Tesla (TSLA) might have disappointed with its second quarter delivery numbers, but ahead of the EV leader’s Q2 earnings (Wednesday, July 20th), Deutsche Bank’s Emmanuel Rosner thinks the company might have a surprise in store.

In fact, such is the analyst’s conviction in his thesis, he has now added Tesla to his “short-term Catalyst Call Buy List.”

So, what’s behind the call? Rosner explained: “The company could report potential upside to low Street expectations for 2Q margins, driven by good cost execution and continued pricing strength, and we expect management to reiterate its full year deliveries growth of 50%, suggesting total volume of approximately 1.4m units and implying considerable volume ramp in the second half.”

The quarter was marred by several big headwinds, which ranged from Covid-driven shutdowns in China, costs related to “closed-loop productions,” and the ramping of the Texas and Berlin facilities. Yet, Rosner believes the Street’s anticipated sequential profit drop of over $1.5 billion more than “captures” all of these.

Additionally, Tesla shares might have retreated ~32% year-to-date, a pullback Rosner thinks mostly reflects the supply issues, but these are “fast improving,” and present investors with a “compelling opportunity to accumulate the stock into 2H and 2023 where volume growth and margin expansion could be meaningful.”

Of course, there are risks to consider here; amongst them is the obvious possibility the Q2 performance will be a let down (mostly due to supply issues) while “negative updates” regarding the Berlin/Texas ramp or in-house battery development will probably sour sentiment too.

However, even in the case of Q2 “margin misses,” Rosner thinks the margin issues will only prove to be temporary and recommends investors take advantage of a pull-back.

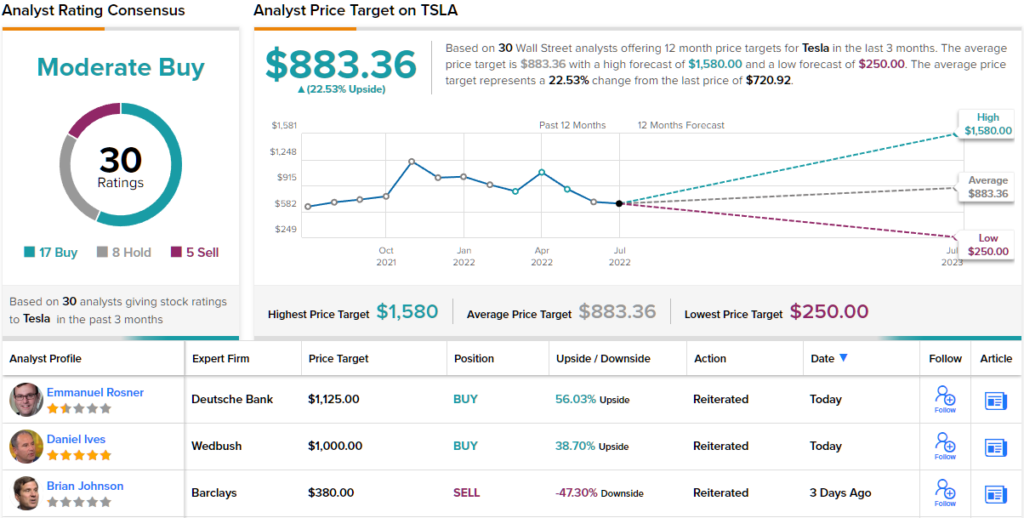

Catalyst Call aside, Rosner rates TSLA shares a Buy, while his $1,125 price target makes room for 56% share appreciation in the year ahead. (To watch Rosner’s track record, click here)

Looking at the consensus breakdown, 17 Buys, 8 Holds, and 5 Sells have been published in the last three months. Therefore, TSLA gets a Moderate Buy consensus rating. Based on the $883.36 average price target, shares could rise 22.5% in the next twelve months. (See Tesla stock forecast on TipRanks)

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.