The S&P 500 rally in 2023 was led by seven technology mega caps, with the group posting gains of over 100% for the year. This year, many of these leaders are expected to continue on their upward trajectory; however, the projections of their future performance differ widely. Let us reflect on these giants’ 2023 accomplishments and try and craft an outlook for their trends in the new year.

The Seven Knights of the Stock Market

The S&P 500 (SPX) index logged an impressive rally in 2023, capping its best year since 2004. However, during most of the year gains were largely concentrated within a handful of mega caps, dubbed “The Magnificent Seven”, with the rest of the market hanging in limbo. The “Remaining 493” stocks joined the party only towards the end of the year, as the markets became increasingly convinced that the Federal Reserve will soon pivot to an easier monetary policy.

The Magnificent Seven stocks – Apple (AAPL), Alphabet (GOOGL, GOOG), Microsoft (MSFT), Amazon (AMZN), Meta (META), Tesla (TSLA), and Nvidia (NVDA), produced an average increase of 111% in 2023. Their collective gain comprised over 75% of the SPX’s total annual increase.

Since the S&P 500 is weighted by market cap, large companies comprise a bigger chunk of the index, which means that their moves affect the index’s moves significantly more than those of their smaller counterparts. At the same time, the Magnificent Seven’s enormous rally has added even more to their capitalization, upping their weight in the index to almost 30% and leading to an even stronger influence of these stocks on the overall S&P 500 performance.

Thus, the question of whether the Magnificent Seven stocks can continue rallying bears heavy implications not only for the tech giants and their shareholders, but also for the SPX as a whole and those investors holding a stake in it.

This Time Was Totally Different

The narrowness of the rally through most of 2023, coupled with the stark contrast in performance between the market leaders and the rest, led to many comparisons to the dot-com bubble of the late 1990s. However, even if the Magnificent Seven stocks did display some bubbly attributes during the year, the comparison is completely out of place.

In fact, things are very different this time. At the time of the dot-com bubble, investors threw money at anything with the word “Internet” in its name, including firms that could not even explain their business model, let alone show a path to profitability. In 2023, the rally was concentrated within multibillion-dollar corporations churning out colossal profits and generating tremendous amounts of cash flows.

The rally of 2023 is the complete opposite of the dot-com bubble. The dot-com bubble occurred in a strong economy and was ignited by hopes for enormous, future profits, last year’s market gains were made by some of the largest and strongest corporations in the world against the backdrop of a very uncertain, and quite pessimistic, economic outlook. A gentle reminder: at the beginning of 2023, the Fed was in the midst of its hiking campaign, with almost everyone in agreement that a recession was imminent.

The New Defensives

The Magnificent Seven companies have become so enormous that their combined weight in the global stock-market index, MSCI All Country World, now exceeds the weightings of the entire stock markets of the U.K., Japan, France, and China combined. No wonder that their size and financial strength have led to their perception as the safest companies on the planet.

So, it was only natural that at a time of uncertainty, investors turned to the “new defensives”, which have the means to do well in any environment. In addition, the Magnificent Seven have proven in the past that they can produce significant earnings growth in almost any economy, in contrast to the traditional defensives, such as consumer staples and utilities. In fact, analysts estimate that the full-year 2023 earnings growth for the S&P 500 companies will show a positive print only thanks to the strong contribution from the Magnificent pack. In addition, despite the wide-held perception, higher interest rates only added to the tech leaders’ bottom lines. These companies don’t need to raise debt, on the contrary: thanks to higher rates, they have seen large interest income on the cash they hold in their coffers.

Thus, after a strong downturn in 2022 which lowered tech giants’ valuations to very attractive levels, investors who loaded up on the Magnificent stocks at the start of 2023 were counting on a win-win situation – and they were correct in their assessment.

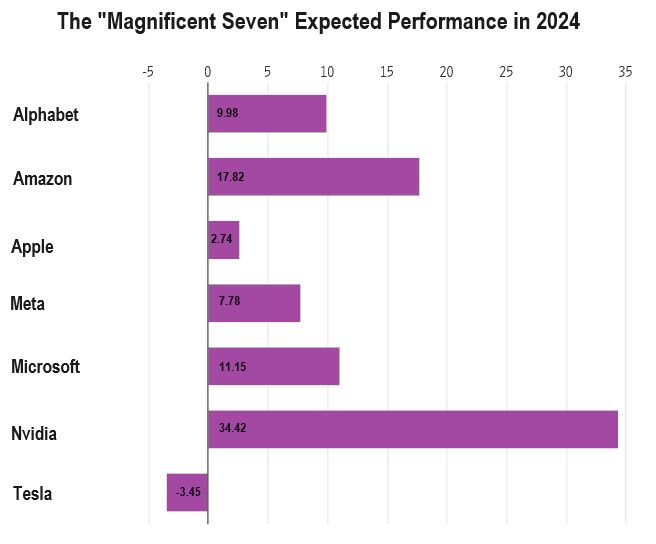

However, as we enter 2024, the main question is whether the Magnificent Seven can keep on rolling. While money managers have become somewhat skeptical, saying that the tech giants have become the most crowded trade on Wall Street, analysts are optimistic about almost all of the seven-largest tech stocks for 2024. According to FactSet, the average analyst forecast is for much smaller but still respectable increases for all the Magnificent stocks except for Tesla, which is slated for a small decline this year.

Feeling in the Clouds with AI

As can be seen, Nvidia is expected to lead the pack again. That is because the artificial intelligence (AI) boom, which propelled it upwards by almost 240% in 2023, is only starting. While companies like Microsoft and Meta will probably see most of the AI contribution to their revenues further down the road, Nvidia, which designs chips needed to implement the technology, has already been reporting a surge in demand, and is the most immediate benefactor of the AI development. But if the technology’s advance and adoption proceeds at rates that are at least reminiscent of those we saw last year, Microsoft and Google may surprise on the upside, capitalizing on their AI-related advancements.

In addition to the new technology, there is an “old” one that continues to prop up the shares of Alphabet, Microsoft, and Amazon: cloud computing. The three companies control about 75% of the cloud computing market, which is slated for prolonged expansion. With all the noise about cost reductions, the world continues to migrate to the cloud, while the global digitalization of everything requires increased computing and storage resources.

Besides, these technologies are interconnected. Thus, Microsoft’s cloud platform Azure has been registering a strong increase in income, becoming the leading AI platform following Microsoft’s investment in OpenAI, the maker of ChatGPT; Microsoft also offers its own AI tools and hardware. Alphabet’s Google Cloud also stands to capture outsized AI benefits as the company increases its investment in the technology.

AI is also slated to add a large chunk to advertising income, especially at Alphabet, with the company continuing the trend of rising revenues seen in every quarter of 2023. After its two-year slowdown, digital ad spending is expected to reaccelerate this year. With the Google parent sweetening its offer with highly effective AI tools, it has positioned itself to make the most of the technology in the ad space.

Taking a Bite of Apple

According to Goldman Sachs (GS) analysts, the Magnificent Seven will grow their earnings at an average rate of 11% in the next two years, while the rest of the S&P 500 companies’ average annual growth will amount to only 3%. Net profit margins and the EPS growth at the seven giants are expected to be almost twice those of the “Remaining 493”. So, in terms of fundamentals, analysts’ optimism about the Magnificent stock performance in 2024 is soundly justified.

The two outliers in the optimistic – or, shall we say, magnificent – forecast for 2024 performance are Tesla and Apple.

Tesla gained over 100% in 2023 even though its U.S. electric vehicle (EV) market share has declined from 62% to 50% due to stiff competition. The company’s share of the market would probably have shrunk even farther had it not cut prices for its cars; however, that came at the expense of shrinking profit margins. Analysts expect the EV maker to continue losing market share, largely because the higher-priced EV niche is fast becoming saturated.

Apple, the only company in global stock market history to exceed a market valuation of $3 trillion, has seen its revenues and operating profits inch down in 2023. Despite the soggy sales growth and no visible progress on the AI front, the iPhone maker’s shares still soared last year, driven mostly by its fundamental strength (the company has more cash than the U.S. government). Besides, Apple has proven numerous times in the past that its marketing craftsmanship can help it overcome demand wobbles. However, for the short term, the outlook for the stock performance is quite benign, and several Wall Street analysts have downgraded their outlook on the stock, citing lackluster demand for phone hardware.

The Investing Takeaway

Following the blockbuster 2023, many investors are doubtful about the Magnificent stocks’ performance this year, with many market participants weary of their rich valuations. However, a little perspective is in order.

First of all, it must be noted that while NVDA, AAPL, and MSFT have surpassed their 2021 high, the other four Magnificent stocks remain below the peak, leaving them with more room to bounce. In addition, while their valuations do look rich compared to the average S&P 500 price-to-earnings ratio, they may be worth paying for – if the tech giants live up to the expectations. As per Goldman Sachs’ analysis, the Magnificent Seven’s valuations adjusted for the expected EPS growth rates, are close to their 10-year averages.

Investors need to factor in the economy, as well. While the current general conviction is that the U.S. has skipped a recession, economic growth is expected to slow at least in the first half of this year. In a slowing economic environment, it would be wise to hold some reliable earnings growers, which can again outpace their smaller, more economically-exposed counterparts with slimmer balance sheets. Conversely, when the economy rebounds, the Magnificent will surely not be worse off than the rest of the pack.

Coming back to the issue of the stock prices, investors have a workaround way to gain exposure to the Magnificent Seven for a lower cost. The Roundhill Magnificent Seven ETF (MAGS) offers investors concentrated exposure to the stocks of the tech giants without the costs associated with buying individual shares. On the other hand, given different prospects for these stocks in 2024, it may be more prudent to pick just those of the Magnificent Seven who are expected to continue posting great results.