Tesla (NASDAQ:TSLA) is back to slashing its car prices in China. After launching a promotional campaign that provides a 4% discount on its Model Y long-range and performance models until September 30th, the EV leader is once again making headlines. This time, the spotlight is on the upscale Model S and Model X models, which are now getting a trim of up to 6.9% in China.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to the company’s official Weibo account, the Model S luxury sedan has been lowered from 808,900 yuan to 754,900 yuan ($103,463), while the Model X SUV has been reduced from 898,900 yuan to 836,900 yuan ($114,702).

That said, it’s not as if this is a Tesla-specific issue. Amid a substandard demand outlook and macro uncertainty, since August, numerous EV makers have embarked on a limited-time promotional push for vehicles (Leap Motor, SAIC GWM Ora) or adjacent cuts (NIO offering charging subsidies).

According to Morgan Stanley analyst Adam Jonas, the price competition is expected to “intensify” in Q3.

The soft demand backdrop in China and the price cuts have also proven detrimental to Tesla’s share price, with the stock retreating by more than 25% over the past month.

“Investors are becoming more cautious on China EVs after a solid run in the past 3 months, with Tesla’s further promotional activity of particular concern,” Jonas opined on the issue.

As such, Jonas thinks the EV market in China is set to go through a bit of a shift in priorities. “All that excess capacity built up over the last ten years (wherein China accounted for over 300% of incremental global auto sales) will, in our view, be allocated to export markets rather than domestic sales,” Jonas further explained. “In our view, China will shift from being an importer to exporter of cars as supply-demand dynamics invert this decade.”

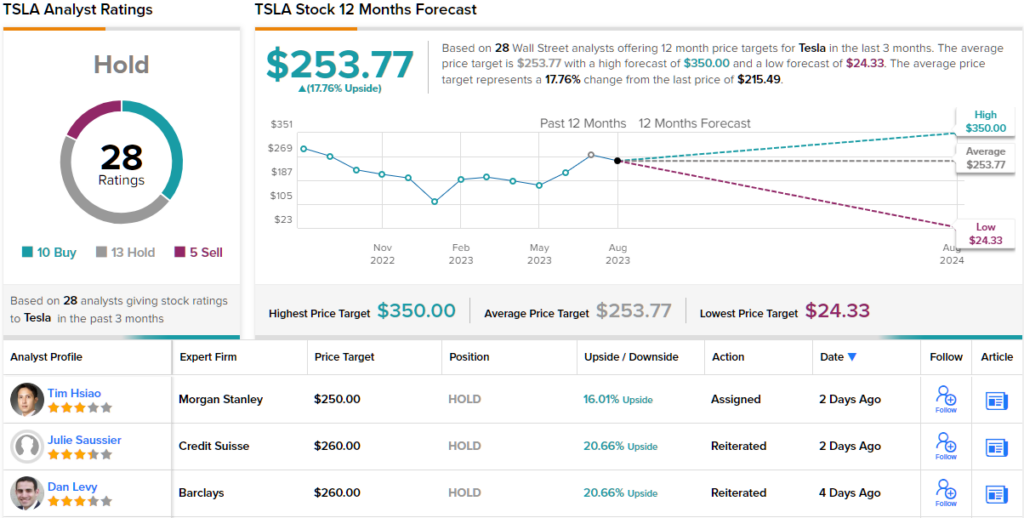

So, what does this all mean for TSLA stock? Jonas sticks with an Equal-weight (i.e., Neutral) rating, backed by a $250 price target. The figure suggests shares have 16% upside from current levels. (To watch Jonas’s track record, click here)

Jonas’ take aligns with that of the rest of the Street. Based on 13 Holds, 10 Buys and 5 Sells, the stock claims a Hold consensus rating. Going by the $253.77 average target, a year from now, investors will be pocketing returns of ~18%. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.