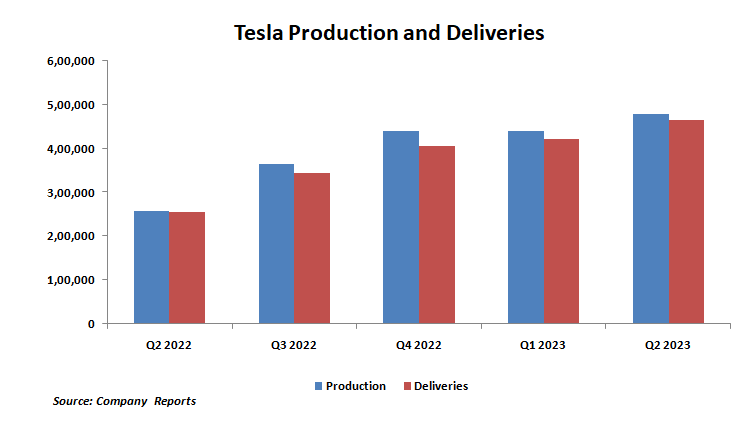

Tesla (NASDAQ:TSLA) continues to impress with its record deliveries. While the leading EV (electric vehicle) maker continues to grow delivery volumes, its production has consistently exceeded deliveries over the past five consecutive quarters. This means that the company could implement more price cuts and take other measures to accelerate volumes, which will pressure margins and limit the upside potential in the short term.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Tesla stock has gained more than 127% year-to-date. The strong run in TSLA stock reflects higher deliveries and an easing supply chain.

Tesla’s Margins Could Remain Under Pressure

In Q2, Tesla produced 479,700 vehicles and delivered 446,140 cars. Further, its production has been consistently ahead of deliveries (see the graph below) for the past five consecutive quarters, raising further concerns over margins.

Tesla implemented price reductions on many vehicle models to accelerate volumes. However, this strategy has resulted in lower margins for the company. The company has experienced a consistent decline in margins, primarily driven by lower prices and a higher-cost operating environment.

While Tesla’s margins have trended lower, they remain higher than the industry average. Tesla CEO Elon Musk said during the Q1 conference call that the company is focused on driving volumes, even if it has to sacrifice some automotive margins in the coming quarters. Further, Musk expects Tesla to recoup margins from service, autonomy, and supercharging.

Goldman Sachs analyst Mark Delaney said that Tesla’s Q2 volumes came in strong and ahead of consensus. However, Delaney reiterated the Hold rating on TSLA stock on July 2. The analyst expects pricing to go down in the coming quarters to “help support volume growth (and reflect global industry supply/demand).”

Is Tesla a Buy or Sell Today?

Tesla is expected to benefit from the ramp-up in production and deliveries. Moreover, opportunities in supercharging, the launch of more affordable models and Cybertruck, and progress with AI (artificial intelligence) products and FSD (full self-driving) bode well for long-term growth.

However, Tesla stock appears expensive on the valuation front, given the recent appreciation in value. Further, Delaney termed TSLA’s valuation “full.” Besides for higher valuation, margin concerns had led several Wall Street analysts to downgrade TSLA stock.

It has received 14 Buy, 12 Hold, and five Sell recommendations for a Moderate Buy consensus rating. Further, the average TSLA stock price target of $219.96 implies 21.39% downside potential from current levels.

Investors should note that Delaney is the most accurate analyst for TSLA stock, according to TipRanks. Copying Delaney’s trades on TSLA stock and holding each position for one year could result in 74% of your transactions generating a profit, with an average return of 18.67% per trade.