Warren Buffett, the legendary Oracle of Omaha, has confirmed that he’ll be stepping down as CEO of Berkshire Hathaway at the end of the year. While he’ll officially hand over the reins, investors are still watching his every move – especially as he takes what may be his final bold swings in the market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

True to form, Buffett isn’t chasing hype. Instead, he’s reinforcing his long-held playbook: invest in companies with strong fundamentals, dependable dividends, and time-tested business models. That steady hand has earned him the title of the world’s most successful investor, and one of the richest people on the planet.

As his storied career nears its final chapter, Buffett is going out just as he came in: with conviction. He’s doubling down – literally – on two names in his portfolio, significantly increasing his stakes in both.

Using the TipRanks database, we’ve pulled together what Wall Street has to say about these two high-conviction picks. Let’s take a closer look.

Constellation Brands (STZ)

We’ll start with one of the beverage industry’s true stalwarts – and a new favorite investment of Buffett’s. Constellation Brands is a leader in the US market for alcoholic beverages, offering a large portfolio of beers, wines, and hard spirits for the consumer market. Constellation also holds the right to import the famous Mexican beer brands Modelo and Corona into the US; the company operates several breweries in Mexico to produce these beers for the import market. Modelo is the number-one imported beer in the US, and, since May of 2023, is the best-selling beer in the US; we should note that Corona is also in the top ten of best-selling beers, at number eight.

Among Constellation’s other brands, the Mexican import Pacifico is proving to be popular in California, while the company’s Modelo Chelada brand is finding favor with customers who prefer a more flavorful beverage.

Constellation’s stock has come under pressure this year. The company missed expectations in its 3Q25 earnings report, released in January, and as a major importer, the company is vulnerable to shifts in trade and tariff policy; against that background, the share price has remained depressed since the hit it took after the January earnings release.

In the most recent earnings report, released on April 9 and covering 4Q and full-year for fiscal 2025, Constellation reported $2.16 billion in quarterly sales, for a modest 0.9% year-over-year gain – a result that looked better after Q3’s 0.4% y/y sales drop. The Q4 revenue also beat the forecast by $40 million. At the bottom line, the company’s quarterly non-GAAP EPS of $2.63 was up 33 cents per share year-over-year and beat the forecast by 36 cents per share.

These results supported the April 9 dividend announcement, for a payment of $1.02 per common share. The payment was made on May 15; the annualized rate of $4.08 gives a forward yield of 2.1%.

Turning to Buffett’s recent purchase, we find that the legendary investor’s STZ purchases in calendar Q1 came to 6,384,676 shares, marking a 114% increase in his holding of the stock. Buffett’s total stake in Constellation Brands is valued at nearly $2.32 billion. He first bought into the stock in the final quarter of 2024.

The company also has a supporter in Roth MKM analyst Bill Kirk. Following the FQ4 earnings, Kirk noted the headwinds faced by the company but he still laid out the bull case, writing, “We understand that macro conditions are unfavorable and tariffs are a major headwind, but Constellation gained more incremental points of distribution in the 2025 resets than even the 2024 resets (~10%), and that the gains were broad-based across brand families. This was one of the more surprising revelations on a recent expert call we hosted. While the extra shelf space hasn’t helped Constellation’s recent trends, should the consumer get more comfortable, the extra shelf space bodes well for summer. We believe consumers adjust to lifestyle shocks, and old habits, including Beer, re-form.

Kirk goes on to rate STZ as a Buy, and his $256 price target implies a one-year upside potential of 33% for the stock. (To watch Kirk’s track record, click here)

Constellation gets a Moderate Buy consensus rating from the Street’s analysts, based on 18 recent reviews that include 11 Buys and 7 Holds. The shares are priced at $192.91, and their $208.11 average price target indicates room for an 8% gain over the next 12 months. (See STZ stock forecast)

Pool Corporation (POOL)

The next stock we’ll look at, Pool Corporation, puts its business right in its name: it’s a leading distributor of supplies, equipment, and other outdoor products for swimming pools. The company employs more than 6,000 people, operates through more than 445 locations in North America, Europe, and Australia, and serves 125,000 wholesale customers. Pool Corp’s products include everything from construction materials to outdoor hot tubs, replacement parts, and fencing.

The company has diversified its product line to include commercial and residential parts and products for outdoor irrigation; power equipment used in professional landscaping; and even specialty leisure products such as outdoor grills and kitchens, outdoor lighting, and water management. Pool Corporation is the world’s largest company in the niche for swimming pools and accessories.

Turning to the company’s financials, Pool Corporation’s 1Q25 revenue of $1.1 billion was down 1.8% year-over-year and in-line with the forecasts; the bottom line, non-GAAP EPS of $1.32, was down 52 cents per share year-over-year and missed expectations by 14 cents per share.

At the same time, Pool Corp felt confident enough to raise its quarterly dividend. The payment was bumped from $1.20 per common share in the previous quarter to $1.25 in the April 30 declaration. The new dividend annualizes to $5 per share, gives a forward yield of 1.55%, and is scheduled for payment on May 29. The company also announced an increase in its share repurchase authorization to $600 million.

As for Buffett, his firm Berkshire Hathaway first bought into POOL shares last year, during the third quarter — and during 1Q25, the firm added 865,311 shares to its holdings. This brings Buffett’s stake in POOL to 1,464,000 shares, currently worth more than $472 million.

This stock has caught the attention of Goldman analyst Susan Maklari, who is impressed by the company’s ability to keep up its business in the face of difficult conditions. She writes, “Pool continues to execute on strategic initiatives, despite ongoing demand headwinds, while also incrementally benefiting from a more inflationary environment… Management noted further adoption of POOL360 and other margin accretive proprietary offerings, which we believe will add to share gains and shareholder returns over time. Moreover, we see Pool’s distribution model, with 60% of revenues from maintenance, as a relative beneficiary of tariffs, even in a weaker demand environment. In line with this, the company raised guidance for price to the high-end of the 1-2% range this year, as related increases come through from suppliers. We also look for these to carryover to early 2026, benefiting future growth.”

The Goldman analyst comes to an upbeat conclusion on the stock, based on her assessment of its underlying strengths, and adds to her comments: “This comes as maintenance demand remains steady in contrast to ongoing pressure in larger ticket, discretionary spend given the macro backdrop and limited existing home sales. Although we look for these conditions to hold over upcoming quarters, we note Pool’s balance sheet strength, supporting investments in company-specific efforts as well as the ability to return cash to shareholders.”

Maklari rates POOL as a Buy, and her $355 price target implies that the shares will gain 10% in the year ahead. (To watch Maklari’s track record, click here)

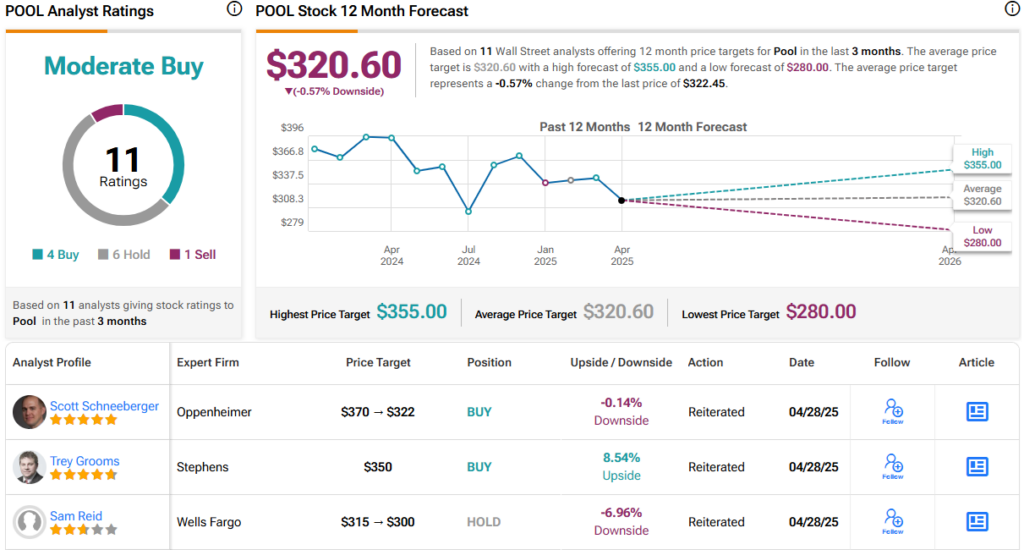

Overall, POOL gets a Moderate Buy rating from the analyst consensus, based on 11 recent reviews that include 4 Buys, 6 Holds, and 1 Sell. The stock’s $322.45 share price and $320.60 average target price suggest the shares will stay rangebound for the time being. (See POOL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.