When stock prices fall, opportunities open up. That’s true whether we’re talking about a general market decline, or a slip in some individual stocks. However, it is crucial for investors to conduct due diligence and investigate the reasons behind the drop in price to ensure that they are making informed investment decisions. The key to success here is recognizing when a low-priced stock is fundamentally unsound or just facing tough trading conditions.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Fortunately, Wall Street’s equity analysts are doing the footwork on this, and their recommendations offer investors a solid guide to sound investments.

With this in mind, we’ve used the TipRanks database to pinpoint two stocks that some Street analysts believe have reached such low levels that they are simply too cheap to ignore right now. In fact, both of these stocks have received enough support from the analysts to earn a “Strong Buy” consensus rating. Let’s take a closer look.

Duckhorn Portfolio (NAPA)

Duckhorn Portfolio takes its ticker symbol from the source of its products: the Napa Valley, and the region’s famous wines. Duckhorn was founded in 1976 and has been setting the standard for fine wine ever since. The company focuses on quality winemaking, taking advantage of the climate and soil of Napa to produce superior grapes. The company’s Merlot and Cabernet Sauvignon wines have been winning awards for decades, and are available across the US and in 50 countries across five continents.

Duckhorn has always focused on producing fine wines, and has based its success on optimal grape selections wedded to innovative winemaking techniques and premium barrel aging. The company’s portfolio is sold under ten different labels – most featuring an anatid theme. Duckhorn has long boasted of its ‘unwavering commitment to quality.’

Committing to quality brought Duckhorn better-than-expected results in its recently reported financials for Q3 of fiscal year 2023. Ending on April 30, these three months showcased Duckhorn’s impressive performance with net sales of just over $91.2 million. Although this marked a slight year-over-year decline, it still exceeded the forecast by $1.49 million. Moreover, the company’s non-GAAP bottom line demonstrated a strong adjusted net income of $19 million, translating to an EPS of 16 cents per share. While the year-ago quarter reported a non-GAAP EPS of 17 cents per share, the current EPS outperformed expectations by 4 cents.

Despite posting results ahead of the estimates, Duckhorn has still seen its shares fall by 19% so far this year. But for Evercore analyst Robert Ottenstein, Duckhorn’s advantages – the solid portfolio and the cheap valuation – make it worth a closer look from investors.

“We continue to believe the firm has the potential to compound sales at a HSD rate as it takes share within the premium wine space and can compound EPS at a DD rate for many years, which would put it in the rarified company of BF, EL, and MNST as a blue chip growth name. The firm has substantial distribution runway, and a compelling portfolio to continue to trade consumers up the pricing ladder. Decoy Limited distribution ramp provides margin tailwind into FY24-25… We also believe that NAPA’s unique COGS visibility warrants a significant premium in the current environment… Stock cheap at 12x 2024 EBITDA vs. KO/PEP 17.5x/16.0x,” Ottenstein opined.

Putting some numbers to this stance, the analyst goes on to rate NAPA shares an Outperform (i.e. Buy) and sets a $20 price target to imply a one-year upside potential of ~50%. (To watch Ottenstein’s track record, click here)

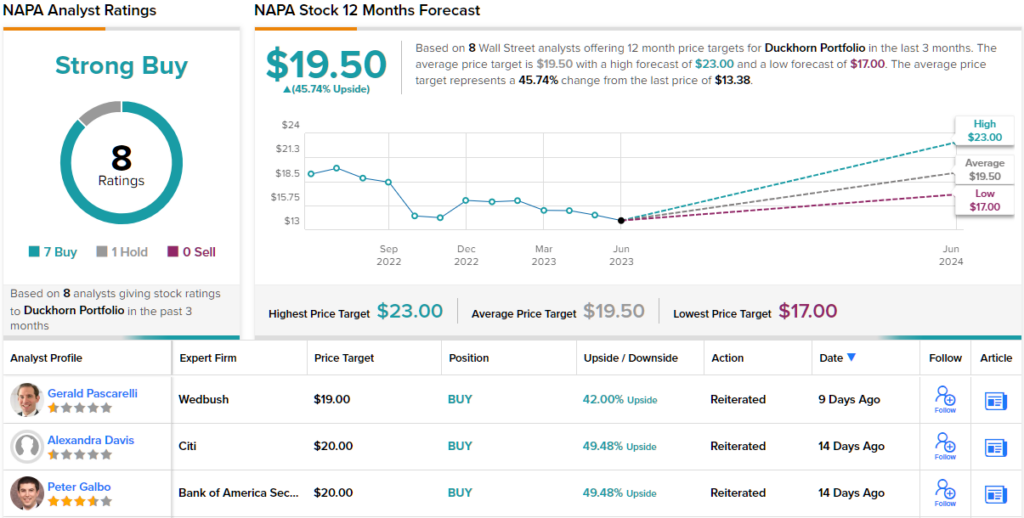

It would seem that Wall Street agrees with this bullish assessment. The stock has 8 recent analyst reviews, with a breakdown of 6 to 1 in favor of Buy over Hold, and the $19.43 average price target suggests ~46% increase from the current share price of $13.38. (See NAPA stock forecast)

Academy Sports and Outdoors (ASO)

From fine wines we’ll turn to retail, where Academy Sports and Outdoors operates an extensive chain of brick-and-mortar locations in the sports and outdoor leisure supply segment. Academy, which got its start in 1938, has grown to a total of 269 stores across 18 states – and expects to open an additional 120 to 140 stores in the next 5 years.

The company offers shoppers a wide range of products for outdoor sports and leisure, including apparel and footwear, swimwear, sandals, patio furniture, outdoor cooking equipment, fishing and camping gear, firearms and ammo, even kayaks and fish finders. Academy says that its chief product is ‘fun for all,’ and the range of merchandise reflects this mindset.

In 2022, Academy reported $6.4 billion in revenue, representing a 5.8% decline compared to the previous year. The recently released 1Q23 results suggest that this downward trend may be continuing into 2023. Net sales for the first quarter reached $1.38 billion, down 5.7% year-over-year and falling short of the forecast by $60 million. Additionally, Academy’s non-GAAP earnings per share for the same period were $1.30, marking a 24% decrease compared to the previous year and missing expectations by 34 cents.

Shares in ASO peaked in April of this year, near $68. Since that time, the stock is down 26%.

Among the bulls is JPMorgan’s 5-star analyst, Christopher Horvers, who notes that Academy is fighting back against its slipping financials with a set of traditional – but also effective – retail strategies, including new products and improved customer targeting.

“ASO is betting on improvement performance in 2H on easier hunt compares, less punitive weather, newness (with some ‘exciting’ new brand launches), merchandise strategies appropriate for the current environment, and a structural improvement in its ability to target consumers digitally to drive sequential sales improvement… The stock is cheap enough to have little downside risk and should rise with earnings,” Horvers opined.

To this end, Horvers rates ASO an Overweight (i.e. Buy), and his $61 price target shows his confidence in a 22% upside on the one-year horizon. (To watch Horvers’ track record, click here)

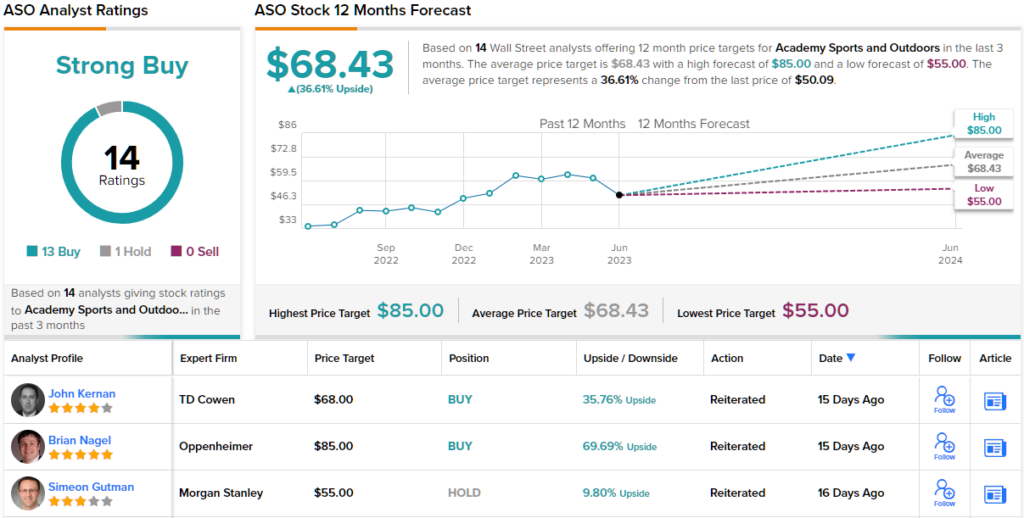

While down, this stock is not out – at least not according to Wall Street’s analysts. They have given ASO 13 Buys against just 1 Hold, for a Strong Buy consensus rating. The current trading price of $50.09 and the average price target of $68.43 combine to suggest a potential one-year upside of ~37%. (See ASO stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.