Electric vehicle giant Tesla (TSLA) reported its second-quarter results, failing to meet bottom-line market estimates and showing weak profitability. The delay in the Robotaxi event also strongly disappointed investors, causing shares to plummet by double digits. Despite this bearish reaction, I remain bullish on Tesla, believing the results weren’t as terrible as they seem.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Some positives included stability in gross margins and strong cash flow generation. Additionally, Tesla’s pricing strategy appears well-conducted, and its AI growth story, which has the potential to disrupt the industry, is yet to be fully appreciated.

Tesla’s Q2 Financial Results Were Not a Complete Disaster

Clearly, the market wasn’t thrilled with Tesla’s Q2 earnings. In fact, results haven’t been impressive for a while. The June quarter marked the fourth consecutive quarter where Elon Musk’s company failed to meet Wall Street estimates. Since Q1 2023, Tesla shares have fallen by more than 9% on the trading day following earnings, except for Q1 of this year.

In Q2, what really disappointed investors was the sharp drop in profitability. Tesla’s net income fell 42% year-over-year to $1.8 billion. On the bright side, gross margins dipped slightly to 18%, only 2 percentage points lower than in Q2 2023. This was somewhat encouraging, considering gross margins had been significantly below 18% for the previous three quarters.

While Tesla’s profit margins are still higher than those of other EV players, the downward trend was concerning. At least in Q2, gross margins held relatively steady when they could have worsened further.

On the revenue side, Tesla reported $25.5 billion in revenue, beating analysts’ expectations of $24.63 billion. However, total automotive revenues, a key focus for investors, remained weak. Tesla had promised to grow vehicle sales and production by 50%, but reality has shown a decline in revenues. In Q2, total automotive revenues were $19.8 billion, a 7% decrease year-over-year. When Tesla released its quarterly production and delivery figures in early July, it reported 443,956 vehicle deliveries, around 5% lower than last year.

Tesla’s price cuts have also led to a lower average selling price. As a result, fewer deliveries and lower prices have caused a decline in total revenue and pressured margins, which investors were unhappy about.

Finally, cash flow generation was another key metric for investors. In Q1, Tesla experienced a significant decline in free cash flow, following four positive quarters. Cash from operations fell 90% year-over-year to just $242 million, while free cash flow plunged to negative $2.5 billion, a 674% drop. Nevertheless, in Q2, the company reported solid numbers: cash from operations reached $3.61 billion, up 18% year-over-year, and free cash flow improved to $1.43 billion, up 34% year-over-year.

Overall, I was impressed with Tesla’s cash flow figures and pleasantly surprised by the relatively stable gross margins despite the challenges posed by lower average selling prices.

Tesla’s Lower-Priced Model Could Drive EV Demand Growth

As mentioned earlier, the pressure on Tesla’s revenues and bottom line has reduced average selling prices. According to CEO Elon Musk, even though Tesla continues to lower prices to eliminate competition, this isn’t a trend that’s likely to continue long term.

In Tesla’s latest earnings call, Musk said- “We saw large adoption and acceleration of EVs and then a bit of a hangover as others struggled to make compelling EVs. They have discounted their EVs substantially, making it a bit more difficult for Tesla. We don’t see this as a long-term issue but fairly short-term.”

Many smaller EV makers have had their margins squeezed to the extreme, forcing them out of business. If Tesla continues to pressure the market by lowering prices, weaker players might exit the space, ultimately benefiting Tesla in the long run.

However, the biggest boost to Tesla’s EV sales could come from introducing a new lower-priced model. Elon Musk indicated during the earnings call that this should arrive by mid-2025. This could be a major catalyst for Tesla, helping to stabilize prices and return demand to solid levels, at least in the short term.

Growth Story Alive and Well with AI, Robotaxi, and Robotics

Tesla’s growth story is increasingly tied to AI, Robotaxi, and robotics. Despite some market participants not viewing Tesla as a major AI player, its extensive installed base and deep involvement in AI are significant. Dan Ives, a well-known tech analyst from Wedbush, argues that Tesla is the most undervalued AI player out there. He believes the company could become a trillion-dollar entity as it stabilizes from a demand and pricing perspective.

I tend to agree with Mister Ives. Three months ago, Tesla shares were around $140, with some predicting a drop to $120. Today, even with the post-Q2 backdrop, Tesla shares are trading close to $225. The main reason for this rebound is that investors are starting to appreciate Tesla’s AI potential.

Although the highly anticipated Robotaxi reveal was postponed until October, which caused some investor unease, having a set date for the event is still good news.

The entire AI story at Tesla revolves around Robotaxi and robotics, which are driven by advancements like Full Self-Driving (FSD) technology. During Tesla’s shareholder meeting in June, CEO Elon Musk hinted that the Robotaxi service would combine elements of Airbnb (ABNB) and Uber (UBER). Tesla envisions owning and operating a fleet of vehicles, with many robotaxis also privately owned.

Is TSLA a Buy, According to Wall Street Analysts?

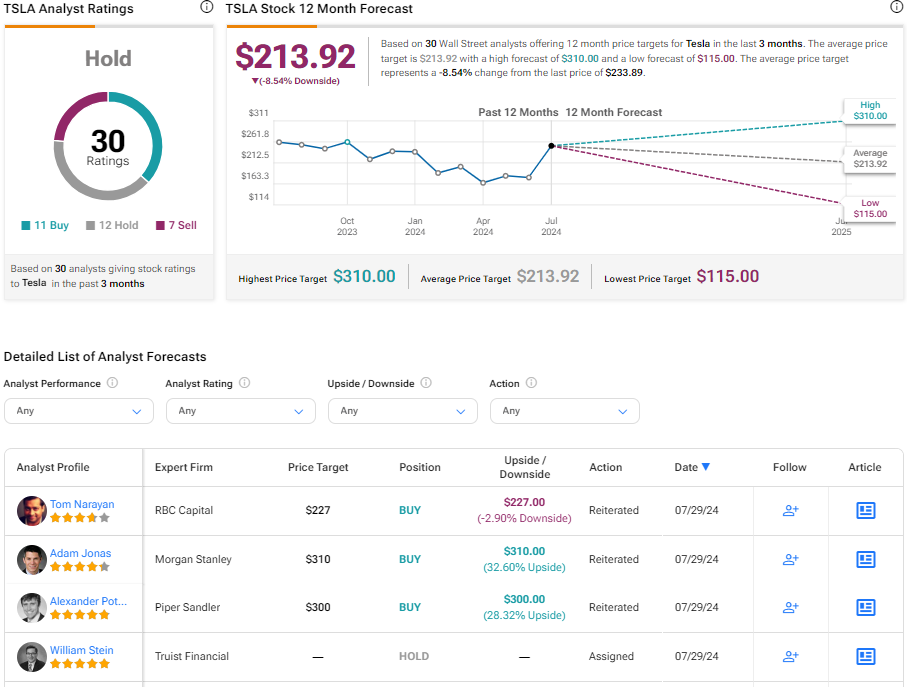

Tesla stock hasn’t impressed Wall Street lately. Among the 30 analysts covering TSLA, the consensus is “hold.” Eleven are bullish, twelve are neutral, and seven are bearish. The average price target for TSLA is $213.92, which implies a potential downside of 4.37% from the most recent share price.

Key Takeaway

I believe Tesla investors should be patient and disciplined at the moment. While the reaction to Tesla’s Q2 earnings is understandable, given the weak bottom-line results, it’s worth noting that cash flows and gross margins could have been much worse. Looking ahead, a lower-priced model could boost EV demand, and the upcoming Robotaxi launch is a key catalyst that could reverse the bearish trend TSLA has faced over the past couple of years.