Despite this week’s dip, Tesla (NASDAQ:TSLA) shares are off to an excellent start in 2023, having posted year-to-date gains of 39%. For investors who are wondering if there’s still more fuel left in the tank, one analyst has some good news for you.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Deutsche Bank’s Emmanuel Rosner gives Tesla shares a $220 price target to go along with his Buy rating. Assuming the analyst is right about that, investors in Tesla stand to rake in ~27.5% profit over the next year. (To watch Rosner’s track record, click here)

This year’s surge comes in the wake of a miserable 2022, during which TSLA shares shed 65%, but a recent overall shift in investor sentiment and Tesla’s better-than-expected Q4 earnings have helped fuel the rally.

Investors liked the recent Q4 report but not all of it was rosy. The quarter was marked by strong revenue but also showed softer vehicle gross margins, mainly due to costs related to the ramp-up of the EV leader’s 4680 cells and new facilities, while lower ASPs on the back of price cuts also played their part.

The company’s outlook also called for production of roughly 1.8 million units for the year, amounting to only 37% year-over-year growth, although from 2020 levels, that figure remains higher than its multi-year target of 50%+ CAGR. Nevertheless, that is below consensus expectations.

According to Rosner, “this represents noticeable downside to street estimates, but management highlighted that this target is conservative, accounting for any unforeseen disruption over the course of 2023. Current order rates are running at about 2x its production rate post the cut, which will likely moderate over the coming quarters but represents a positive signal for the volume outlook in the near term.”

Rosner now models 1.84 million units, amounting to a 40% year-over-year increase, and resulting in a revenue forecast of $94 billion (from $92 billion on “higher” ASP).

Looking ahead, with Q1 set to be the “trough” for the year and margins expected to “incrementally improve” as the year progresses, Rosner believes investor expectations “should largely reset following the quarter.”

Investor focus will now turn to the upcoming investor day. The March 1st event will take place in Austin, Texas, and Rosner will be keen to find out more regarding the company’s next-generation vehicle platform, which the analyst reckons should support “several different top hats across multiple vehicle segments,” robotaxi included.

Tesla is targeting a COGS of around $20,000 per unit for the platform – half the present price – and for the manufacturing output to double based on the same footprint, with spend reaching just half the current capex.

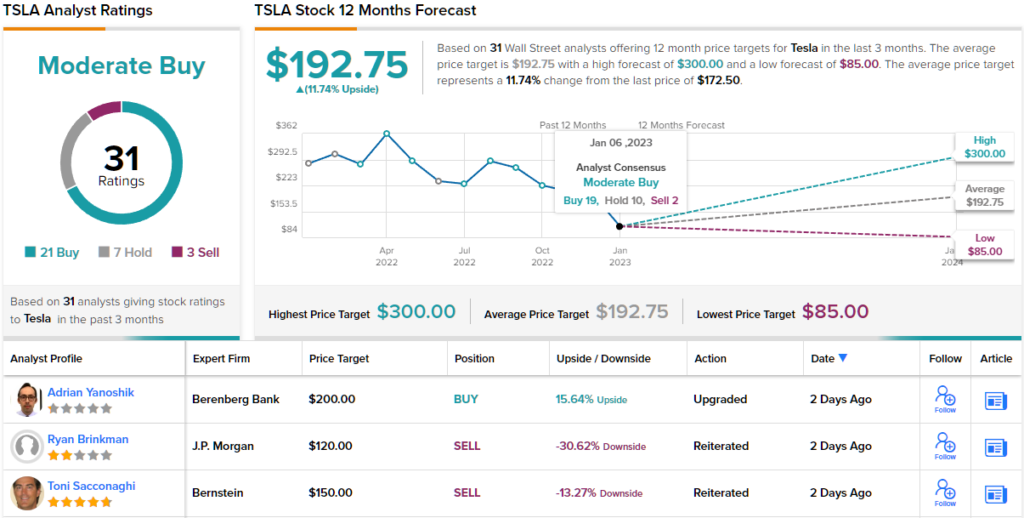

Overall, Wall Street is generally positive about Tesla’s forward path. Looking at the consensus breakdown, based on 21 Buys vs. 7 Holds and 3 Sells, the stock claims a Moderate Buy consensus rating. Going by the $192.75 average target, the shares will see gains of ~12% over the coming year. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.