Tesla (NASDSAQ:TSLA) investors were greeted with exciting news this week as the China Passenger Car Association (CPCA) unveiled a remarkable resurgence in Tesla’s car sales in China.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

For the month of August, Tesla sold 84,159 China-made electric vehicles, which was up a respectable, if not exhilarating 9.3% from one year ago. Of particular note was the sequential increase from July in Model 3 and Model Y electric cars sold (Tesla’s two most popular models). Sales of these two models grew an impressive 30.9% month-over-month.

Now compare these numbers from what Tesla was saying one month ago. In July 2023, Tesla sold only 64,285 China-made EVs. On the one hand, this was more than twice its sales in July 2022, when pandemic concerns and work on Tesla’s Shanghai production lines depressed Tesla’s production numbers. On the other hand, though, 64,285 China-made EVs was a 31% decrease from what Tesla sold more recently in June 2023. And adding insult to injury, each of local Chinese automakers Nio, Xpeng, and BYD saw their sales grow in July, as Tesla’s sales shrank.

And yet, while Tesla may have hit a bump in the road in July, it now appears that this was more of a pothole than a chasm. Tesla seems to have quickly bounced back from its July slump to post impressive performance in August.

But… exactly how impressive was this performance, in context?

Well, as CNBC reported over the weekend, Tesla easily outdistanced some of the better known names in China. Chinese electric car company Li Auto, for example, reported August deliveries of 34,914 EVs. Nio did 19,329 EV sales in the month. Tiny Xpeng remained “far behind,” shipping only 13,690 units.

Tesla sold more EVs in China than these three local companies sold, combined.

On the other hand, state-owned Guangzhou Automotive Group (GAC) reported that it sold 52,057 of its Aion-brand electric cars. While GAC isn’t a name that pops up too often in reports on the Tesla-versus-everybody-else state of the Chinese electric car market, this is a significant number. And it’s important to note that GAC’s sales are therefore about as big as those of Li and Nio, combined.

As for the local automotive heavyweight in China, BYD — think GM, Ford, and Chrysler all rolled up into one — sold a whopping 274,086 passenger vehicles in August. Nealy half of these cars were powered by internal combustion engines. But BYD also sold 145,627 pure EVs in the month — 73% more than Tesla. BYD’s total number of cars sold, meanwhile, rose 57.5% year over year. And while one could argue this is not an apples-to-apples comparison given that many of BYD’s cars are not electric, it still represents significantly greater growth than what Tesla produced.

More cars sold — whatever their means of propulsion — means greater economies of scale when ordering car parts, and can generate the kinds of cost savings that determine whether a company wins or loses a price war, such as the EV price war currently raging in China. And in that regard, it’s worth pointing out that BYD’s cheaper Dolphin EV did in fact outsell Tesla’s cheapest Model 3 sedan in August.

For the time being, BYD remains the company Tesla has to beat, if Tesla is to become the dominant automaker in China.

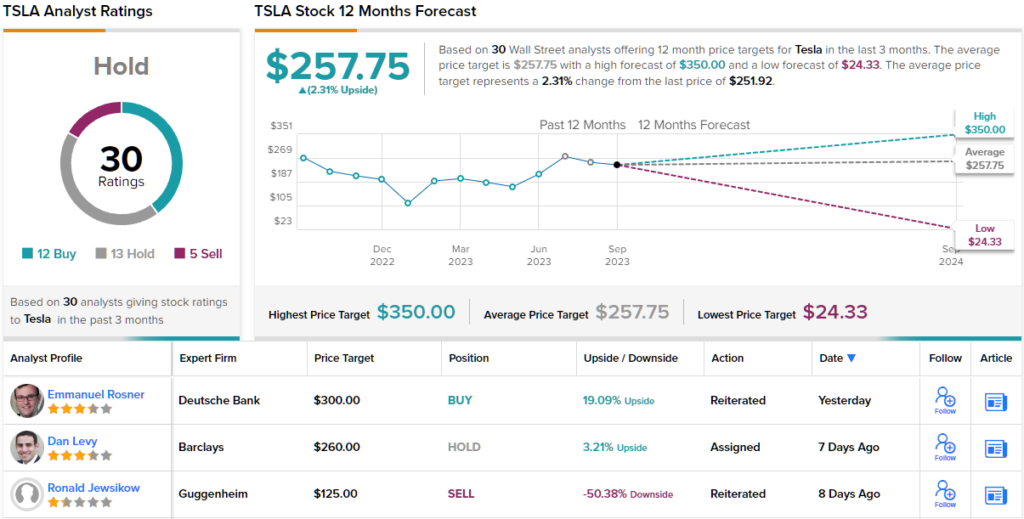

Turning now to Wall Street, TSLA stock has a Hold consensus rating based on 30 recent analyst reviews. Among these, 12 analysts say “Buy,” 13 suggest “Hold,” and 5 recommend “Sell.” The average price target of $257.75 suggests there’s only about a 2% potential upside from where TSLA currently stands. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.