Big-box retailer Target (NYSE:TGT) is scheduled to announce its results for the third quarter of Fiscal 2023 on Wednesday, November 15. TGT shares have fallen 28% year-to-date, as concerns about the company’s declining sales amid macro pressures, rising shrink or retail theft, and consumer backlash due to Pride month displays have weighed on investor sentiment. Analysts expect Target’s Q3 FY23 earnings to decline due to lower revenue.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Expectations from TGT’s Q3 Results

Back in August, Target delivered mixed Q2 FY23 results, as the retailer’s sales lagged expectations due to the controversy related to the Pride month merchandise. Investors are waiting to see whether the issue has affected Q3 earnings as well. Moreover, high interest rates and macro pressures are weighing on consumers’ discretionary spending, and Target has more exposure to discretionary items than rival Walmart (NYSE:WMT). Additionally, higher inventory shrink is impacting the company’s performance.

Coming to Q3 FY23 expectations, analysts project Target’s adjusted earnings per share (EPS) to decline to $1.48 from $1.54 in the prior-year quarter. They expect sales to decline about 5% year-over-year to $25.3 billion.

Analysts’ Opinions Ahead of Q3 Earnings

On November 10, Telsey Advisory analyst Joseph Feldman lowered the price target for Target stock to $145 from $162 but reiterated a Buy rating on the stock ahead of the Q3 print.

Feldman reduced his Q3 estimates to reflect the ongoing weakness in TGT’s store traffic as the quarter progressed, subdued consumer spending on discretionary merchandise, and higher-than-expected promotions. While the analyst expects these trends to impact Q4 results as well, he contends that soft trends are largely priced in the stock at current levels. He remains bullish on TGT stock, looking beyond the short-term headwinds.

Like Feldman, Oppenheimer analyst Rupesh Parikh lowered his price target to $150 from $165 but reiterated a Buy rating on TGT stock. For Q3 FY23, the analyst expects the company to achieve the guidance. He reiterated his $1.20 EPS forecast.

Parikh sees an earnings bottom in the current fiscal year at $7.00. However, he lowered his FY24 and FY25 EPS forecasts as he expects continued pressure on the discretionary category. Nevertheless, he views current levels as an attractive entry point for longer-term investors.

What is the Future Price of TGT?

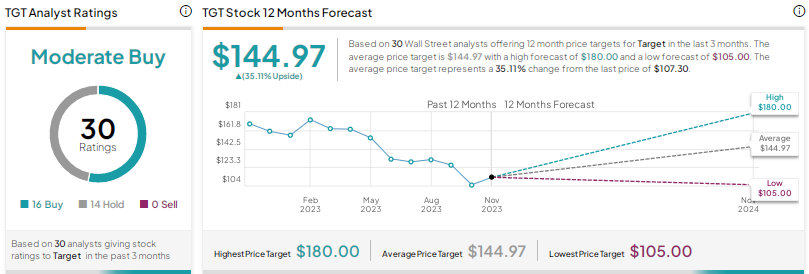

Wall Street is cautiously optimistic on Target stock, with a Moderate Buy consensus rating based on 16 Buys and 14 Holds. The average price target of $144.97 implies 35.1% upside potential.

Insights from Options Trading Activity

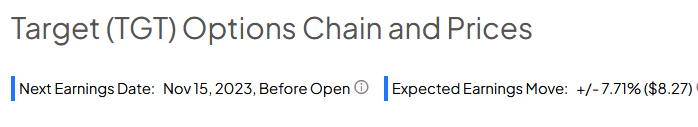

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 7.71% move on Target’s earnings. TGT shares have averaged a (3.6)% move in the last eight quarters. In particular, the stock rose about 3% in reaction to the company’s Q2 FY23 results.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Conclusion

Wall Street expects Target’s fiscal third-quarter earnings and sales to decline year-over-year against a tough retail backdrop. Investors will pay attention to the company’s guidance for the crucial holiday season and commentary on the ongoing macro pressures and the impact of the resumption of student loan repayments, given that Target has notable exposure to younger customers.