Of all the stocks seeing sky high valuations over the last two years, almost none has garnered more naysayers than Tesla, Inc. (TSLA). The electric vehicle producer and its outspoken billionaire CEO, Elon Musk, have had both investors and financial analysts projecting an imminent collapse for years. Unfortunately for the bears, this massive selloff in shares has yet to materialize. Instead, TSLA stock has increased 1006.47% since January 10, 2020.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Until Monday afternoon, Tesla had posted four consecutive sessions of losses, finally turning around as traders bought up the discount. The industry-leading EV stock most recently reported better-than-expected deliveries for Q4, and saw its share price climb sharply by the start of the new year.

Now, just a couple weeks before Tesla’s earnings report is released, the bulls and the bears are butting heads yet again.

The Optimist

Recently publishing his encouraging report on the EV company is Adam Jonas of Morgan Stanley, who was enthused by last week’s 20% beat on delivery projections, and is expecting more good news later in the year. Jonas argues that TSLA is widening its already massive lead above its peers, although this is not necessarily a net positive for its sector.

While he noted that Tesla is not his favorite EV stock, not holding TSLA “means not owning the one company that could make all other EV names obsolete,” the analyst said.

Jonas rated the stock a Buy, and raised his price target to $1,300 from $1,200. This new target currently represents a potential 12-month upside of 22.86%.

Moreover, he wrote that “Tesla is clearly in the financial, human/cultural, technological position to drive industrialization across vehicle manufacturing, battery technology, supply chain, EV infrastructure and other important aspects of the ecosystem.”

The Pessimist

Founder and CEO of GLJ Research, Gordon Johnson recently took a vehement stance against Tesla’s outlook. The analyst took to CNBC to decry the high valuation and even higher price targets, stating that the only unique asset held by Tesla, Inc. is its supercharger technology. Johnson added that even this kind of tech could ultimately meet its obsolescence.

While Johnson may be staunch in his beliefs, his results do not instill the same kind of confidence in investors. On TipRanks, the zero-starred analyst is rated as #7,590 out of 7,762 total experts. Johnson has been seldom correct in his ratings, but perhaps this is the uphill battle he wins.

The pessimistic analyst may be able to state the facts of Tesla’s earnings multiplier and its financial standing, but that doesn’t always translate into a dramatic drop in stock price. If the market has shown us anything over the last two years, it is that share prices can become detached from their underlying fundamentals and behave in relatively irrational ways.

On the other hand, if Johnson sticks to his view, he may eventually be vindicated. After all, a broken clock is right twice a day.

The Rest

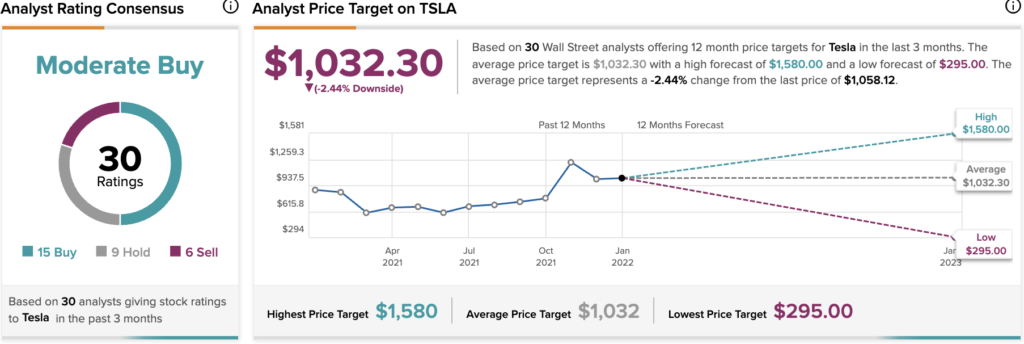

On TipRanks, TSLA has an analyst rating consensus of Moderate Buy, based on 15 Buy, 9 Hold, and 6 Sell ratings. The average Tesla price target is $1,032.30, suggesting a possible 12-month downside of 2.44%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Download the TipRanks mobile app now

Read full Disclaimer & Disclosure