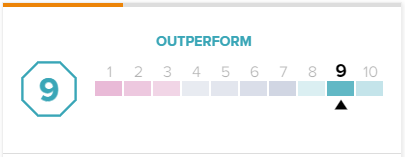

Telus (TSE: T) (NYSE: TU) is a Canadian telecommunications giant offering phone and internet services and more. Following this year’s sell-off, the stock is now yielding 4.9%. It also has a Strong Buy consensus rating from analysts and a 9 out of 10 Smart Score rating on TipRanks, suggesting that it has a good chance of outperforming the market. However, there may be better opportunities elsewhere in the market. Let’s take a look at the pros and cons of Telus Stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

What to Like about Telus Stock

There are a few things to like about Telus. The first thing is that it’s a relatively safe, blue-chip stock. It has a 0.60 beta, meaning it’s only 60% as volatile as the overall market. In fact, Telus stock is only down 7.3% on the year compared to -11.8% for the TSX and -21.9% for the S&P 500 (SPX).

It’s a safe company because it’s one of the biggest players in the Canadian telecommunications market. If you live in Canada, you know that there are only a few major players when it comes to telecommunications, giving these companies significant competitive advantages and pricing power over consumers. Two of Telus’ main competitors are BCE Inc. (TSE: BCE) and Rogers Communication (TSE: RCI.B).

Telus’ dominant position has allowed its revenue to grow every single year for at least the past 10 years, going from C$10.85 billion in 2012 to C$17.34 billion on a trailing-12-months basis. Its 10-year revenue CAGR comes in at 5%. Meanwhile, its gross profit margin has hovered around the 35% to 36% range during the same period, suggesting that competitors aren’t chipping away at profits.

Also, Telus is consistently profitable on an earnings basis, allowing it to pay hefty dividends that are likely to grow going forward – although not by very much. Its latest dividend hike, which came a few months ago, was only by 3.7%.

What Not to Like about Telus Stock

Telus has its positives, but it also has its negatives. The biggest negative is its large debt load. Telus only has C$382 million in cash while having C$21.9 billion in total debt. While the company can manage its debt levels, as it has an interest coverage ratio of 3.9x, this coverage ratio has been downtrending over the years (it was 5.9x in 2013).

Therefore, Telus needs to be careful to not overleverage, especially in a rising-rate environment, where issuing debt becomes more expensive. Interest coverage is measured as earnings before interest and tax divided by interest expenses over a specified period.

Also, while its earnings per share have grown at a 2.7% CAGR over the past 10 years, which still isn’t much at all, its free cash flow is often negative. This is because the company invests a heavy amount into capital expenditures to operate its business. Therefore, Telus’ dividend isn’t covered on a free-cash-flow basis, meaning it has to take on debt to fund its dividend payments – part of the reason why its debt level keeps rising.

Is Telus Stock Undervalued?

Analyst estimates call for Telus to see C$1.26 and C$1.43 in EPS for 2022 and 2023, respectively. This gives the stock forward P/E ratios of 22.2x and 19.6x, respectively. Considering that Telus’ EPS is expected to see 17.5% growth this year and 13.4% growth next year, its valuation is reasonable but isn’t a screaming buy to us, especially considering the many stocks that are on sale in today’s market.

What is the Price Target for Telus Stock?

Turning to Wall Street, Telus stock has a Strong Buy rating based on seven Buys and two Holds assigned in the past three months. The average Telus price target of C$35.92 implies 30% upside potential.

Conclusion: Telus Stock is Solid but Not the Best

Telus is a solid stock for dividend investors that want a high-yielding stock with low volatility. However, high returns shouldn’t be expected from Telus. Its valuation is reasonable at best, and its 4.9% dividend yield is not supplemented with buybacks. These factors, combined with low growth and high debt, give Telus stock a Neutral rating from us.