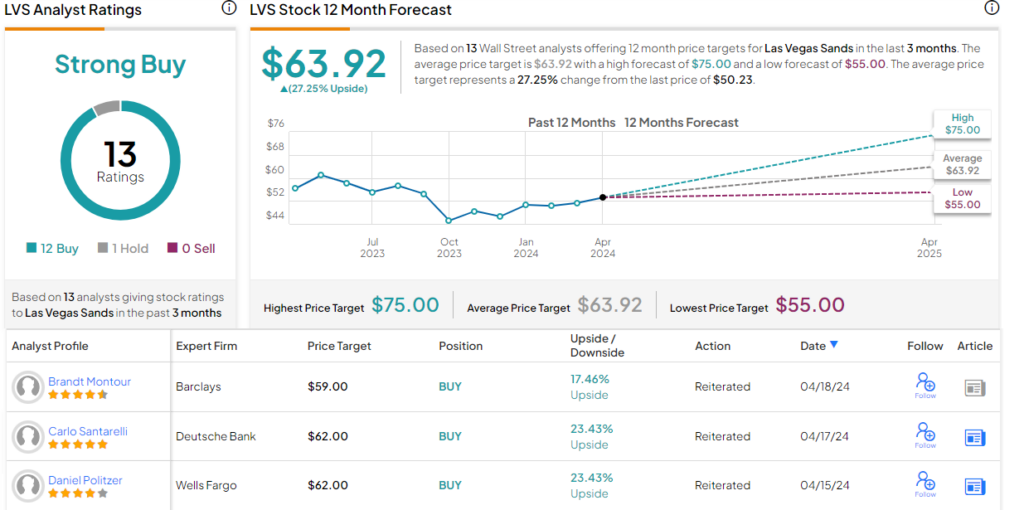

Las Vegas Sands has 13 recent analyst ratings on file, and these break down 12 to 1 in favor of Buy over hold, to give the stock a Strong Buy consensus view. The shares are trading for $50.23, and their $63.92 average price target suggests an increase of 27% from that level. (See Las Vegas Sands stock forecast on TipRanks)

MGM Resorts (MGM)

We’ll wrap up our look at Macau casino stocks with MGM Resorts, a name long associated with the famous Las Vegas Strip. In its current incarnation, MGM is a component stock of the S&P 500 index and is the owner/operator of 31 hotel and gaming resorts around the world. Most of these are in the US, located in Nevada, Maryland, Massachusetts, Michigan, Mississippi, and New Jersey; MGM’s Detroit casino stands at the core of the city’s downtown revitalization efforts, ongoing since the 1990s.

On the international scene, MGM has an important presence in Japan and China. While the company has operations on mainland China, its two Macau properties have shown strong gains recently. These properties are the MGM Macau, described as a luxury integrated resort, and the MGM Cotai, located on Macau’s famous Cotai Strip intended to be the ‘jewelry box’ of Cotai. MGM’s Macau properties have, between them, approximately 2,000 guest rooms and suites, along with extensive meeting and conference spaces, spas, retail establishments, and fine dining. The MGM Macau even includes an Art Space, with more than 8,000 square feet to display artistic works. The company boasts that MGM Cotai is the largest single property in Macau.

The last quarterly report we have from MGM covers 4Q23. For that period, the company reported a top line of $4.4 billion, beating the forecast by $240 million and growing 22% year-over-year. The company attributed most of the year-over-year growth to increased revenue from MGM China, post-COVID restrictions. At the bottom line, MGM’s $1.06 EPS, by non-GAAP measures, was 35 cents per share better than had been anticipated – and it was a far better result than the $1.54 EPS loss recorded in 4Q22.

A closer look at the company’s China results gives an idea of just how much that segment has rebounded. In 4Q23, MGM China had net revenues of $983 million, up from just $175 million one year prior; this marked an increase of 462%. Even better, the 4Q23 results were 35% better than had been reported in 4Q19, the last pre-COVID quarter.

Zooming out and looking at 2023 as a whole, MGM reported a full-year top line of $16.2 billion, up 23.6% from 2022. The company’s 2023 free cash flow came to $1.8 billion.

Covering this stock, Umansky notes how it differs from its peers, writing, “MGM is the most heavily US exposed of our current coverage group with 73% of its consolidated net revenue (2024) coming from US land-based casino operations in Las Vegas (9 properties) and seven regional casinos… The critical drivers of MGM medium term success (1-2 years) are 1) maintain cost controls in the US in light of a potentially softening market while continuing to develop destination offerings to keep MGM competitive, 2) in Macau, MGM is likely to face pressure on market share as other operators ramp up premium mass marketing and base mass return accelerates (where MGM is weaker), 3) continued smart use of capital allocation (selling underperforming assets and investing in higher growth/ROI or returning capital to investors.”

Going forward from this, Umansky gives MGM a Buy rating, and he sets a $56 target that points toward a 33% one-year share appreciation.

Once again, we’re looking at a stock with a Strong Buy consensus rating from the Street; MGM’s recent analyst reviews include 12 Buys and 2 Holds. The stock has a current price of $42.03 and an average target price of $57, suggesting a 12-month gain of 35.5%. (See MGM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.