The outrage against Anheuser-Busch InBev (NYSE:BUD), Target (NYSE:TGT), and Kohl’s (NYSE:KSS), which showed their support to the LGBTQ+ community through their products and campaigns, has been a major drag on their stocks recently. Shares of BUD, TGT, and KSS have declined about 7%, 8%, and 13%, respectively, just over the past five days due to the ongoing controversy and volatility in the broader market. Given the intensity of the backlash, these stocks might remain under pressure in Pride Month (June).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Pride Stocks Caught in Controversy

The controversy began on April 1 when conservatives called for a boycott of Bud Light, a highly popular beer brand of brewing company Anheuser-Busch, after it featured in a social media promotion by transgender influencer Dylan Mulvaney. Reacting to the severe backlash and declining Bud Light sales, CEO Brendan Whitworth clarified, “We never intended to be part of a discussion that divides people. We are in the business of bringing people together over a beer.”

Retailer Target was the next company to face hate from conservatives, when several customers knocked down its Pride displays at certain stores and angrily approached workers. Citing “volatile circumstances,” Target removed some items from its stores and made other changes to its LGBTQ+ merchandise, keeping the Pride month in mind. Most recently, department store chain Kohl’s got embroiled in the controversy, with social media posts urging to boycott the company for selling LGBTQ+ merchandise.

These companies have been receiving bomb threats at factories and threats of violence against employees. The problem doesn’t end here, as LGBTQ+ supporters are criticizing these companies for making profits through the sale of their products during the Pride month but failing to stand by them when the situation demands. Overall, many American companies seem to be caught in a “Catch 22” situation currently.

Amid the current controversy, Anheuser-Busch announced this week that it will donate $200,000 to the National LGBT Chamber of Commerce to support small businesses owned by LGBTQ+ across America.

Retail giants Target and Walmart (NYSE:WMT), and several other peers have been selling LGBTQ+-themed merchandise for several years. In the wake of the ongoing controversy, Walmart clarified this week that it has not made any changes to its LGBTG-related merchandise related to the Pride Month. Walmart’s chief merchandising officer Latriece Watkins said that the retailer has not made any changes to its assortment or security measures in response to the potential threats to stores cited by Target.

Overall, culture wars surrounding transgender and LGBTQ+ issues are hampering the business of several companies and are weighing on their stocks. There is a risk of more firms getting caught up in the “anti-woke” controversy during Pride Month.

Wall Street Ratings

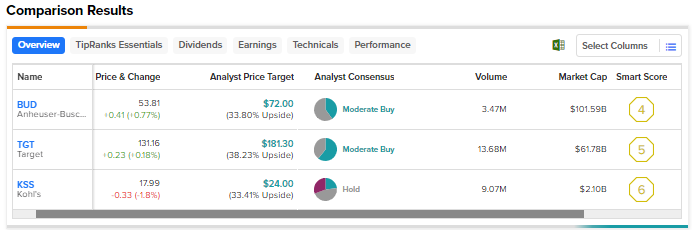

Coming to Wall Street’s ratings, analysts have a Moderate Buy consensus rating on BUD and TGT, while they are sidelined on Kohl’s amid pressure on consumer spending due to macro challenges. On average, Wall Street sees over 30% upside in these three stocks over the next 12 months.

On Thursday, JPMorgan analyst Christopher Horvers downgraded Target to a Hold from Buy, citing several reasons, including market share loss that could accelerate into the back-to-school season and continue into the holiday season due to macro headwinds and “recent company controversies.” Horvers lowered the price target to $144 from $182.