So far this year, we’re looking at broad-based declines in all of the stock market’s major indexes. But just like every thorn has a rose, this bearish market environment has a bright spot for investors.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

While markets are weak overall, the energy sector has been riding high, with the S&P 500 Energy Index up 48% year-to-date.

So the question for investors is, does the energy sector have more room to run? According to some Wall Street pros, the answer to that is ‘yes.’

So let’s run down that path, and take a look at two energy stocks that are showing clear opportunities for investors. These are Strong Buy tickers, according to the analyst community, and while both have already achieved serious growth this year, they are primed to keep climbing higher.

We’ve pulled up the details from the TipRanks data; here’s a closer look, along with analyst commentary.

ExxonMobil (XOM)

First up is one of the oil majors, ExxonMobil. This company is active in petroleum and natural gas production; that makes up the ‘Upstream Company’ business division, and accounts for a major part of ExxonMobil’s activities. In addition to its world-wide hydrocarbon extraction business, ExxonMobil has refining activities in the US, and is actively working to develop newer, more efficient fuels, and low carbon solutions for a net-zero future.

All of this adds up to an industrial giant, a $415 billion dollar behemoth of the world economy. In the second quarter of this year, XOM showed a top line of $115.68 billion, a 70% gain from the year-ago quarter’s result. On earnings, the company reported $17.9 billion, up from the $5.5 billion in 2Q21, for 69% increase. Per share, earnings nearly quadrupled, from $1.10 in 2Q21 to $4.14 in the current report. ExxonMobil had $20 billion in cash flow from operating activities in 2Q22.

Of interest to investors seeking a defensive stance, XOM pays out a sound dividend, with a long history – some 39 years – with a 6% CAGR. The current payment is 88 cents per share, which annualizes to $3.52 and gives an above-average yield of 3.5%.

In his coverage of this stock for Evercore ISI, analyst Stephen Richardson writes: “With the global energy system laboring under constrained supply (some by design some by externalities) and still improving demand (post pandemic), XOM fits the market thematic very well. The procyclical investments in Guyana, the Permian, and even downstream now look fortuitous in hindsight. Further, higher prices are supportive for the long-standing portfolio trimming that was in order particularly for legacy domestic NG assets. So while production is trending low vs. guidance (divestitures and entitlement drag) the cash generation continues.”

Richardson follows up these comments by reiterating his Outperform (i.e. Buy) rating on the stock, and maintaining a $120 price target that suggests a one-year upside potential of 20%. (To watch Richardson’s track record, click here)

Overall, there’s no doubts on Wall Street that the bulls are running with XOM; the stock’s 10 recent analyst reviews break down 8 to 2 in favor of Buys over Holds for a Strong Buy consensus rating. The shares are priced at $99.61 and have an average target of $109.05, which indicates room for ~10% growth in the year ahead. (See XOM stock forecast on TipRanks)

Marathon Petroleum Corporation (MPC)

Let’s stick with the oil majors, and with one of North America’s biggest refining companies in the grouping. Marathon Petroleum, with its $50 billion market cap and its $119 billion in annual revenues, is a leader in the North American refining market. The company also transports and markets its range of refined petroleum products, the output of 13 operating refineries in 12 states, with a combined capacity of 2.9 million barrels of crude per day.

Marathon’s operations – and its revenues and profits – have been increasing in recent years, getting a boost from the high price of oil in the world markets, and the high prices for refined products such as gasoline and diesel fuels. In the 2Q22 results, Marathon showed an adjusted net income of $5.7 billion, translating to an impressive $10.61 per diluted share. This EPS value was light-years ahead of the mere 67 cents EPS reported in the year-ago quarter.

On the balance sheet, Marathon reported a high level of available liquidity, with $13.3 billion in cash and cash assets on hand, and another $5 billion available through an existing bank revolving credit facility. This was balanced against debt of $7 billion. The company will report its Q3 results on this coming November 1.

All of this supports a reliable dividend, of 58 cents per common share, last paid out in September. The dividend has been paid out at this level for the past 11 quarters, and its annualized rate of $2.32 per common share gives a yield of 2.25%.

JPMorgan’s John Royall likes what he sees in Marathon Petroleum, especially its ‘top-tier balance sheet.’ He goers on to praise the ‘return of capital,’ “…with >25% to be returned to shareholders in 2022 and high teens % on average in 2023-24E, well in excess of the next best returning refiner…. we think MPC should also announce a sizable dividend hike in the next few months, which, while anticipated by the market, could be a catalyst if it beats expectations (JPM +15% in 2023).”

Royall’s comments back up his Overweight (i.e. Buy) rating on the shares, as does his $136 price target, which implies a gain of 26% in the next 12 months. (To watch Royall’s track record, click here)

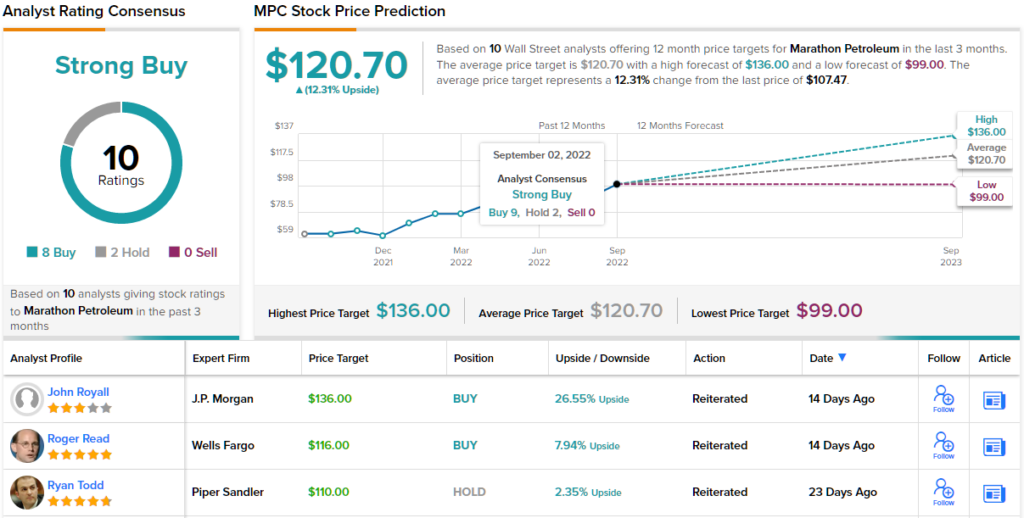

This large-scale refinery company has picked up the notice of 10 Wall Street analysts, reviews which include 8 Buys and 2 Holds for Strong Buy consensus rating. The stock is selling for $107.28 and its $120.70 average price target suggests an upside potential of 12%. (See MPC stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.